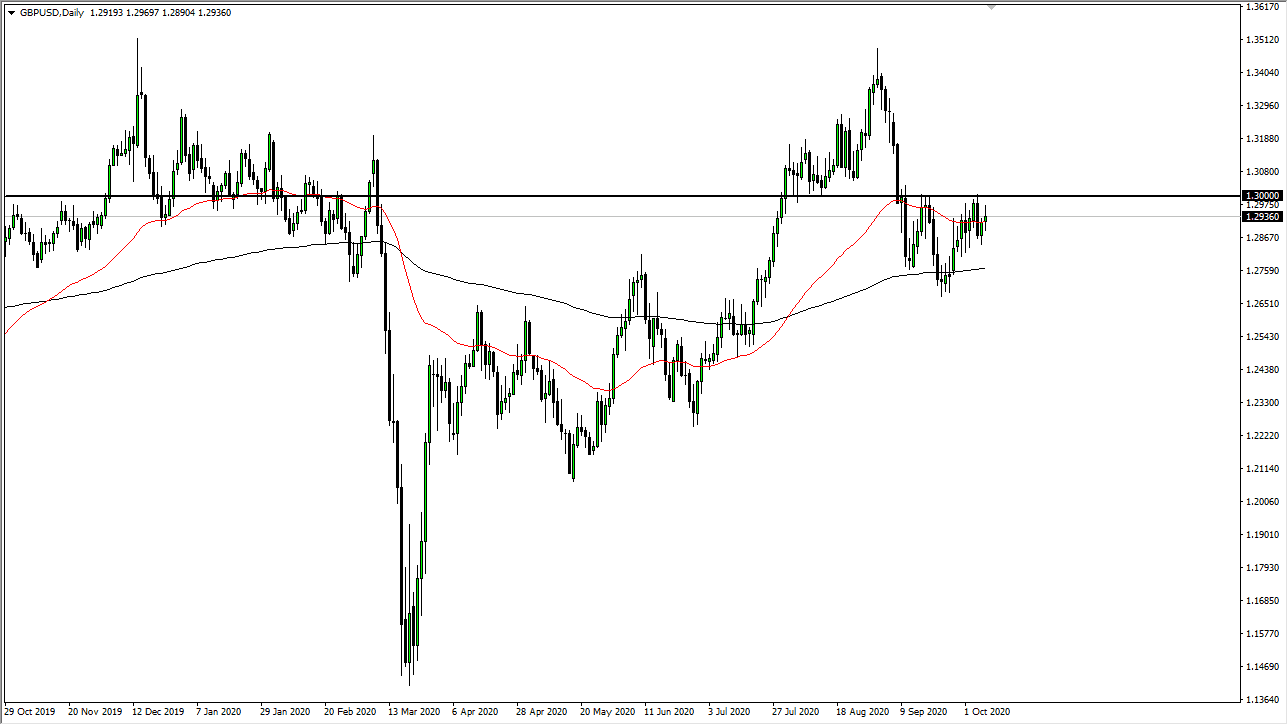

The British pound has gone back and forth during the trading session on Thursday, as we continue to see a lot of resistance in the same general vicinity. The most obvious resistance barrier at this point is the 1.30 level, an area that of course is a large, round, psychologically significant figure, and an area that we have already seen tested several times. The fact that we cannot break above there should not be a huge surprise, simply because we are still dealing with all of the nonsense that comes along with Brexit. As long as we still have no clue as to what that is going to produce, the British pound will essentially be stuck.

The 50 day EMA is slicing right through the candlestick for the session, so that of course will attract a certain amount of attention itself. Furthermore, the 50 day EMA is flat, so that also suggests that the market is not ready to continue the trend one way or the other. The candlestick for the day is relatively neutral, and I think this is a good representation of exactly what is going on here. However, we could eventually get some type of finality, and once we do, we can start training the Pound like a normal currency.

Keep in mind that there will be the occasional Tweet, rumor, or headline that could come back into play, which would have this market jumping around in various directions. The biggest problem with this of course is that we never really know when we are going to get these, so the most important thing you can do is perhaps be cautious about your position size, recognizing that the news is going to make this very difficult to trade with any type of confidence. At this point, the easiest trade is probably fading short-term rallies to get too close to the 1.30 level, but I recognize that if we were to break out and close on a daily chart above 1.3050, it is likely that this pair goes much higher. It is also very likely that it would be a direct result of something Brexit related. Until then, expect more of the same type of action. The other variable of course is the US dollar, which seems to be making a bid for strength again, or at the very least a bit of stabilization.