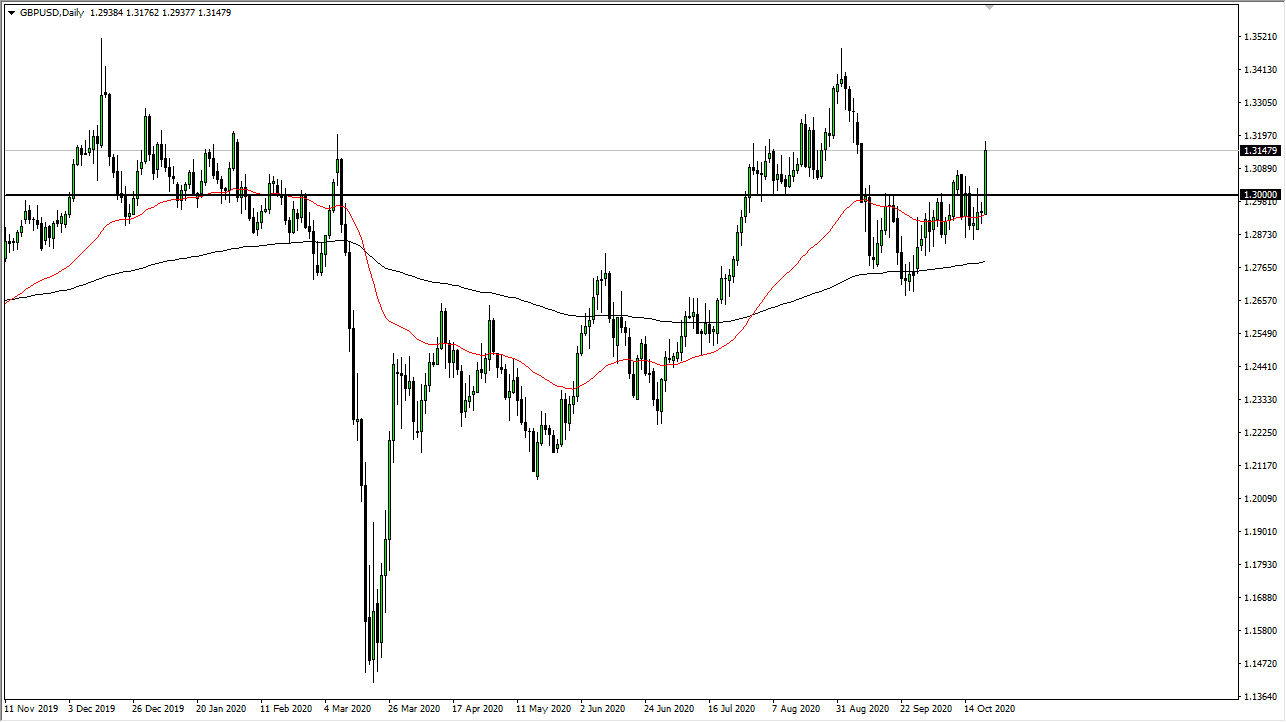

The British pound rallied significantly during the trading session on Wednesday, breaking above the 1.31 handle. This is an area that had previously been massively resistant, but now that we have broken above there it is likely that we could continue to see upward pressure. A lot of this is probably based upon hope yet again on Brexit's situation proven itself to be positive again, but it is very difficult to imagine that we are going to simply get some type of bargain in living happily ever after. After all, the market is likely to see a lot of headlines that will throw this pair back and forth.

On the other side of the equation, we also have to think about stimulus in the United States, and therefore that could work against the value of the US dollar. However, if we do not look likely to get stimulus, that could have the opposite effect, sending the British pound lower as people would cover US dollar shorts. For what it is worth, the 50 day EMA sits at the bottom of the massive candlestick that formed during the day, so I think at this point we are more than likely going to see buyers underneath to pick up short-term British pound pullbacks. I think that the market probably goes looking towards the 1.34 handle above, which was the recent high. I think that we will eventually try to get there given enough time, but it is probably going to be a very difficult scenario between here and there.

If we were to break down below the 1.2850 level, it could open up the door to the 1.2750 level which is near the 200 day EMA. The market continues to see a lot of resiliency when it comes to the British pound, so that is most certainly something that you should be paying attention to. The market continues to offer a lot of noisy trading, but obviously, the British pound is flexing its muscles every time it gets the opportunity. I have no interest in shorting this market right now, at least not until we break down below the 200 day EMA or unless we get some type of significant announcement that kills the idea of a Brexit deal anytime soon. Quite frankly, this is going to be probably one of the most difficult markets to trade over the next couple of weeks.