With the Eurozone post-lockdown recovery losing steam in September, led by a concerning slowdown in Spain, and the second wave of Covid-19 infections sweeping across the continent, the fourth-quarter outlook remains bearish. While Spain is leading new daily cases in the Eurozone, France is a close second, with localized lockdowns and social distancing restrictions elevated amid full capacity in several hospitals. The EUR/USD advanced into a former short-term resistance zone and converted it into support, from where the rise in bullish momentum favors a new breakout.

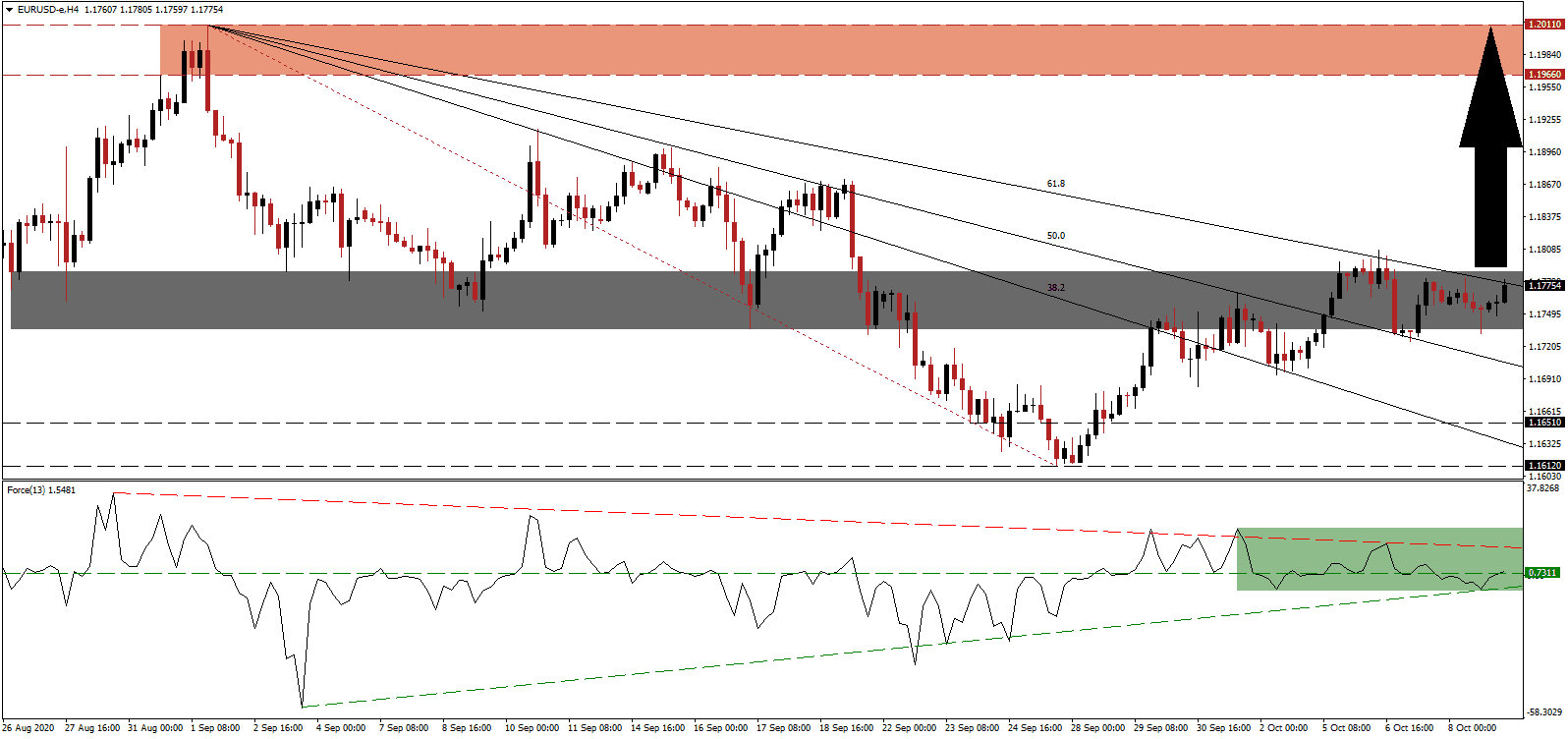

The Force Index, a next-generation technical indicator, recorded its third higher low, a bullish development suggesting more upside potential. After piercing through its horizontal resistance level, as marked by the green rectangle, assisted by it its ascending support level, it was converted into support and delivered another boost to bullish momentum. This technical indicator crossed above the 0 center-line and is now positioned to eclipse its descending resistance level, ceding full control of the EUR/USD to bulls.

Germany shifted its focus away from Italy and Greece and now believes Spain became the economy to derail the Eurozone recovery. The kingdom experiences political turmoil amid the fallout from the Covid-19 response. A rapid rise in unemployment and new lockdown measures threaten a domestic economic malaise that could swiftly spread to neighboring countries, especially France and Italy, already on shaky ground. The EUR/USD, driven higher by US Dollar weakness, challenges its descending 61.8 Fibonacci Retracement Fan Resistance Level. It presently crosses through the short-term support zone located between 1.1736 and 1.1788, as identified by the red rectangle.

While the situation across the Eurozone is deteriorating, with the European Central Bank (ECB) boosting its asset purchase program by another €1.35 trillion, the US faces more significant pressures. Initial jobless claims data continues to disappoint, confirming weakness in the labor market, while the global downturn risks a double-dip recession. The EUR/USD is on course to extend its advance into its resistance zone located between 1.1966 and 1.2011, as marked by the red rectangle, where the 1.2000 level serves as significant resistance.

EUR/USD Technical Trading Set-Up - Breakout Extension Scenario

- Long Entry @ 1.1775

- Take Profit @ 1.2000

- Stop Loss @ 1.1720

- Upside Potential: 225 pips

- Downside Risk: 55 pips

- Risk/Reward Ratio: 4.09

Should the descending resistance level reject the Force Index and pressure it into negative territory, the EUR/USD may partially retrace its rally. Given the intensifying weakness out of the US, where new debt threatens to pressure the US Dollar lower, together with monetary policy, Forex traders should buy any sell-off. The downside potential remains confined to its support zone between 1.1612 and 1.1651.

EUR/USD Technical Trading Set-Up - Confined Breakdown Scenario

- Short Entry @ 1.1680

- Take Profit @ 1.1615

- Stop Loss @ 1.1720

- Downside Potential: 65 pips

- Upside Risk: 40 pips

- Risk/Reward Ratio: 1.63