Investors' giving up the US currency temporarily contributed to an upward rebound in the EUR/USD, to the 1.1880 resistance, its highest level in more than a month, before settling around 1.1845 at the time of writing. After those recent gains, forex traders are wondering about the selling opportunity. We believe that yesterday's peak and above, is the most appropriate to sell, as the single European currency is still facing fears due to the strength of the new Coronavirus outbreak and the resorting to impose strict restrictions to contain the COVID-19 in Europe. Despite the pair's gains, it appears that the potential for financial market volatility is increasing and the dollar's strength in the coming weeks will grow if Democratic presidential candidate Joe Biden's lead over Donald Trump begins to diminish.

Biden has for some time maintained a lead over Trump, but the latest indications are that not only has that progress stalled, but it may also reverse. Developments will prompt markets to anticipate a repeat of what happened during 2016 when Hillary Clinton's lead in opinion polls and forecasting markets proved unhelpful in determining the final result that made Donald Trump assume the presidency of the White House. Commenting on this, Holger Schmidding, an economist at Bernberg Bank, said: “With a chance of luck, we will know the exact outcome of the US election two weeks from now, on the morning of November 4. As it stands, Joe Biden remains the favorite to win. But in two of the three main metrics that we follow regularly (betting on controversy and opinion polls), his lead over Donald Trump has diminished somewhat. ”And he added,“ The 2016 experience with the late rise in support for Trump in some major states followed by his surprise victory over Hillary Clinton indicates also that the race is still open. ”

Schmidding's remarks indicating a tightening of the race are based on notes on bets covered by Electbettingsodds.com as Biden's probability of winning fell to 60.5% from 65.3% on October 12. The chance that Trump will win is now 36.6% versus 32.1% on October 12. According to Schmiding, at the same stage of the 2016 election, betting markets saw Hillary Clinton ahead of Trump with odds ranging from 82.3% to 16.8%. The average polls compiled by RealClearPolitics now show an 8.6 point lead for Biden (51.1% versus 42.5% for Trump) after a 9.8 point advance on October 12.

Financial markets have made an assumption in recent weeks - based on polls, betting on market prospects and modeling - that Biden will comfortably lead the White House while the Democrats appear to be on their way to overturning the Senate. Therefore, such an outcome would lead to a "blue wave" as the White House and Senate agree on a major stimulus program in early 2021. Economists and market participants see this as generally supporting stock markets and negatively for the US dollar's outlook. Therefore, the implications for the markets as a result of a tight race will be significant, as it will increase uncertainty levels with the approach of November. Increasing uncertainty tends to confront weaker equity markets, the strong US dollar, and other "risk-insulated" currencies such as the yen and the Swiss franc.

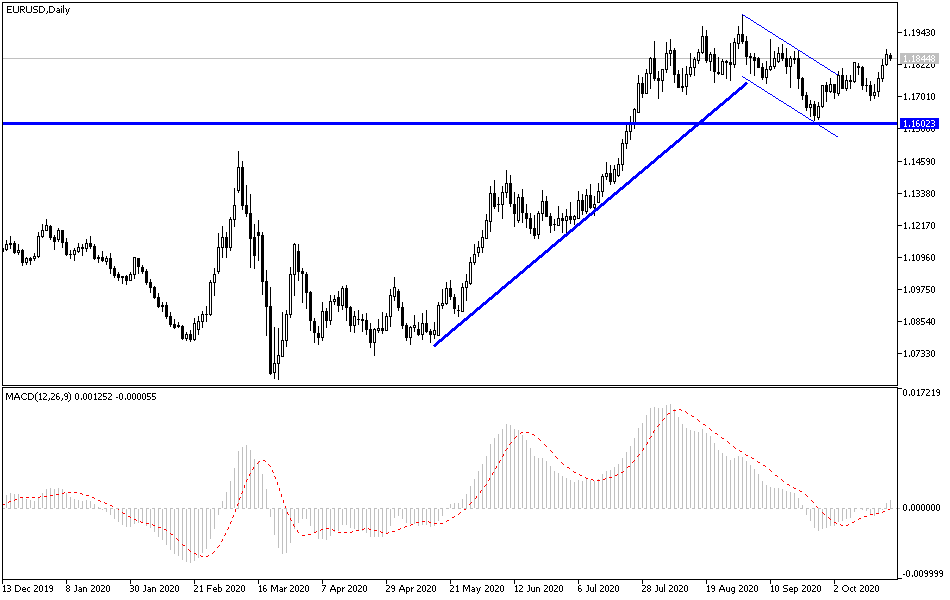

According to the technical analysis of the pair: Despite the recent EUR/USD gains, I still prefer selling at any gains achieved by the pair, and the selling may be ideal at the present time from the resistance levels at 1.1880, 1.1930, and 1.2000, respectively. As the Euro is still facing uncertainty about the Coronavirus and strict measures to contain the disease, which threatens the European economy and thus the Euro, as well as increasing the demand for the dollar as safe havens. In the long term, the general trend is still bearish. Returning to the support level at 1.1740 will support the move in the descending channel, as shown on the daily chart.

As for the economic calendar data: The GFK index of the German consumer climate will be announced, and later, the consumer confidence index in the Eurozone will be announced. As for the US dollar, unemployment claims and pending home sales data will be announced.