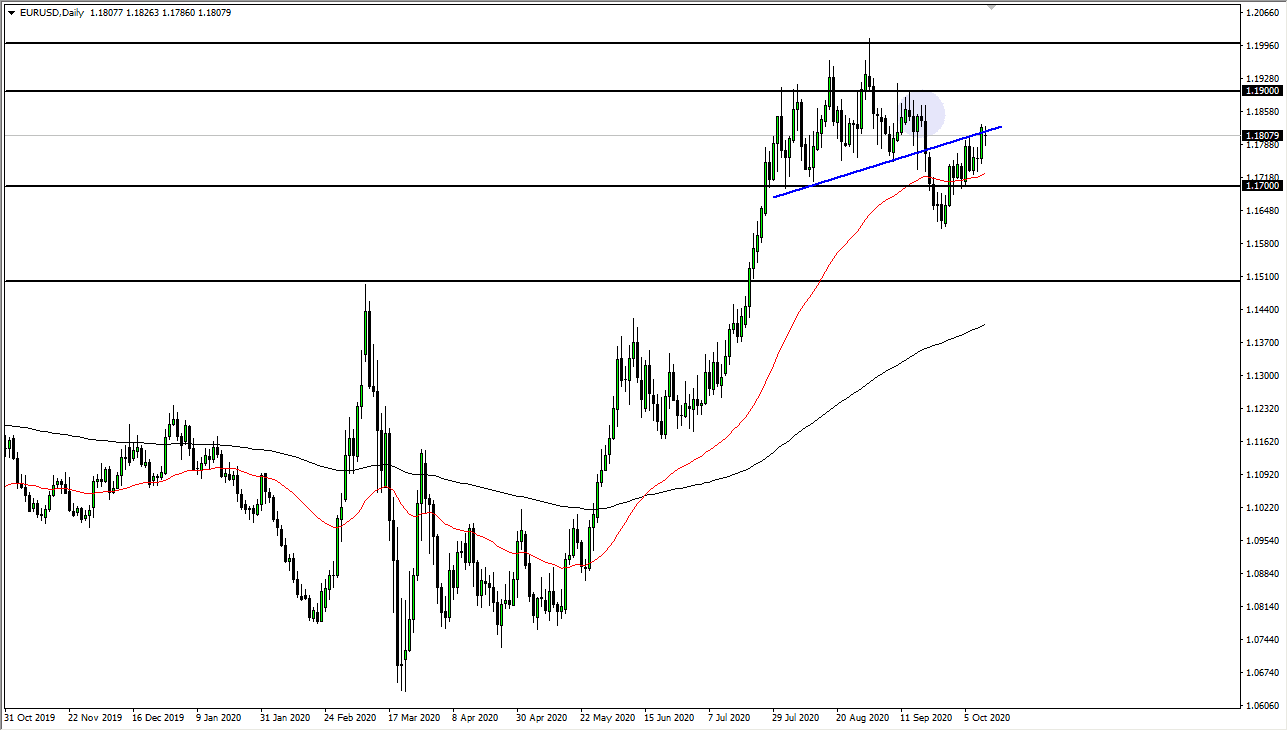

The Euro went back and forth during the trading session on Monday, initially gapping lower before going back and forth. Looking at the chart, I believe that the 1.1850 level as a potential resistance barrier that will be difficult to get above, because we have seen so much supply there. That being said, I think that the Euro continues to be very noisy in general, and the only thing that seems to be lifting the Euro right now is the fact that the US dollar is getting hit hard due to the perceived idea of massive stimulus coming.

That being said, there are a lot of poor economic headwinds out there when it comes to the European Union, and as a result it is likely that the Euro is going to struggle to have significant gains. At this point, I think what we are looking at is a massive amount of choppy volatility and it is more or less going to be down to short-term trading. I believe that the massive amount of resistance above continues to be a major issue, so I do not expect the Euro to break out until we get stimulus, something that is not coming anytime soon. Between here and the 1.20 level I anticipate that the market will struggle to make serious gains, because we have seen so much in the way of crushing negativity.

To the downside, the market will more than likely go down to the 50 day EMA, perhaps down to the 1.17 level under there. Once we clear that area, then the market is likely to go down to the 1.16 level where we had bounced from previously. Underneath there, we could even go down to the 1.15 level which has been my longer-term target for a while. In general, the Euro has no business going higher but at the end of the day it is the US dollar falling apart that has been helping here. If we get a sudden rush towards safety, or perhaps even further negative European economic numbers this week, we could see this market turn right back around. Nonetheless, I think you are looking at a market that you probably have to trade short-term wise more than anything else. Longer-term, I know that a lot of people were expecting the Euro to break out, but I am not completely convinced until we get above the 1.20 level.