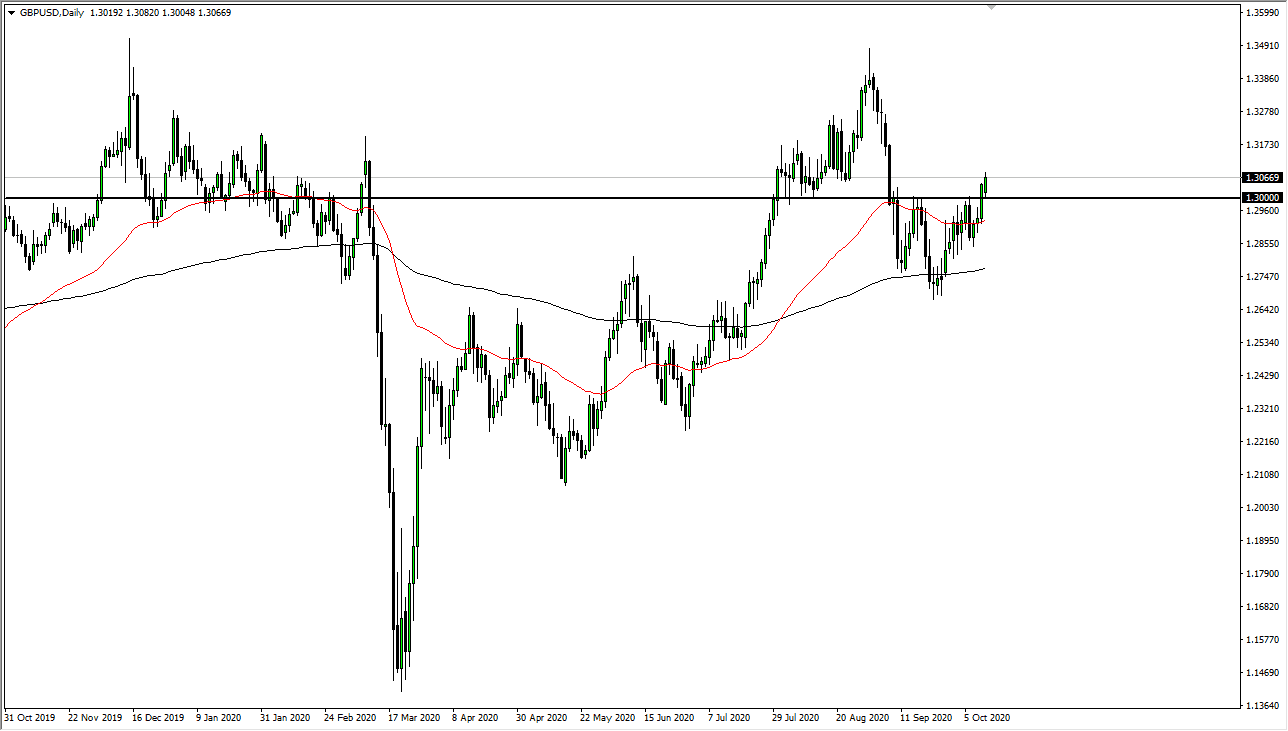

The British pound continues to rally significantly during the trading session on Monday, as we continue towards the highs again. We have seen the 1.30 level underneath as a significant level that we are now through. Ultimately, short-term pullbacks will more than likely attract a lot of attention, mainly because the British pound seems to be somewhat impervious to all of the bad news out there. After all, Boris Johnson is cranking up the lockdowns in the United Kingdom, and even though it is not considered to be an extraordinarily brutal one, the reality is that it will slow down the overall economic growth.

To the downside, I believe that the 50 day EMA will probably offer quite a bit of dynamic support, which is essentially the lows of the candlestick for the trading session on Friday. I think that pullbacks towards the 1.30 level will more than likely attract a lot of attention, and therefore I think that we will be value hunters in general. This may be due to the fact that people are expecting some type of Brexit scenario that is less than what has been feared over the last couple of years, or perhaps this is simply a matter of what is going on with the Federal Reserve and the United States Congress as far as an attempt to devalue the greenback.

Ultimately, I have no interest in shorting the British pound, even though there are plenty of reasons to think that perhaps the British pound should be suffering more than it is. Nonetheless, this is a market that has been very resilient for the last several months, so I am not ruling out a return to the highs, somewhere near the 1.34 level. You will probably have to do most of your trades offer shorter-term charts, buying dips as they go along, but at the end of the day, the real trade might end up being shorting the EUR/GBP pair, because you are buying the relative strength of the British pound while dumping the relative weakness of the Euro and completely eliminating the safety of the US dollar. In other words, you are triangulating where money flow is going recently, and that chart looks a bit fragile at the moment.