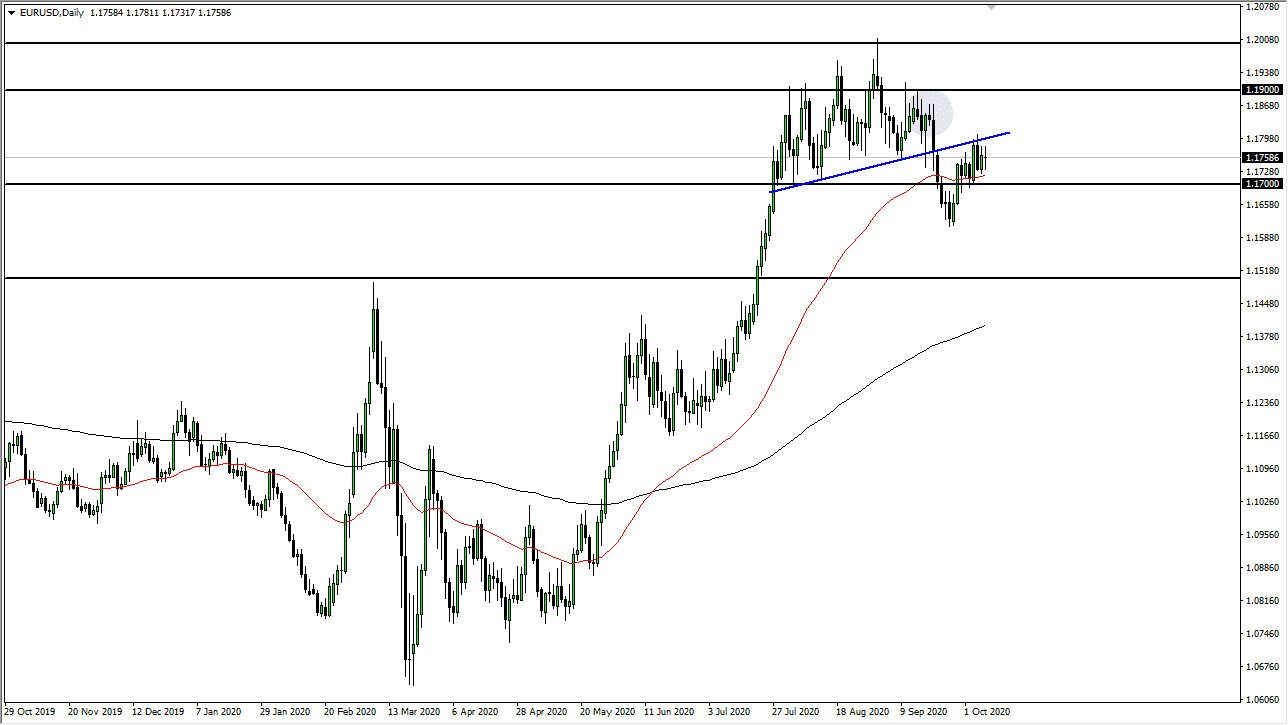

The Euro went back and forth during the trading session on Thursday, as we continue to see a lot of noise in general. When I look at this chart, it is obvious that we broke down below a significant uptrend line for the last several months, and at this point in time it looks as if we are ready to roll over and perhaps break down. That being said, at the very least I think it is likely that we are going to see a bit of confusion more than anything else.

Underneath, the 50 day EMA is offering a bit of support, and it looks as if the market is going to continue to look at that as a potential support level from a technical standpoint, not only due to the fact that the 50 day EMA is so closely follow, but it is also coinciding quite nicely with the 1.17 level which of course is a large, round, psychologically significant figure. If we break down below there, the market is likely to go down to the 1.16 level, which was a massive bounce that happen, but I think it still a minor level. A breakdown below there probably sends this market down towards the 1.15 level. That is an area where we had broken out of previously and it should have a certain amount of “market memory” coming into play.

To the downside, the market also has the 200 day EMA racing towards that level, so I think that could also offer quite a bit of support as well. I do think that eventually we may see a little bit of a bounce, but at this point we still have plenty of exhaustion coming into the market and it is obvious that until we can break above the uptrend line, I think this market still looks a little bit suspicious. This market will continue to move back and forth that the ideas of stimulus and of course the idea of whether or not the US dollar continues to go higher, or if it goes lower. For what it is worth, the US dollar has rallied on the US Dollar Index from a major trendline. We are most certainly at a crossroads right now and it should not be forgotten that the German economic numbers as of late have been rather negative.