It looks as if the United States still cannot decide on stimulus, so that could bring a little bit of bullish pressure into the US dollar in general. Furthermore, we have to pay attention to what is going on in Europe, and it is not necessarily a good thing.

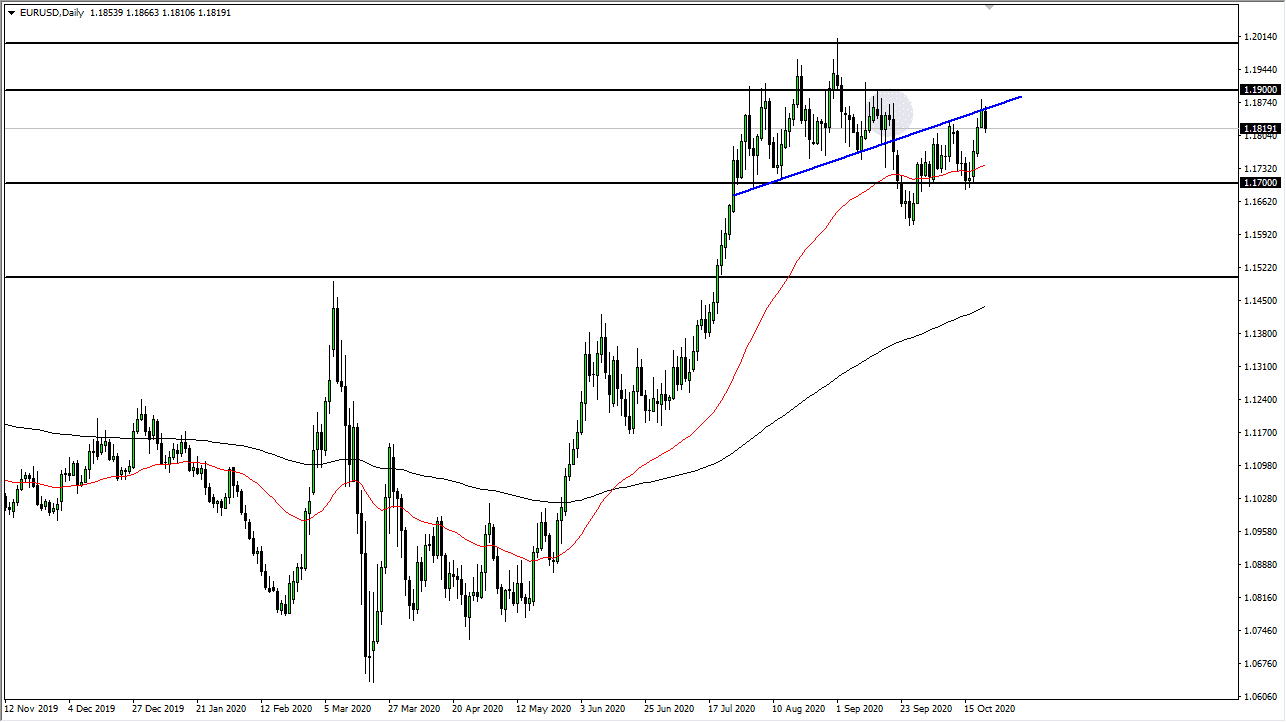

We are starting to see deflation enter the European Union, and central banks will more than likely put the thumb on the scales in order to devalue the common currency. With this, it is likely that we will see this market go looking towards the 50 day EMA over the next couple of days if we continue to see a lack of stimulus in the United States. The uptrend line had offered quite a bit of support previously, but now we have tested it a couple of times, and it looks as if that uptrend line is holding as resistance now that we have retested it. Furthermore, the 1.19 level above seems to be massive resistance and clearly there is a zone of selling between the 1.19 and 1.20 levels. In other words, we are struggling to break out.

At this point, I think it continues to be a very noisy market but that is nothing new for the Euro. The size of the candlestick is not necessarily overwhelming, but it does wipe out the candlestick from the previous session. That is essentially a “48-hour shooting star”, showing signs of an overbought condition or perhaps even exhaustion. I think that the 1.17 level will offer support, but if we break down below there it is likely that the market goes looking towards the 1.16 level after that. Granted, we could get a headline coming out the United States about stimulus that could cause his market to rally, but I think this is going to be short-lived at best. In fact, I am more than willing to jump all over this and start selling if we get close to the 1.19 level as it has been so important. I do believe that the next couple of days will probably be negative, so in that situation I do think that the sellers are going to take over, at least for the short term. If we do not get stimulus and things break down a bit in the United States, we could see an acceleration to the downside.