Hans Kluge, the Regional Director of the World Health Organisation (WHO) for Europe, warned against Covid-19 fatigue by the population, which according to the latest data, reached over 60%. It comes despite more than 6.2 million infections and over 240,000 fatalities since February. The continent experiences a second wave, and while full nationwide lockdowns are unlikely, and localized ones see protesters clashing with police. Many ignore guidelines and threaten the collapse of the strained healthcare system. Despite concerns, the EUR/USD completed a breakout above its short-term support zone, from where more upside is possible, driven by a weak US Dollar.

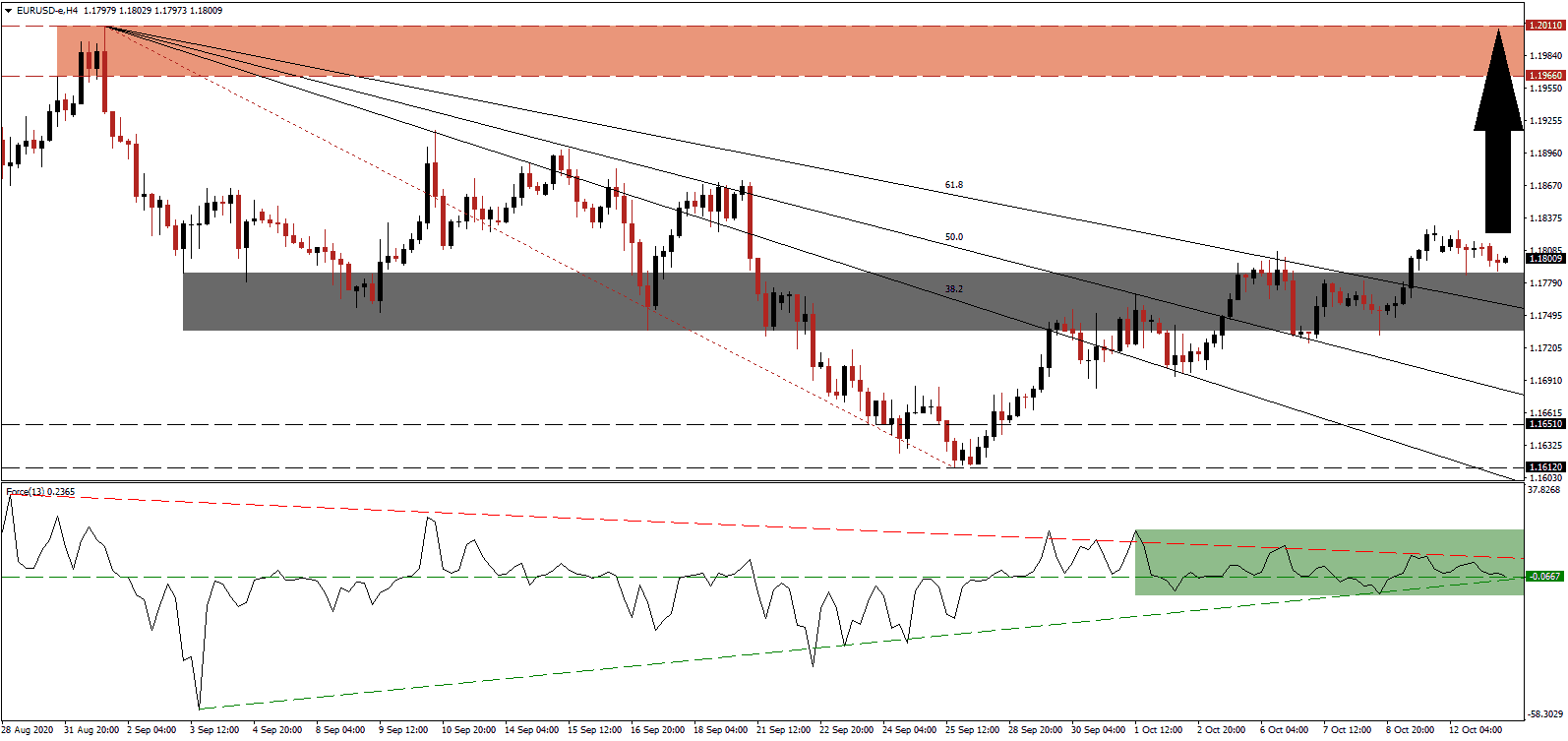

The Force Index, a next-generation technical indicator, was rejected by its descending resistance level, as marked by the green rectangle, but remains above its horizontal support level. It is enforced by its ascending support level, while a minor negative divergence is invalidated. This technical indicator maintains its position in positive territory, granting bulls control over the EUR/USD.

Lothar Wieler, the Head of the Robert Koch Institute (RKI) for Infectious Diseases, issued a grim outlook for the next few weeks, acknowledging that the situation is worrisome. The risk of an uncontrollable spread of Covid-19 remains elevated as the holiday season approaches. Germany started to implement localized restrictions on hospitality venues in hot spots, and the Eurozone economy will remain under pressure, in conjunction with the global one. Following the breakout in the EUR/USD above its short-term support zone located between 1.1736 and 1.1788, as marked by the grey rectangle, more upside is probable.

While the European Central Bank (ECB) announced its willingness to cut interest rates farther into negative territory, together with a €1.35 trillion boost to quantitative easing, the US Federal Reserve counters the negative impact on the Euro. The more massive bearish force on the US Dollar results in net bullish pressure on the EUR/USD, magnified by the breakout above its descending 61.8 Fibonacci Retracement Fan Resistance Level. It cleared the path for price action to advance into its resistance zone located between 1.1966 and 1.2011, as identified by the red rectangle.

EUR/USD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 1.1800

Take Profit @ 1.2000

Stop Loss @ 1.1740

Upside Potential: 200 pips

Downside Risk: 60 pips

Risk/Reward Ratio: 3.33

A breakdown in the Force Index, enforced by its descending resistance level, below the 0 center-line could lead to short-term profit-taking. It will present Forex traders with an excellent buying opportunity, driven by a worsening US Dollar outlook. Political uncertainty merges with an ongoing healthcare crisis and a crumbling labor market with an excessive appetite for debt. The downside potential remains limited to its support zone between 1.1612 and 1.1651.

EUR/USD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.1690

Take Profit @ 1.1615

Stop Loss @ 1.1740

Downside Potential: 75 pips

Upside Risk: 50 pips

Risk/Reward Ratio: 1.50