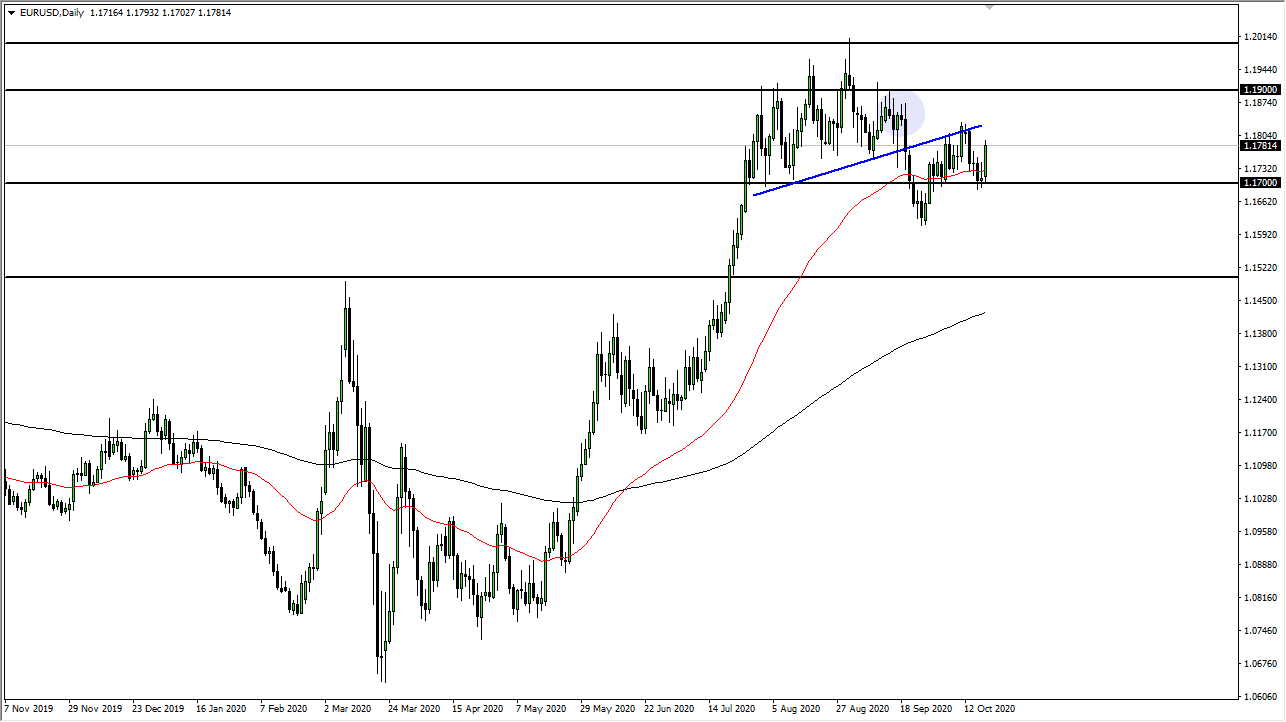

The US dollar lost against the Euro quite early during the trading session on Monday, as the EUR/USD pair has reached towards the 1.18 handle. The 1.18 handle is a large, round, psychologically significant figure that could bring some selling in. Furthermore, we have a previous uptrend line just above that could cause some resistance, so I think it is only a matter of time before the sellers takeover again.

Beyond all of that, we have to worry about coronavirus cases in the European Union picking up, and the likelihood of further lockdowns when it comes to the continent. As to whether or not the United States has further lockdowns, there is a lot less appetite for something like that in America, so it is likely that will not be as much of a factor. However, if we do have Congress flirting with the idea of providing more stimulus, so if we were to get massive amounts of stimulus the EUR/USD pair will more than likely go higher. On the other hand, if we do not get stimulus anytime soon, the market is likely to go looking towards the 1.17 level underneath which is a crucial level.

Breaking down below that level is to go looking towards the 1.16 handle, which was where we bounced significantly from and I think that if we can break down below there it is likely that we go down towards the 1.15 handle. The 1.15 handle was the scene of a major break out, so it does make sense that we may have to fall back towards that area and offer a bit of a retest. The 200 day EMA is starting to reach towards that area, so it is very likely that the area could offer quite a bit of interest. With that being said, the market is likely to see a lot of noise on the way down to that area if we do in fact make that happen. On the other hand, if we were to break to the upside it is very difficult to imagine a scenario where we simply slice through the 1.20 level, as there are multiple areas between here and there that could continue to offer resistance. I believe that eventually, we pull back, but I am not necessarily looking for some type of massive meltdown.