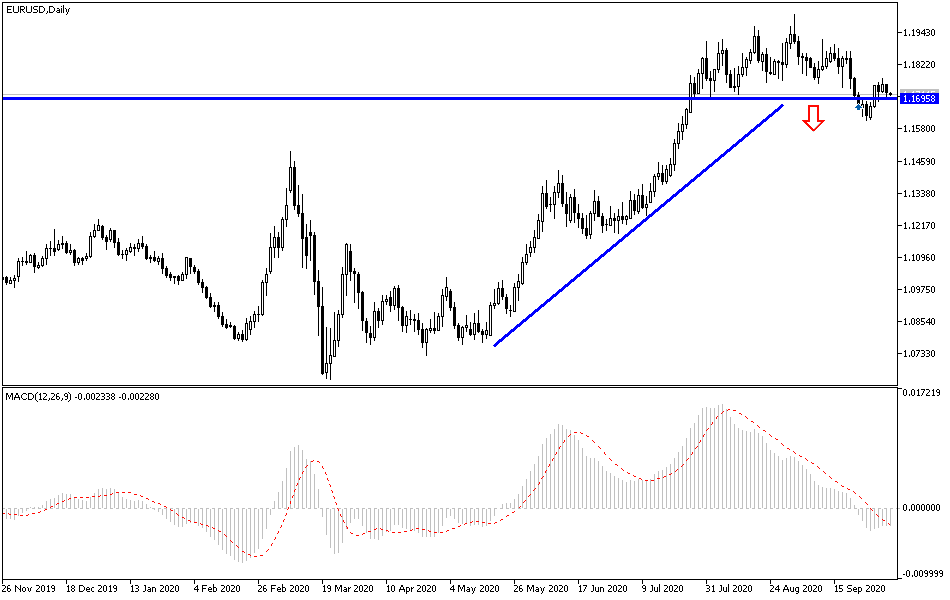

EUR/USD attempts a bullish rebound in a limited range and did not exceed 1.1770 resistance after it retreated in the previous week to the 1.1612 support, its lowest level in more than two months. By the end of last week's trading, the pair retreated to the 1.1696 support and closed around the 1.1716 level due to the variation in the US employment report results. What also weakened the chances of the single European currency to rebound higher were fears that the second COVID-19 wave would cause a second closure of the European economy, which is still suffering from the consequences of the first wave, which took place at the beginning of 2020. On the other hand, the USD demand as a safe haven increased after the announcement of US President Donald Trump's infection with the Coronavirus, but it may face difficulty this week if European Central Bank President Christine Lagarde speaks against the Euro in any of her multiple speeches.

Despite the recent performance, the Euro ended last week’s trading with almost 1% gain, but it was unable to surpass the important resistance at 1.1800. We expect the volatility of the single European currency to increase in the coming days as investors react to updates related to Trump's health, which will be an important determinant of risk appetite. In this regard, says Franziska Palmas of Capital Economics: "The news that President Donald Trump tested positive for the Coronavirus has boosted the odds of Joe Biden winning." "We may see politics take centre stage in the next few weeks, as they lead daily moves in the S&P500."

Trump was rushed to the hospital late last Friday where he receives Remdesivir, an experimental drug developed by the US-based Nasdaq-listed Gilead Science. Commenting on his condition, Trump's doctor said on Saturday: “The president was diagnosed with COVID-19 on the evening of Thursday, October 1 and received an antibody cocktail from Regeron on Friday, October 2,” after earlier describing it as “working very well…. His condition does not require extra oxygen ... he is resting stably.”

News about Trump's health will have a greater impact on global financial markets, including the forex market.

There is a widespread agreement among analysts that the Democratic president would be a negative outcome for the dollar given Joe Biden's friendly stance on China, but his onerous tax and regulatory agendas along with the Democrats ’growing group of“ socialists ”cannot be welcomed by the stock market. In other words, the aforementioned engagements may be subject to at least a break in the post-Trump world.

The Euro is one of the first to benefit if Trump is either unable to run or be re-elected, which may explain why previous losses were reduced on Friday after the announcement that shook all markets. This week there will be several occasions during which European Central Bank Governor Lagarde will speak and the Euro may interact with it a lot. “The question now turns to what the European Central Bank will do to counteract the impact of the Euro’s strength,” says Pipan Rai, head of North American foreign exchange strategy at CIBC Capital Markets. “The EUR/USD is still struggling to breach the 1.1750 level that was the previous support again, which is an indication of the pair rebalance issue emergence. Nevertheless, another test of the 1.1600 psychological support should not be excluded.”

Lagarde's speeches may get more attention than usual this week after Eurozone inflation statistics surprised by being on the negative side for September, a month in which policymakers at the European Central Bank have repeatedly warned of the risks the bank's inflation outlook poses due to this year’s strong gains.

According to the technical analysis of the pair: According to the EUR/USD performance on the daily chart, the pair still lacks sufficient momentum to strengthen the opportunity for a rebound to the recent high, and as I mentioned in the recent technical analyses, breaching the 1.1800 psychological resistance will remain important for the bulls' stronger control, because it will technically support the next most important move towards the 1.2000 resistance, which has been of great interest since the European Central Bank commented on it, and the extent of its damage to the European economy. On the downside, the 1.1600 support will remain important for bears to control performance for a longer period.

As for the economic calendar data today: Eurozone services PMI reading, followed by the retail sales figures for the bloc will be announced, and there will be a meeting of the Eurogroup. During the US session, the ISM Services PMI reading will be announced.