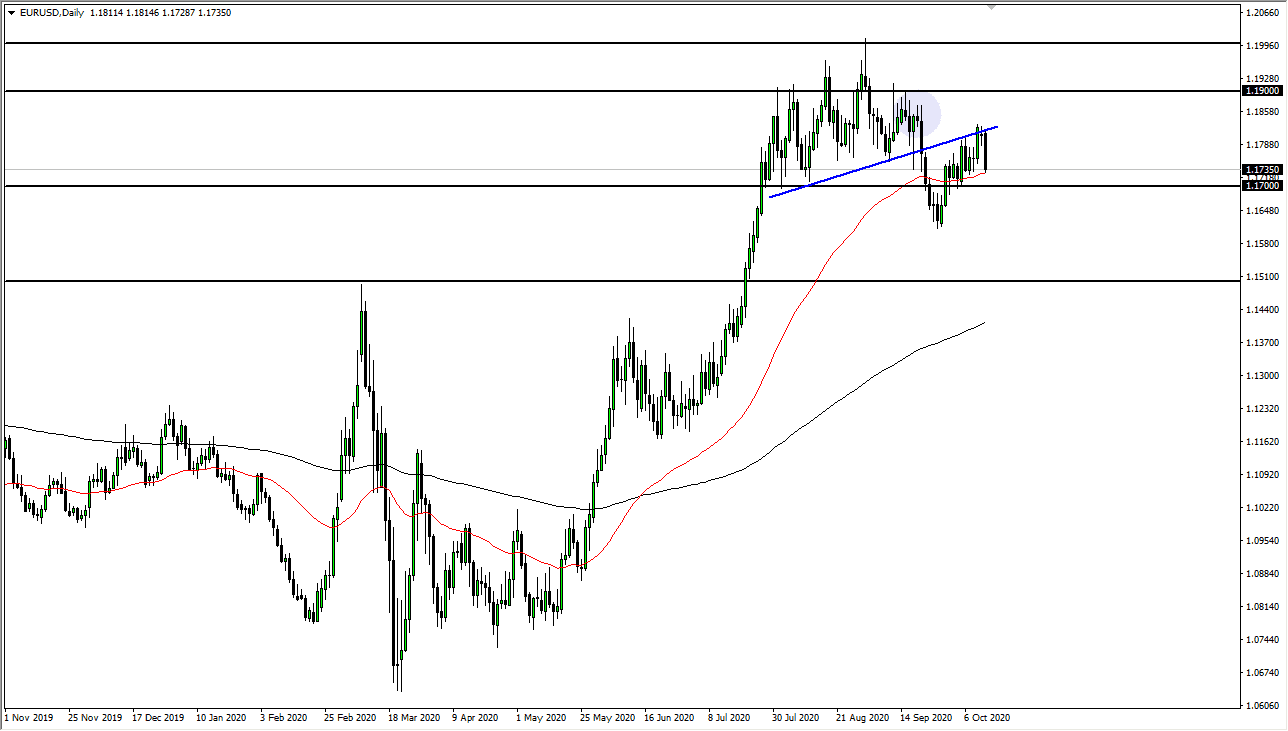

The Euro has broken down significantly during the trading session on Tuesday, crashing into the 50 day EMA. This is a very negative turn of events and it looks like the market is ready to continue dropping from here. Ultimately, we had tested a major uptrend line and found it to be resistant. By doing so, it looks like we are in fact starting to see the trend continued to the downside. At this point, we continue to look at short-term rallies as selling opportunities, at least until we can break above all of that noise.

The fact that we are trying to close out the day towards the bottom of the range tells me that there is plenty of follow-through waiting to happen. Short-term charts that show signs of exhaustion will continue to be opportunities from what I see. While there has been a lot of hype surrounding the idea of fiscal stimulus, and perhaps the US dollar falling, you can clearly see that this is a lot different than the reality of price. It looks as if the 1.17 level will continue to be an area where people are going to continue to pay the most attention to. The 50 day EMA is sitting just above there, so both of those things could offer a little bit of support. Nonetheless, we have clearly made a bit of a turn and now I think at this point we should be looking for selling opportunities based upon short-term structure.

To the downside, if we can break down below the 1.17 level it is likely that we will go looking towards the recent low at the 1.16 level. Underneath there, the market likely will run down towards the 1.15 handle. Ultimately, the 200 day EMA seems to be rushing towards that area which could offer support as well. I believe that the European economic numbers are starting to weigh upon the Euro, so I think this pullback makes quite a bit of sense. Ultimately, I believe that the market has gotten way ahead of itself and likely needs to bring itself back to reality. Fiscal stimulus could drive down the value of the US dollar theory, but the European Union and of course the entire Brexit situation continues to look very likely to be negative overall.