The British pound was all over the place during the trading session on Wednesday as traders continue to focus on Brexit as per usual. Unfortunately, things got a little bit hectic as Boris Johnson admitted that the United Kingdom was going to continue to look for some type of resolution to Brexit beyond October 15. This had originally been the “line in the sand” that the British had set up, but now that they have back down it shows that we have even more nonsense ahead of us.

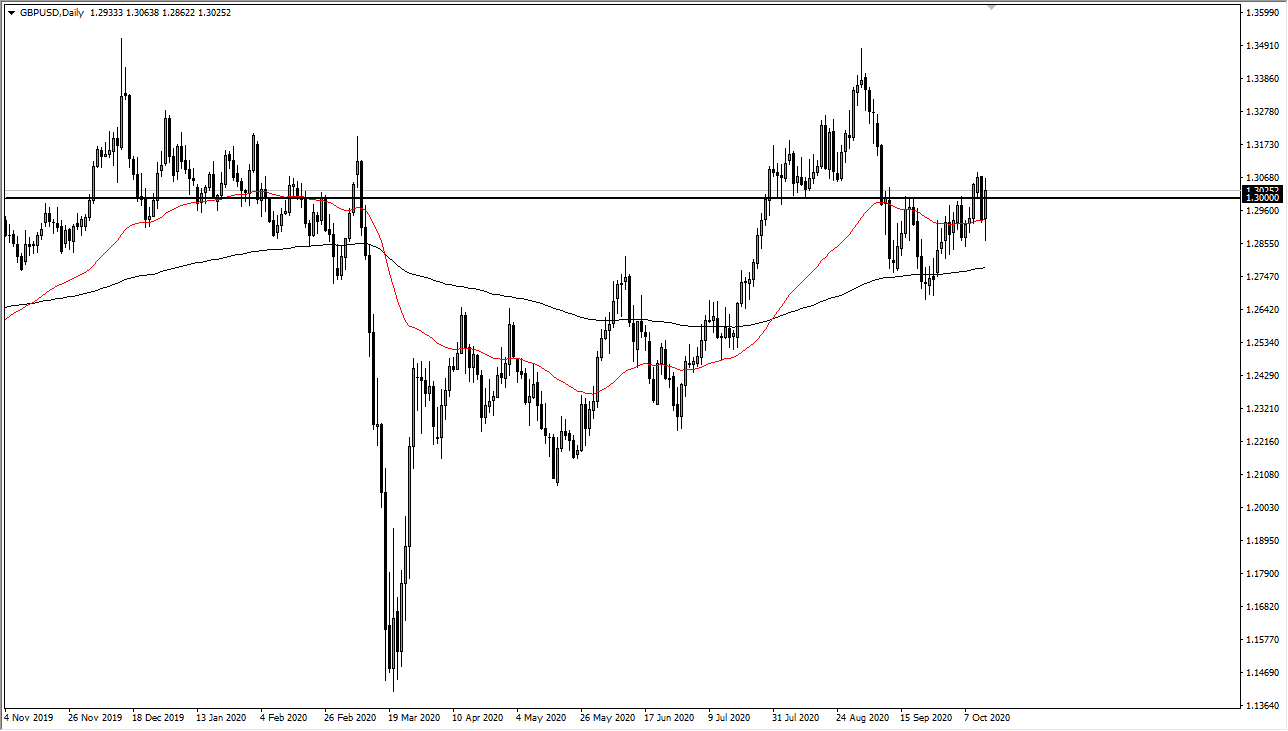

The market breaking down below the 50 day EMA during the early part of the session was negative, but there has also been a lot of buying pressure underneath the 50 day EMA previously to offer a bit of a bounce. If you have been following me here at Daily Forex, you know that I said it might be difficult to break down through that area. Having said that, we bounced quite nicely as soon as we had a reason and then shot above the 1.30 level. I would also point out that we did in fact reach towards the top of the range of the last couple of days, and then failed to continue going higher. This tells me that the market still has no idea what to do with itself and I think we are essentially trying to find some type of short-term range.

At this point, if we can break above the highs of the last couple of days, then the market is likely to go looking towards the 1.34 handle. That will not be an easy move, but nothing is going to be easy in this pair anytime soon. Even if we break down, the 200 day EMA and the 1.2750 level both come into the picture as potential support, so with that being said I think that most trading will probably be short-term nature, because we are held hostage to the next rumor or Tweet the comes out about Brexit, be it good or bad. Traders around the world continue to worry about a “no deal Brexit”, but quite frankly I think at this point the most important thing people are looking for some type of certainty. We do not have that obviously, so that continues to see a lot of volatility.