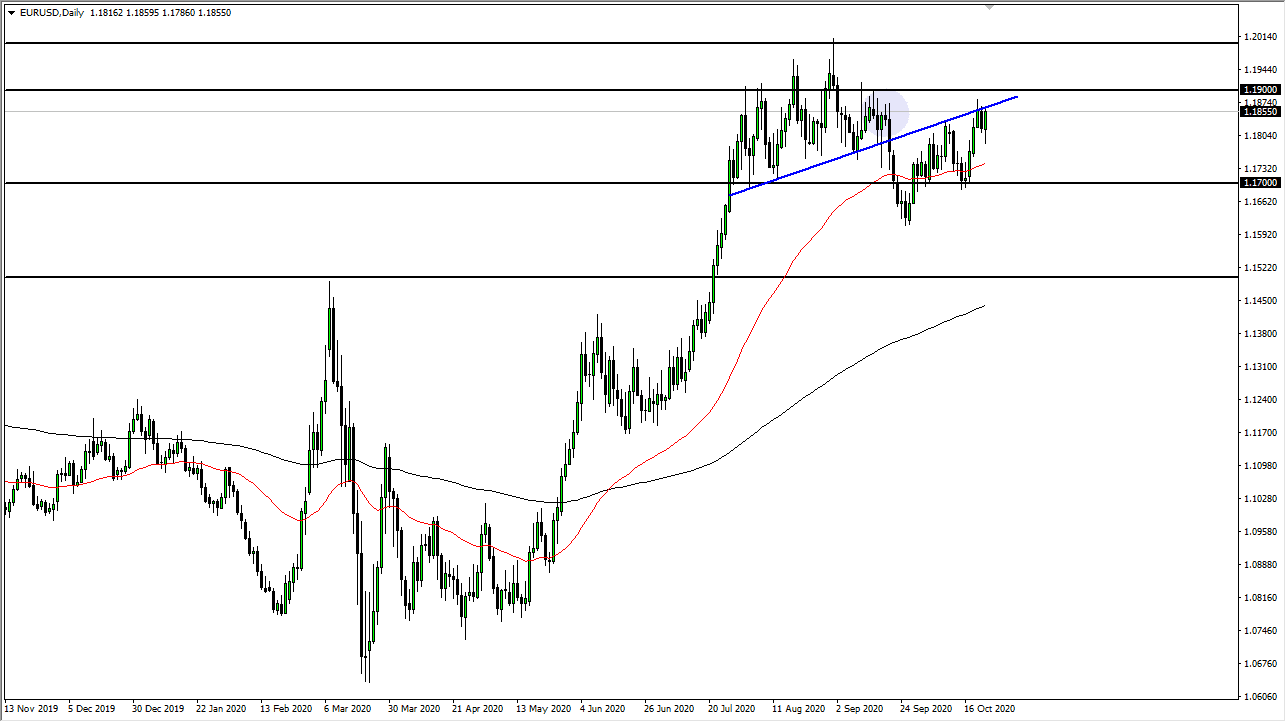

The Euro initially fell during the trading session on Friday, reaching down below the 1.18 level initially, but then turned around to rally towards the 1.1850 level. That is an area where we have seen some resistance in the past, and a lot of supply. The uptrend line that previously had been so important should now have a significant amount of resistance as well. That being the case, I think that it is only a matter of time before we break down. At this point time, it is likely that the market will continue to see a lot of choppiness, and the massive amount of resistance above.

We look at the chart, the 1.19 level is the beginning of massive resistance that extends all the way to the 1.20 level. The market formed a massive shooting star the last time we try to get to the 1.20 level, and eventually there is a massive amount of selling coming into the marketplace in that area. There is roughly 100 point resistance barrier that is going to take a significant change in the fundamentals to break out. If we do break above there, then the market is likely to go much higher, but I think it is difficult to imagine how that happens in the short term. With the stimulus problems and everything else going on, it is difficult to imagine that the market is going to simply break out to the upside for a bigger move without some type of massive change in the attitude of lawmakers in Washington.

Furthermore, we have to worry about the numbers coming out of the European Union, and they have been looking at rather poor as of late. This continues to cause major issues as well, so looking at this chart it is likely that we continue to see a lot of back and forth, and I do believe that some sign of exhaustion will more than likely be jumped upon by short sellers yet again. Ultimately, I think that you are probably still looking at shorter-term charts type of trading environment, but at this point time anything could happen based upon the latest headline. The 50 day EMA underneath could be a bit of a target if we do break down. I anticipate that it is going to continue to be very choppy between now and the early part of November.