After three trading sessions in a row, the EUR/USD pair moved in an upward correction performance that tested the 1.1755 resistance. The pair stabilized around 1.1720 at the beginning of Thursday's trading. Failure to correct was due to fears that Europe will turn into a hot spot for the outbreak of the deadly Corona pandemic in what is known as the second wave, as was the case at the beginning of 2020. In general, the EUR/USD exchange rate remains subject to short-term losses, especially in the event of President Donald Trump's surprise victory in the November elections, but Credit Agricole CIB told clients that these declines should be used to implement the "low-level buy trade strategy".

The single European currency has lost its luster steadily throughout September amid a correction in the stock markets that is positively correlated with it. After an apparently successful intervention by the European Central Bank (ECB), which questioned the merits of the high rate of the EUR/USD that was trading at its higher levels in more than two years around 1.20 at the turn of the month. Since then, the all-important S&P500 index has fallen more than -3% while the Euro has tumbled -1.5% after European Central Bank officials including Bank Governor Christine Lagarde and chief economist Philip Lin, sought to persuade the market further to rein in EUR gains.

Valentin Marinov, Head of Foreign Exchange Strategy at Credit Agricole CIB, says: “We maintain our constructive outlook for the EUR/USD pair for 2021 when we expect the pair to return to 1.2000 and head higher.” However, Donald Trump's surprise victory could lead to a period of weak EUR/USD performance in the fourth quarter of 2020 towards 1.1500, on the back of concerns about potential trade tariffs.

The EUR/USD fell below the 1.17 support amid a correction in stock markets last week. Although it has regained this level since then, gravity has severely affected the single European currency, preventing it from surpassing the 1.1750 resistance and gravity may be supported by Christine Lagarde, who said in a Monday speech that the bank will closely monitor the Euro and that it may respond in the coming months to any bullish moves that compromise policymakers’ ability to deliver long-term inflation target of "close to, but less than 2%".

The European Central Bank still has the option to increase the number of government bonds it buys as part of its pandemic-related quantitative easing program, which would add weight to the burden on the Euro even though many doubt that pumping the balance sheet with an extra dose of government debt would do much to restrict currency moves, at least because the market already expects this exact outcome before the end of the year.

On the other hand, the dollar was strengthened as a safe haven during the years 2018 and 2019 with the outbreak of the trade war between the two largest economies in the world, but this happened under the cover of a program of tax cuts strengthening the economy that masked its impact on the United States. This would leave the ball in the Fed’s court, which has already undermined the dollar’s appeal by pumping an extraordinary amount of newly created dollars into the financial markets in response to the pandemic, leading to dollar shortages that triggered the March fluctuations. The Fed expanded its balance sheet by more than $2 trillion in the two-quarter period.

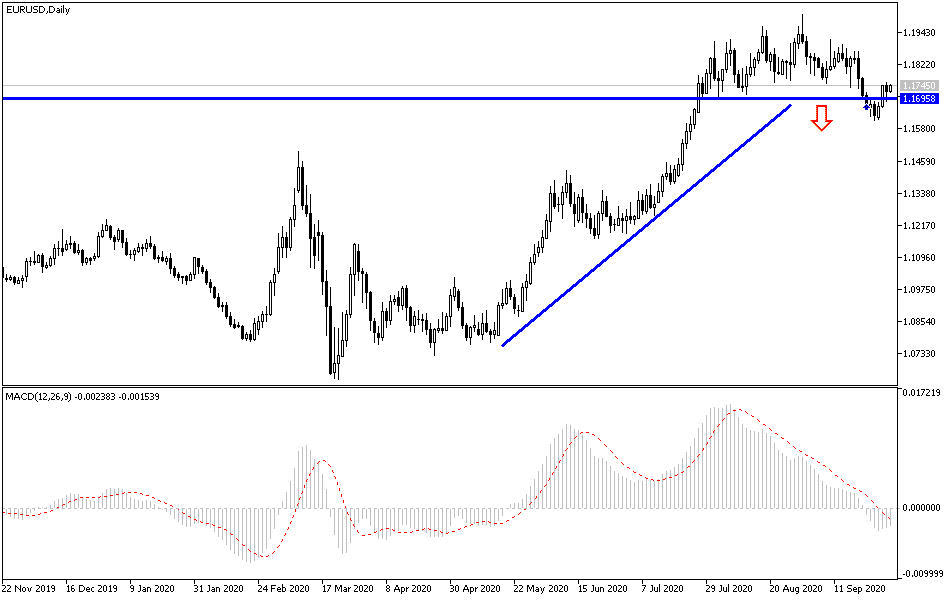

According to the technical analysis of the pair: EUR/USD bullish correction attempts stopped in the last trading sessions, which means that the upward correction lacks incentives to complete the last path. At the same time, it emphasizes the extent to which bears control the performance. Therefore, support levels at 1.1690, 1.1600, and 1.1545 will be the strongest of the general trend in the long term, which is still bearish. On the other hand, there will be no chance for a real and continuous break of the trend without the pair surpassing the resistance levels at 1.1800 and 1.2000, respectively. The last level is the most monitored by the markets and even the European Central Bank.

As for the economic calendar data today: Regarding the Euro, the Industrial Purchasing Managers' Index (PMI) reading for the Eurozone economies will be announced, along with the unemployment rate. Regarding the dollar, the weekly jobless claims announcement, the preferred indicator of the Federal Reserve to measure inflation in the country is expected, as well as prices of personal consumption expenditures, the average income and spending of an American citizen, and then a reading of the ISM industrial purchasing managers' index will be released.