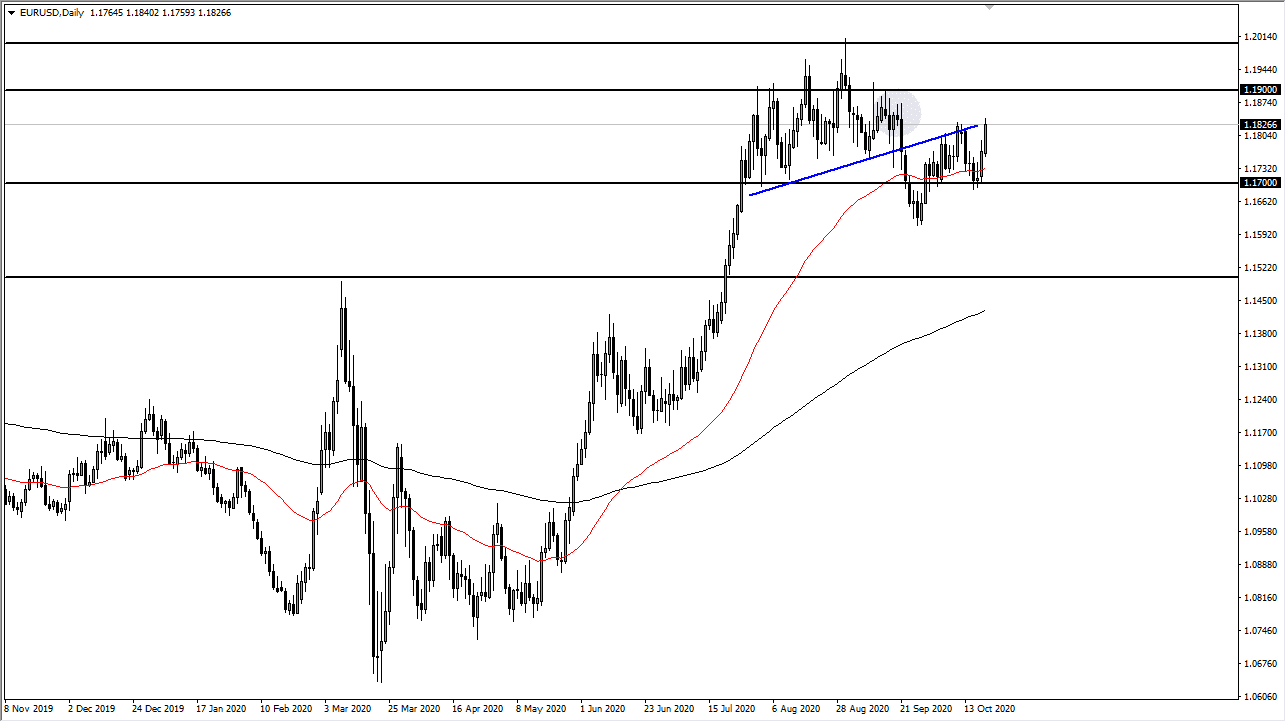

The Euro has rallied significantly during the trading session on Tuesday, reaching towards the 1.1850 level, which is also the previous uptrend line being tested again. It has held so far, and of course people are starting to pay quite a bit of attention to the idea of stimulus, which of course is going to cause a bit of a reaction in the US dollar, at least for the short term. Ultimately, I think that we are going to be looking at a lot of back-and-forth trading and at this point there is a lot of noise above. Because of this, I think that it is only a matter of time before we see a bit of a pullback.

After all, the European Union has a whole host of issues, not the least of which will be a spike in the coronavirus figures. Beyond that, Paris and London are both facing the potential of lockdowns and that of course will do nothing good for the economy. Finally, we also have to worry about the anemic growth numbers coming out of the continent, which yet again suggests that there could be problems going forward. Nonetheless, in the short term it seems like the only thing that we are paying attention to is stimulus coming out of Congress in the United States, so that is part of the reason why the Euro has been favored over the last couple of sessions.

I still believe in selling this market on rallies, but we have not seen an exhaustive candle that I can jump on at the moment. With that in mind, I stay on the sidelines look for exhaustion on short-term charts in order to get involved, but I recognize that in general we have a significant amount of support near the 1.17 handle. If that is going to be the case, then it is very likely that the market will find a bit of a bounce there. If we do not find a bounce there, then it is the 1.16 level that would be targeted next. While it is very likely that we continue to see a lot of volatility, the reality is that there is a ton of resistance above that continues to stand in the way of the Euro rallying from a longer-term standpoint.