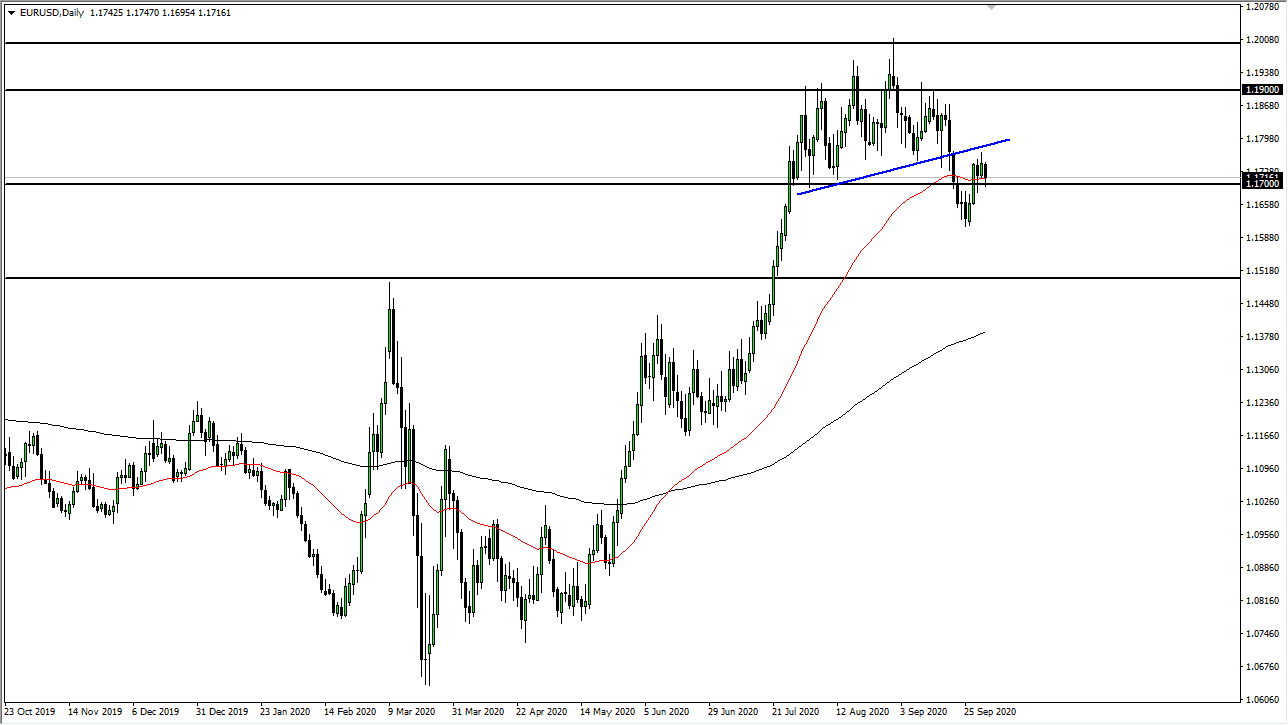

The Euro fell during most of the session but did find marginal support at the 1.17 level. At this point, the market looks as if it is ready to go back and forth in the short term, but I think a bigger move is just about ready to happen. I suppose it is worth mentioning that we did see the 50 day EMA offers a little bit of support, but it appears to me that the Euro is a bit overbought, and we are starting to see that come out on the charts.

When you look at the chart, you can see I have a short-term uptrend line marked on the chart that has been broken, and we have retested it. We also have a lot of concerns when it comes to the European economy. We are starting to see the global economy slowdown, and this almost always sends the value of the US dollar higher, which then by extension the value of the Euro lower. Looking at this chart, I think that we could go down to the 1.16 level rather quickly if we break down below the 1.17 level, as it was the most recent low. After that, then we have the possibility of a move down to the 1.15 level underneath. That is an area where we have broken out from and have not retested yet. This is not to say that it is going to be an easy move to the downside, but we have clearly made the first attempt to break the market down, and now are retesting that area for resistance.

Beyond all of that, we have a lot of potential “risk-off event” just waiting to happen. Donald Trump contracting the coronavirus is obviously one thing that is weighing upon the risk appetite of the markets, but after that, we have to worry about the very soft economic numbers that we are seen everywhere all of the sudden. The jobs number missed by over 200,000 anticipated jobs, and Germany has entered a deflationary pattern. This all lines up for safety, and perhaps people buying bonds in the United States for safety. That in and of itself guarantees that the value of the US dollar is likely to go higher. At this point, I do think that we grind lower. Even if we did break down to the 1.15 handle, that does not necessarily mean that the uptrend is over and it would be at the very least a very healthy pullback.