For the third day in a row, the EUR/USD, is in an upward correctional range that has pushed the pair towards the 1.1850 resistance at the time of writing, which is the highest level in a month. Despite the positive moves of the single European currency, the threats remain, as it may face actions from the European Central Bank (ECB), which they may eventually do in light of the strong gains in the Euro exchange rate that harm European trade, along with a new threat from the Coronavirus to the economic outlook in the block. The European Central Bank complaints helped bring the Euro back from its two-year high when it broke through the 1.2000 peak early last month.

In this regard, monetary policy makers at the European Central Bank have repeatedly warned that they will closely monitor the rate of the Euro against the dollar due to the effect that fluctuations in the exchange rate can have on European trade. As it is known that the Eurozone relies on exports more than internal trade, and accordingly, higher Euro makes European goods less competitive in global markets. The EUR/USD represents a fifth of the TWI in the Eurozone, which has also risen to multi-year highs this year but at a time when neither the Eurozone economy nor the European Central Bank can afford it.

The stronger trade-weighted exchange rate made imported goods cheaper to buy, which risks pushing the ECB's inflation target "below, but close to 2%" out of sight while potentially dampening the recovery if a stronger currency reduces export competitiveness.

Jordan Rochester, a strategist at Nomura, said in a recent note: "The low inflation expectations in the Eurozone are likely to keep the European Central Bank in a pessimistic state of mind." And “From our point of view, it is all about the risk bias during and through the US elections, as the EUR/USD pair has been closely tied to the US equity markets lately. The market is currently holding its highest levels in several decades in US dollar short positions. With COVID-19 cases rising, social distancing slowly re-tightening and mobility data declining, we see risks heading lower in the EUR/USD at the moment.”

The exchange rate of the Euro rises against the dollar, and the trade-weighted exchange rate rises in Europe at a time when European economies face pitfalls from the recovery in the last quarter due to new restrictions on economic activity related to the Coronavirus. European governments have mostly avoided returning to the sweeping "shutdown" we saw in the second quarter, but even so, increasingly heavy restrictions on social contact have put the GDP growth recovery at risk.

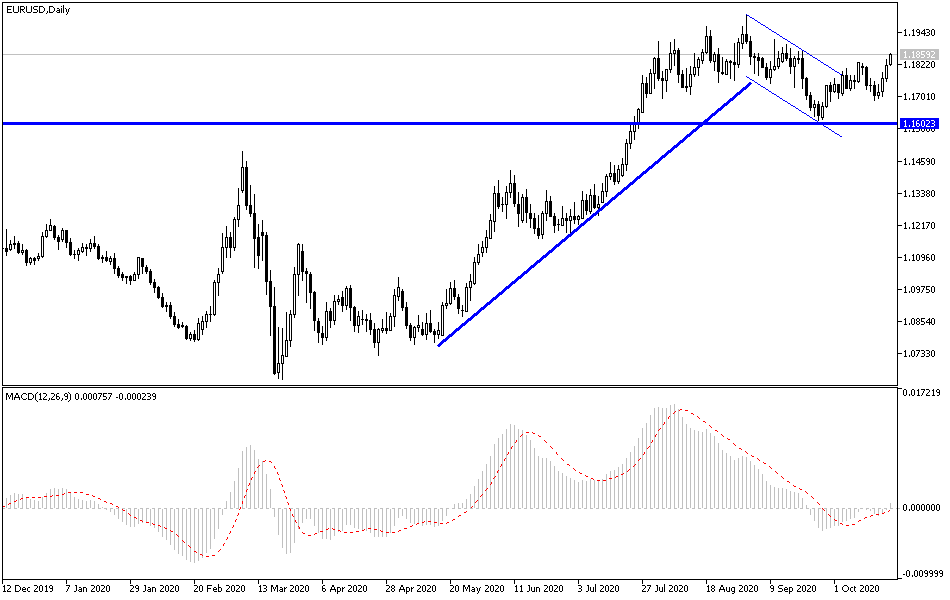

According to the technical analysis of the pair: As we mentioned in the recent technical analysis of EUR/USD, stability above the 1.1800 resistance stimulates the bulls to push the pair towards higher resistance levels and the closest ones are currently at 1.1855 and 1.1920 and the psychological resistance of 1.2000, of which controversy arises among policy officials in the monetary policy of the European Central Bank in the extent of the damage from the Euro’s gains to the European economy, and with that in mind, the rise of the Euro towards that resistance may trigger selling. On the downside, according to the EUR/USD performance on the daily chart, returning to the 1.1700 support will push the pair back to the path of the strongest descending channel for it in the long run.

Regarding today's economic calendar data: The currency pair does not expect any important data today, whether from the Eurozone or the United States of America.