As expected, more European restrictions to contain the new Coronavirus outbreak will increase pressure on the single European currency, as the European economy is still in the recovery phase from the consequences of the first wave. A new strict closure may end what has been achieved and will increase pressure on the European economy. Accordingly, the EUR/USD currency pair is being sold for three consecutive trading sessions, which pushed it towards the 1.1730 support, where it was close to at the time of writing. The pair's gains, which reached the 1.1830 resistance, evaporated at the end of last week's trading, with pressure on the dollar in light of the skirmishes of stimulus plans to help the US economy from the effects of the pandemic, especially since the United States is still leading global figures of infections and deaths due to the virus.

Weak sentiment towards the German economy, the largest economy in the bloc, contributed to the currency pair's losses as well. As the outlook for the Eurozone turned grim in October according to respondents to the latest survey by the Leibniz Center for European Economic Research (ZEW), who indicated that uncertainty about the outcome of Brexit trade talks, and the US elections, are behind more pessimistic views on Europe's outlook. Accordingly, the ZEW index declined from 73.9 to 52.3 in October, when expectations were for a decline to only 72.0, although the index, which measures investor assessments of the current situation, rose from -80.9 to -76.6.

Meanwhile, the indicator that measures optimism about the six-month economic outlook for Germany fell sharply in October from 77.4 to 56.1, although a measure of the current situation rose from -66.2 to -59.5. Commenting on the numbers, Professor Akim Wambach, President of the ZEW Institute, said: “The recent sharp rise in the number of COVID-19 cases has increased uncertainty about future economic development, as did the possibility of the UK leaving the European Union without a trade agreement. And the current situation in the run-up to the US presidential election is adding to the uncertainty”, adding that “experts’ sentiments regarding economic development in the Eurozone have also subsided”.

The survey asks analysts and investors from 300 institutions including banks, insurance companies, and financial departments of large companies for their assessments and expectations regarding the economic situation in all major economies in the world, but with a special focus on Europe. Expectations for the six months have deteriorated more in Germany and the Eurozone than they have for the United Kingdom and the United States, although the Japanese forecast deteriorated more than anywhere else in the developed world.

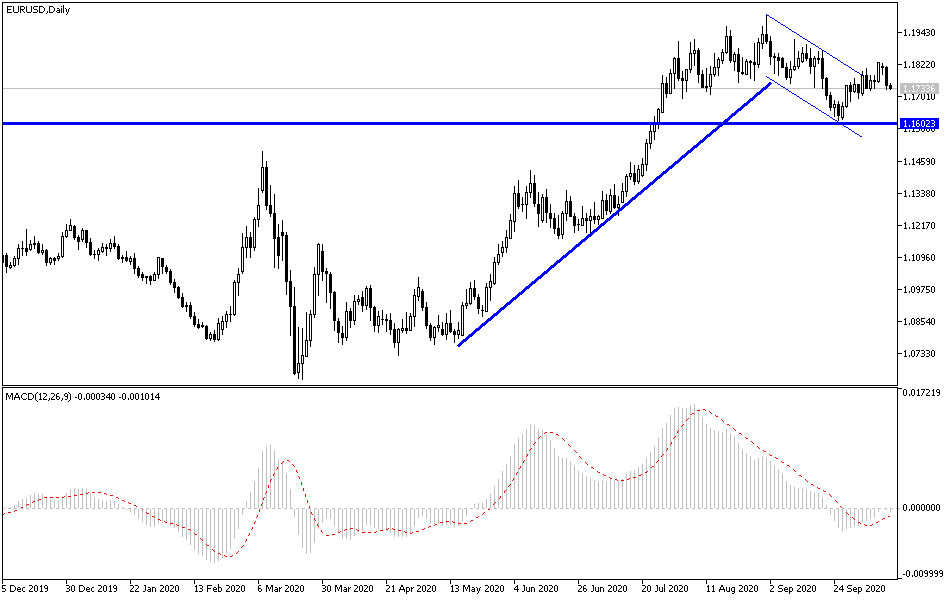

According to the technical analysis of the pair: The recent EUR/USD selling pushed it to the vicinity of its descending channel according to the performance on the daily chart and the success in breaking below the 1.1730 support will increase the bearish momentum for the pair to rush towards the next support levels at 1.1680 and 1.1590, which are considered the best places to buy and wait for the bounce. On the upside, the 1.2000 resistance will remain an important symbol for bulls to dominate the performance and begin to signal a reversal of the current bearish outlook. And as I mentioned before, I confirm now that any Euro gains may collide with important measures to contain the outbreak of the Coronavirus.

As for the economic calendar data today: Regarding the Euro, industrial production in the Eurozone will be announced. Regarding the dollar, the US Producer Price Index numbers will be released.