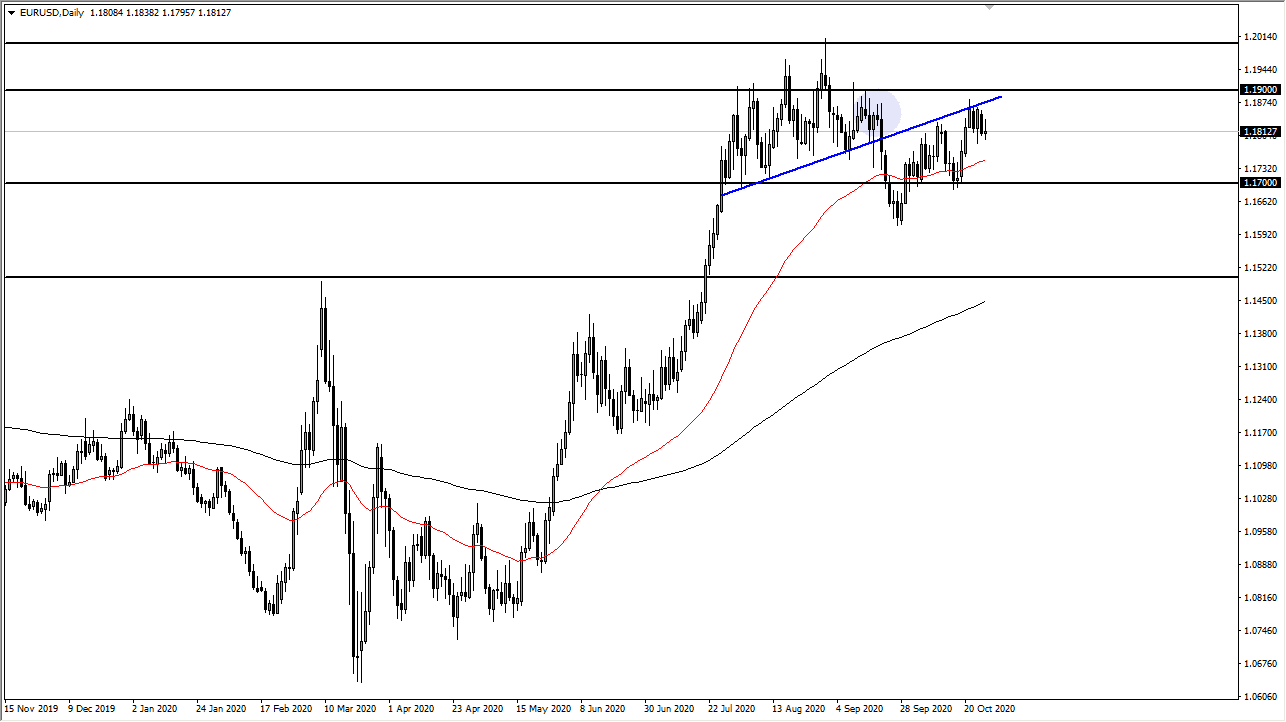

The Euro has gone back and forth during the trading session on Tuesday, reaching towards the 1.1840 level before pulling back again. By the end of the day, we ended up forming a bit of a shooting star and that suggests that we are running out of momentum. This would not be a huge surprise, because the European Union has a whole mess ahead of itself. I think at this point, you are still looking at an opportunity to short this market every time we rally in a short-term chart, and the action on Tuesday signifies that perhaps we are looking at a scenario where pressure is building to the downside but we have a ton of noise between here and there.

When you look at the chart, we had recently broken through a major uptrend line, and have tested it a couple of times. Having said that, the market is likely to continue to see a lot of noise just above, especially near the 1.19 handle, which I believe extends all the way to the 1.20 level. The 1.20 level has been very difficult to break above, and I think that will continue to be the case until we get some type of resolution with the United States elections. Because of this, I think we simply go back and forth more than anything else but I do think that eventually we will break down towards the 1.17 level underneath. The 1.17 level has been crucial more than once, and of course we have the 50 day EMA sitting just above there. With all that being said, if we were to break down below there it would be a very negative turn of events, opening up the market for a bigger move down to the 1.16 handle, possibly even down to the 1.15 level where the 200 day EMA is going to be approaching.

To the upside, if we were to somehow smash through the 1.20 level, it opens up the market to reach towards 1.25 handle underneath, which is a large, round, psychologically significant figure and also an area where traders have paid close attention to over the longer term. All things being equal, I think we see a lot of choppy behavior and then eventually at one point or another we would get a decision on where we go next with the greenback.