The EUR/USD is still enjoying the opportunity of an upward rebound amid clear investor risk appetite. The gains of the bounce culminated in testing the 124.88 resistance before settling around 124.68 at the beginning of Thursday's trading which was before the announcement of the European Central Bank's monetary policy minutes. On the economic side, industrial production in the Eurozone increased by 4.1% in July compared to the previous month, but it is still 7.7% lower than it was in July 2019, according to the latest data released by the European Statistical Office Eurostat. Annual inflation in the Eurozone was at 0.3% in September, far from the official ECB target of “less than 2% but close to 2%”. It is expected that the Euro and other currencies will remain sensitive to US political developments at least until after the elections of November 3, although it is likely that everyone will sooner or later turn their attention to successive events from the path of the Coronavirus outbreak within Europe, as recent developments does not support the Euro.

“The main risk to the down path of the US dollar remains the very low inflation picture in the Eurozone and the risks that could lead to increased purchases of ECB assets,” said Richard Franolovich, Head of Foreign Exchange Strategy at Westpac. “While some of the weakness in inflation reflects one-off temporary situations (i.e. delayed summer sales and sales tax cuts), the ECB is likely to be watching closely. Low inflation remains undesirable in the Eurozone.”

Eurozone inflation fell -0.3% in September, a new record high set down by -0.2% in August, and in a month in which economists and markets expect price pressures to rise, which risks exonerating policymakers at the European Central Bank who protested against the strength of the Euro.

The single European currency ignored the September data when it was released last Friday, but this does not mean that lower prices or weak growth in inflation will not have an impact in the coming months. And if prices continue to fall, or even fail to keep pace with those in the United States and Germany, the spread of bond yield - the difference between the yields on the two countries' bonds - is also likely to diminish and this could have implications on the EUR.

The European Central Bank has been using interest rate cuts and quantitative easing for years, hoping to lift inflation to its long-elusive target. But this was not working even before the pandemic, which has since undermined the limited previous growth and inflation.

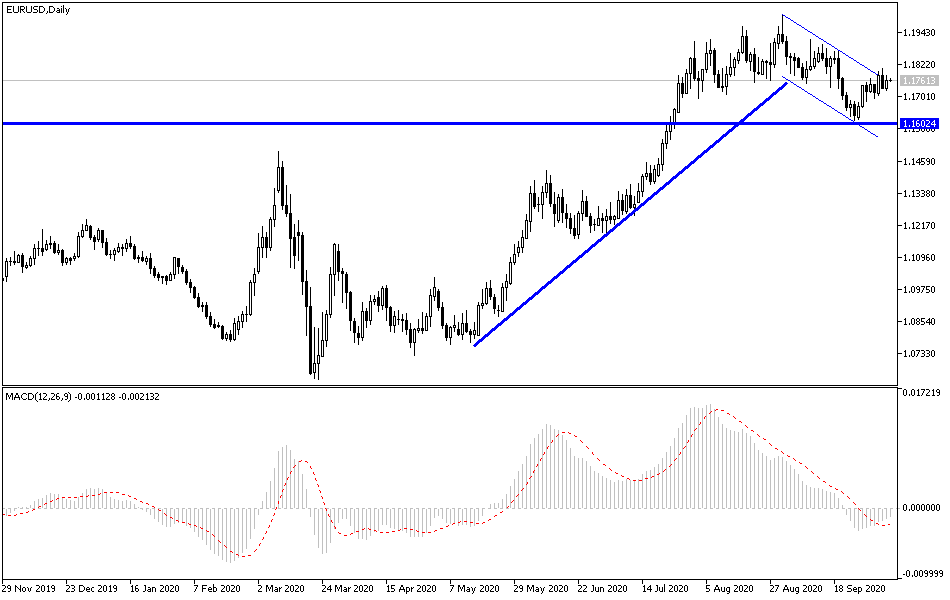

According to the technical analysis of the pair: On the daily chart, the EUR/USD is moving inside the formation of its ascending channel that has been formed since the end of last month and is waiting for the bulls to push the pair up from the 126.00 resistance to confirm the strength of the current bullish momentum. For four trading sessions in a row, the bulls have been trying to push the pair above the 125.00 resistance. On the downside, the return of the pair to move around and below the 123.00 support will restore bears’ control of the performance and end optimism for an upward correction. I still prefer to sell the pair from every higher level. The second wave of the Corona epidemic in Europe will continue to hinder Euro’s gains in the coming days and months.

The pair will interact with investor’s risk appetite, as well as the announcement of the European Central Bank's monetary policy minutes.