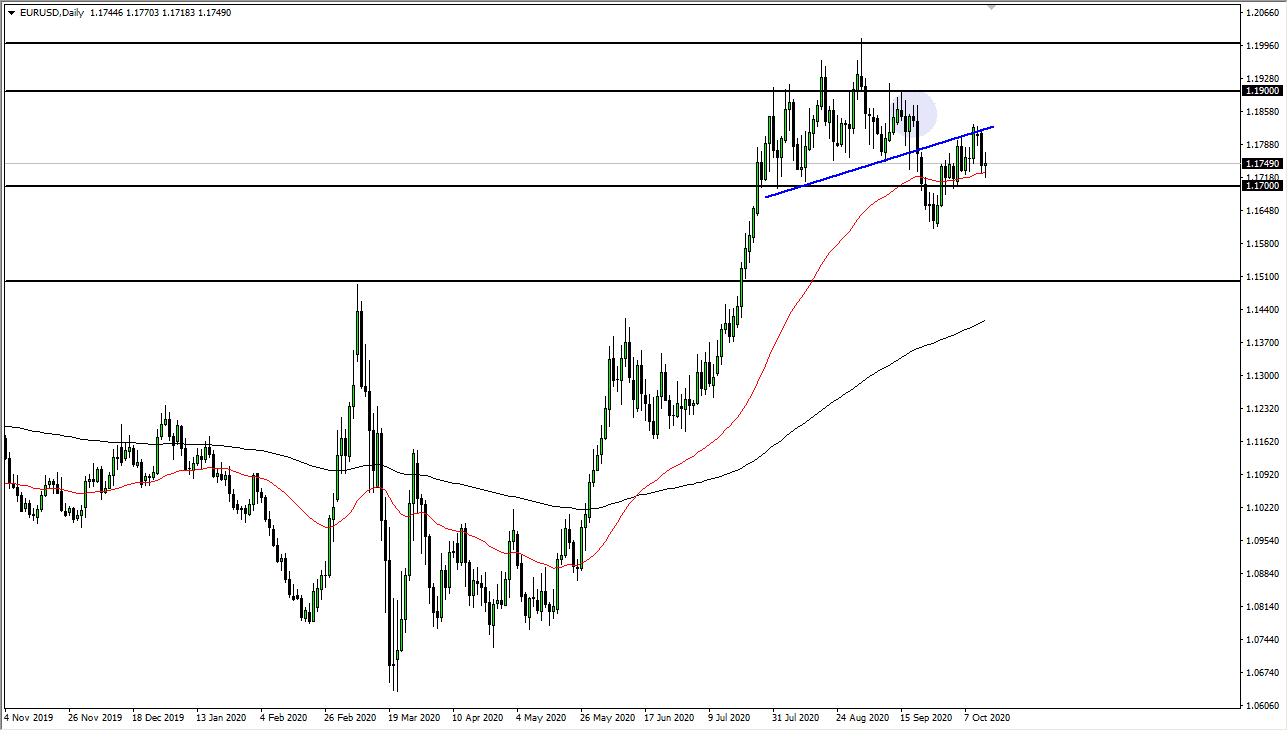

The Euro has gone back and forth during the trading session on Wednesday as we continue to dance around the 50 day EMA. Ultimately, the recent move that we had made by breaking through the uptrend line that suggests to me that the market is ready to go much lower. Having said that, I believe that we are going to make an attempt to break down below the 1.17 level. After that, then I think that the market goes looking towards 1.16 level where we had bounced from previously.

This is not to say that the market is going to suddenly break down, as this pair is typically rather quiet. However, the Euro got way ahead of itself recently, and now we are going to have to start to think about whether or not we really are going to get stimulus in the United States. Furthermore, the European economic numbers continue to be very poor, and one would have to assume that the ECB will step in and do something rather soon. Quite frankly, this is a market that technically got a bit stretched and now the question is whether or not money goes back into the US Treasury market? If it does then obviously the US dollar should continue to strengthen overall.

To the upside, if we break above the highs of last week, then it is likely we go looking to challenge the 1.1850 level, and then the 1.19 level, followed by the massively important 1.20 level. It is once we break above there that I think the longer-term trend will continue to go higher. That being said, I believe that we are more likely to see sellers of rallies than anything else. At this point, I believe that the candlestick from the trading session on Wednesday is very symptomatic of what we are looking at right now, a lot of confusion. With the market focusing on stimulus and the US presidential election, I suspect that it is going to take a lot to get the markets moving again. Granted, we will certainly get another movement but right now it looks like we are lining up for a potential fall rather than a rally. Clearly, it is easier to fall from here than it is to break out through that massive resistance barrier above. With all that in mind, the longer-term trend is not necessarily set yet.