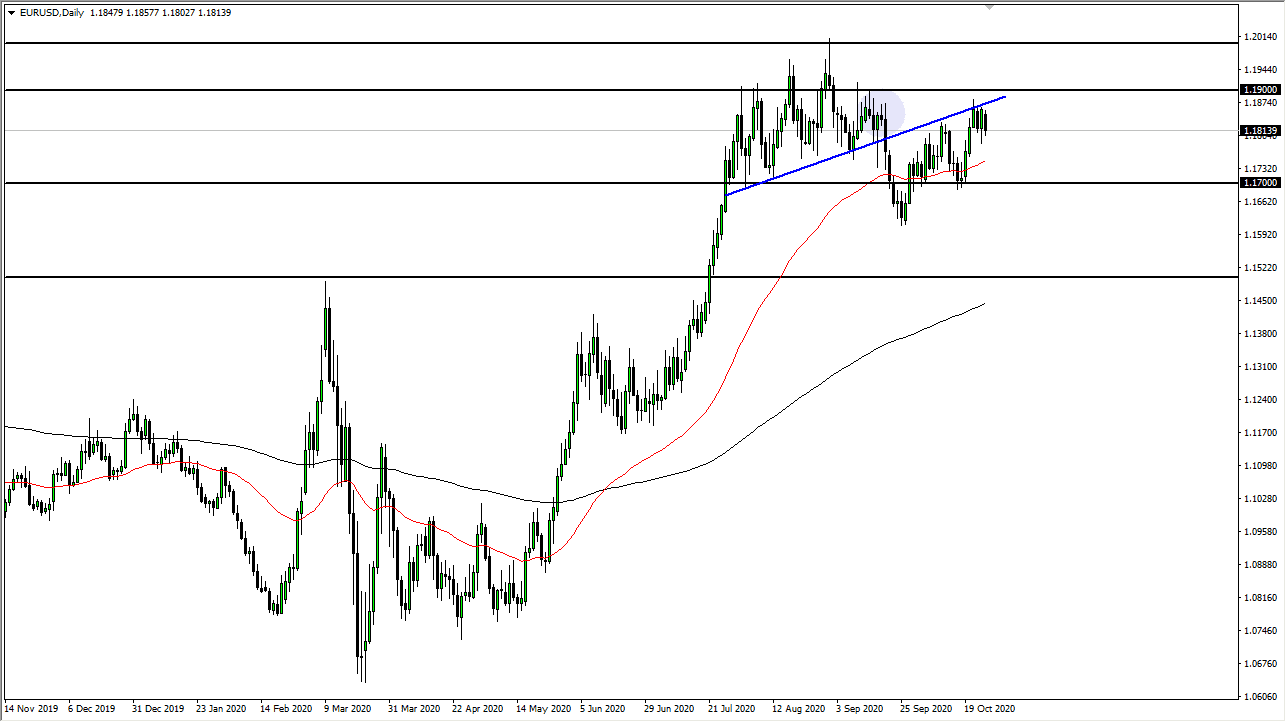

The market looks as if the 1.18 level is going to offer a little bit of support, but ultimately, I would not be surprised at all to see a breakdown through there and go looking towards 1.17 level. The 1.17 level has been crucial more than once, and the 50 day EMA sits just above it that could offer some support as well. With that being the case, I think that this is a market that will be very noisy, mainly because we have so many different things push in the markets around right now.

We have the presidential election, which is a huge issue, and therefore markets will probably move based upon that. Rallies at this point in time will be sold into, and I do not see any reason why we are going to suddenly take off to the upside, unless of course we get some type of stimulus coming out, and that is not happening anytime soon. After all, Congress will continue to be toxic and certainly will not work with the White House.

If we do break down below the 1.17 level, then the market is almost certainly going to go looking towards the 1.16 level next. Underneath there, then the target of the 1.15 level will come into the picture, as the 200 day EMA sits just below. To the upside, the 1.19 level is massive resistance, extending all the way to the 1.20 level that is very difficult to imagine breaking above. If we were to break above there, then it would be a massive continuation of an overall trend change. It is difficult to imagine a scenario where the Euro suddenly explode to the upside, unless of course something drastic happens in the US. After all, the European Union has to deal with a massive amount of coronavirus infections, and that is not getting any better. Granted, the United States also has that as well but it also has the benefit of being the world’s reserve currency, and that might be more or less what is going on here due to the rush of money into the treasury markets which had seen a four basis point job early in the day.