The British pound has been all over the place during the trading session on Thursday as we continue to see a lot of volatility. A handful of idiots coming out of both the EU and the UK had suggested that perhaps talks and a deal are possible going forward that could finalize Brexit. This of course sent the market straight up in the air, only to be followed very shortly by people pouring cold water on that entire idea. Ultimately, this is just like two years ago, there will be the array of random announcements that will have this market jumping around like we saw during the trading session.

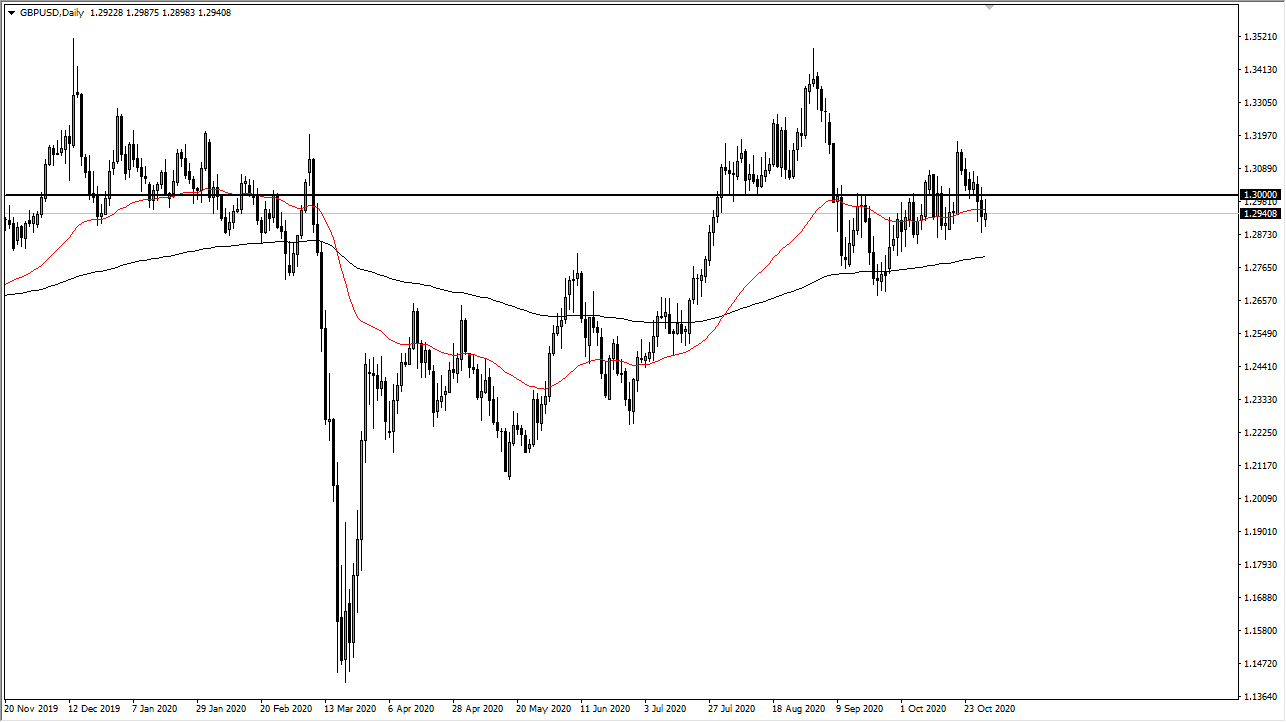

The 50 day EMA slicing through the candlestick of course has caused a bit of noise as well, and I do believe that it is only a matter of time before we see an opportunity to place a trade going forward. For buying, I would need to see this market break above the 1.3050 level on a daily close. As far as selling is concerned, that is much easier to do on signs of exhaustion based upon short term time frames. Keep in mind that Friday is the Non-Farm Payroll announcement, and that of course will offer a lot of volatility into the market as well.

To the downside, I see the 200 day EMA as a potential target, closer to the 1.2750 level. However, if we did break above that 1.3050 level, it would show a “higher high”, which of course is very bullish. Looking at this chart, you can see that we are also perhaps trying to form a bit of a down trending channel, so that something worth paying attention to also. At the end of the day, the market was all over the place and formed a slightly negative candlestick. So, what does this tell you? It tells you that there are still plenty of sellers out there waiting to jump on the British pound if it gets a bit overbought. The market will continue to be very noisy to say the least, and for a lot of traders it could end up being very untradable as we get towards the end of the year and crunch time when it comes to finding a solution to Brexit issues and some type of potential deal between London and Brussels.