At the end of last week's trading, the EUR/USD, jumped to its highest level in two weeks, when it tested the 1.1830 resistance and closed trading near that level. Downward pressure throughout the week’s trading pushed it towards the 1.0725 support. I still see that Euro’s gains will remain a selling opportunity, as the second wave of the Coronavirus outbreak in European countries will be followed by strict restrictions to contain the disease, which will put pressure on the European economy and consequently on the single European currency. In return, the market was waiting for the US stimulus.

House Speaker Nancy Pelosi, a California Democrat, has rejected Trump administration's most generous plan yet as, considering it "a step forward, two steps back." The Republicans who control the Senate rejected it as too costly and a political loss for the Conservatives. Pelosi said she remained hopeful that progress could be made towards a deal, but it is more evident than ever that the Republicans do not want a deal on her terms.

The White House had strengthened its bid before Treasury Secretary Stephen Mnuchin and Pelosi spoke on Friday afternoon. US President Donald Trump is eager to reach a deal before Election Day, even though his strongest Republican ally in the Senate has said it is unlikely that the Congress will provide relief by then.

Aides familiar with the matter said the new offer totaled about $1.8 trillion, with a major component of government and local financial relief moving from $250 billion to at least $300 billion. For its part, the White House says its most recent offer before that was about $1.6 trillion. The aides were not authorized to discuss the private negotiations publicly and spoke on condition of anonymity.

US wholesale inventories for August missed expectations of 0.5%, by a reading of 0.4%. US jobless claims exceeded expectations of 720 thousand, recording 740 thousand, while continuous claims missed expectations of 11.4 million, recording 10.976 million. Also, jobs in the US for the month of August missed expectations of 6.685 million, with a record 6.493 million. The US ISM Services PMI reading for September was forecasted at 56.3 but came with a reading of 57.8.

From the European Union, August retail sales beat expectations (year over year) at 2.2%, recording 3.7%. The Services PMI for September beat expectations of 47.6 with a reading of 48, while the Composite PMI came in at 50.4, surpassing the expected level of 50.1. Investor confidence in the European Union for October also outperformed the expected reading of -9.5 with a record of -8.2.

According to the technical analysis of the pair: In the near term and according to the EUR/USD performance on the hourly chart, it is trading within an upward channel. This indicates a slight upward slope in the short term depending on market sentiment. The pair has now risen several levels above the 100-hour and 200-hour simple moving average lines. Accordingly, bulls will look to extend current gains towards 1.1868 or higher to 1.1914. On the other hand, bears will be looking to jump on gains from a short-term pullback around the 1.1777 support level or lower at 1.1732.

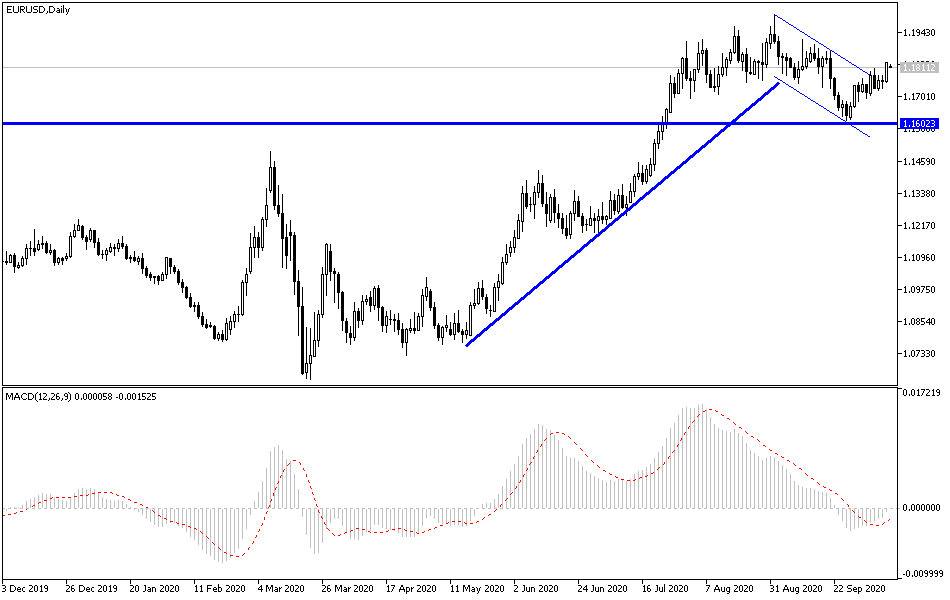

In the long term, according to the EUR/USD performance on the daily chart, it is trading within a downward channel. This stems from a sharp upward channel. This indicates an attempt by the bears to dominate the pair over the long term. Accordingly, they will target long-term gains at 23.60% and 38.20% Fibonacci retracement levels at 1.1682 and 1.1491, respectively. On the other hand, bulls will be looking for profits at 0.00% Fibonacci level at 1.2014 or higher at 1.2207.

Today, the pair is not expecting any important or influential data, whether from the Eurozone or the US, and there is an American holiday today.