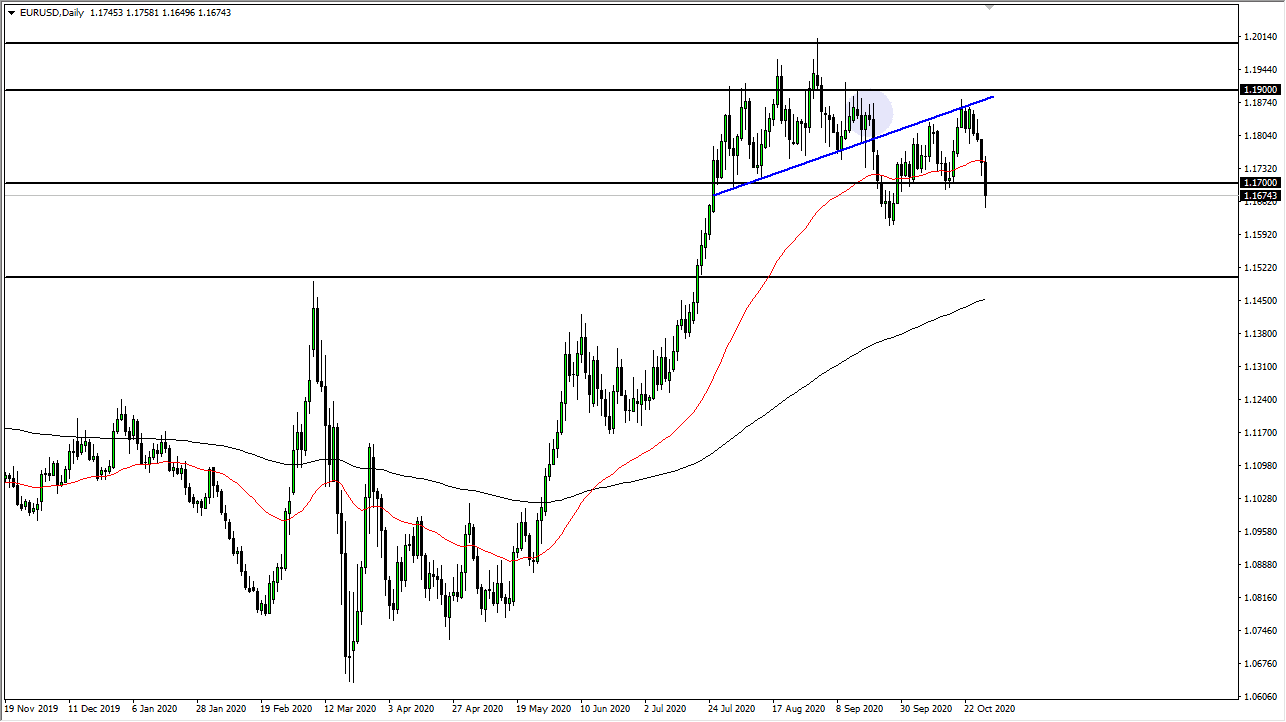

The Euro initially tried to rally a bit during the trading session on Thursday, but then broke down as the 50 day EMA offered a bit of resistance. At that point, the market then broke down significantly to reach towards the 1.17 handle. That is an area that has been important recently, but it now looks as if we are going to see that perhaps offer a bit of resistance. The US dollar has been strengthening for some time now, and the Euro is probably going to be one of the major victims of greenback strength, so I think we will continue to see this pair drop.

Rallies at this point should show resistance at both the 1.17 level, and the 50 day EMA. If we break down below the bottom of the candlestick, then we will almost certainly threaten the 1.16 handle next. Breaking below their opens up the possibility towards the 1.15 handle underneath, which gives a look at the 200 day EMA racing towards it. This could be an area where a lot of buyers would be coming into pick up a bit of value, but at the very least I believe it offers a nice target.

We were to break down below the 200 day EMA, then that is a complete collapse of the trend. That being said, I do not expect that to happen in the short term but clearly with the EU locking things down due to the coronavirus, it would make sense that the Euro would continue to suffer. I believe that will be the main driver of this pair in the short term, not to mention the fact that the stimulus package in the United States will not be coming anytime soon, due to the fact that we now have the elections on next Tuesday, and Congress has left Washington DC. It is not impossible for them to fly back and pass the measure, but it is obvious that nobody has any idea of working together.

It looks like that trendline that I had been paying attention to previously has now ended up forming a top in this market, so ultimately this is a market that is in the midst of changing the trend to the downside. How far that runs, we do not know yet, but this clearly looks like a “sell the rallies type of environment.”