In the same EUR/USD performance during last week’s trading, the pair has continued to move up since the beginning of this week’s trading. The gains of the rebound stopped around the 1.1830 resistance, in the midst of a limited movement in light of the American holiday, the pair moved in a limited range between the support level 1.1786. The level of 1.1826 and stabilized around 1.1810, before the announcement of the German ZEW index reading and US inflation figures. The recent performance has increased expectations that the pair will re-test its highest levels from early September in the coming days, and despite this optimism, the corporate profits seasons, US stimulus talks, opinion polls, and developments of Coronavirus are all factors of headwind to the pair's gains.

The single European currency achieved gains for three weeks in a row, with the rise of global stock markets and the decline of the dollar, in what many analysts said is a response to that. Accordingly, expectations are growing about a "clean sweep" of the Democratic Party in the US elections in November. Opinion polls have moved further in favor of opposition candidate Joe Biden at the national level as well as in major swing states, reducing the perceived likelihood of a disputed election and improving the odds of providing a significant fiscal stimulus over the coming months.

Commenting on this, Lee Hardman, a currency analyst at MUFG says, “We still expect the Euro to remain in the consolidation phase at higher levels ahead of the US elections. The recent loss of bullish momentum for the EUR brings some relief to the ECB although we still expect policymakers to offer more easing at next month's meeting.”

In general, the increasing expectations for a Democratic victory were bearish for the dollar and bullish for stocks, as well as the currencies that followed them. There is uncertainty about what America's own response to Jeremy Corbyn’s style policies might mean for the US economy and markets, but for Europe, the upside of the Democratic presidency is clear in that it will lead to an end to trade tensions with the European Union and a reduction in hostilities between the United States and China, a major trading partner of Europe. Europe’s economies have often suffered from the trade war between the United States and China.

However, before the United States elections on November 3 and during this week's trading, the Euro will have to overcome many obstacles, including changes in opinion polls that favor the opposition but in the extreme, the beginning of the corporate profit season and the fruitless ongoing negotiations aimed at Introduce a renewal of financial support to American families.

The most prominent profit announcers will be GB Morgan, Citigroup, Bank of America, Goldman Sachs, and Morgan Stanley. Accordingly, some currencies, including the Euro, will be sensitive to positive and negative surprises. Coronavirus developments in Europe will also be key this week, given the recent tight restrictions on activity in a number of major economies including France, Germany, Spain, and the United Kingdom. The increasing numbers of positive tests have led governments to flex their regulatory muscles, with new restrictions hampering the bloc's economic recovery.

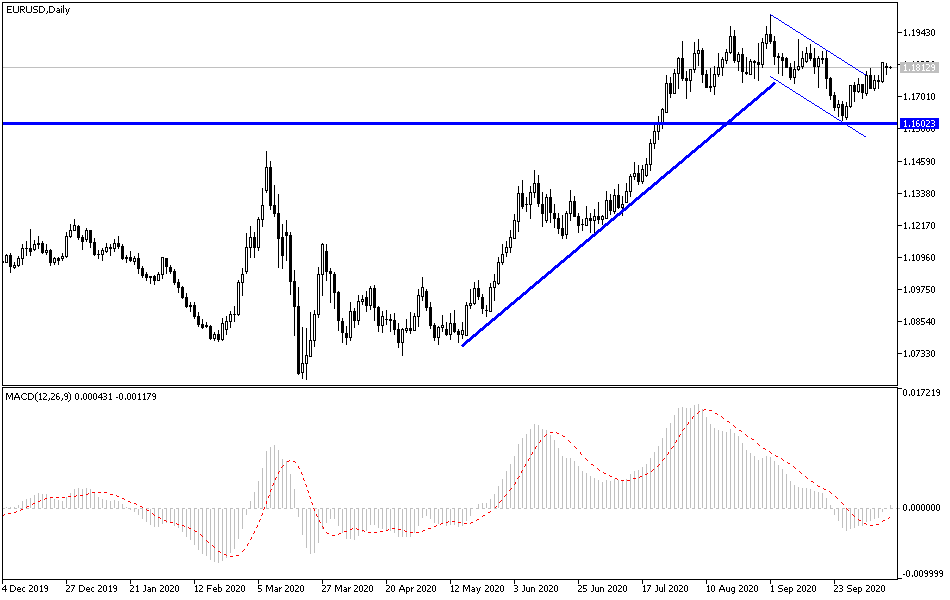

According to the technical analysis of the pair: I do not see any change in my technical view of the EUR/USD performance, as stability above the 1.1800 resistance will stimulate the bulls to push the pair towards higher levels that may lead us to the psychological resistance at 1.2000, which was often angering the monetary policy officials of The European Central Bank, as Euro gains hinder efforts to revive the European economy from the consequences of the pandemic, reaching there may trigger profit-taking selling to avoid any comments from the European Central Bank. On the downside, bears will return to control the performance in case the pair moves towards the 1.1730 support. I still prefer to sell the pair from every upper level.

As for the economic calendar data today: Regarding the Euro, the reading of the ZEW Economic Sentiment Index for the German economy will be announced. For the Dollar, the US Consumer Price Index reading will be announced.