The Euro shot higher during the trading session on Friday, as we continue to trade based upon the idea of the stimulus. The stimulus situation is hijacking the entire market, and it should be noted right now that it is the only thing that people are focusing on. However, there is a lot more out there going on with the Euro right now then just stimulus in the United States, as the deflationary figures in Germany continue to weigh upon the idea of recovery. Furthermore, we have seen signs that the European Union is likely to lock down quite a bit due to the coronavirus, with Spain going as far as declaring Madrid a disaster zone.

In a normal world, the Euro would be getting hammered. However, traders are focused on stimulus and stimulus only it seems, as the Euro continues to gain against the US dollar. There is an old saying in the trading world, which is something like “get the dollar right, and you got most things right.” In other words, if you understand what is happening with the dollar then you can price other assets accordingly.

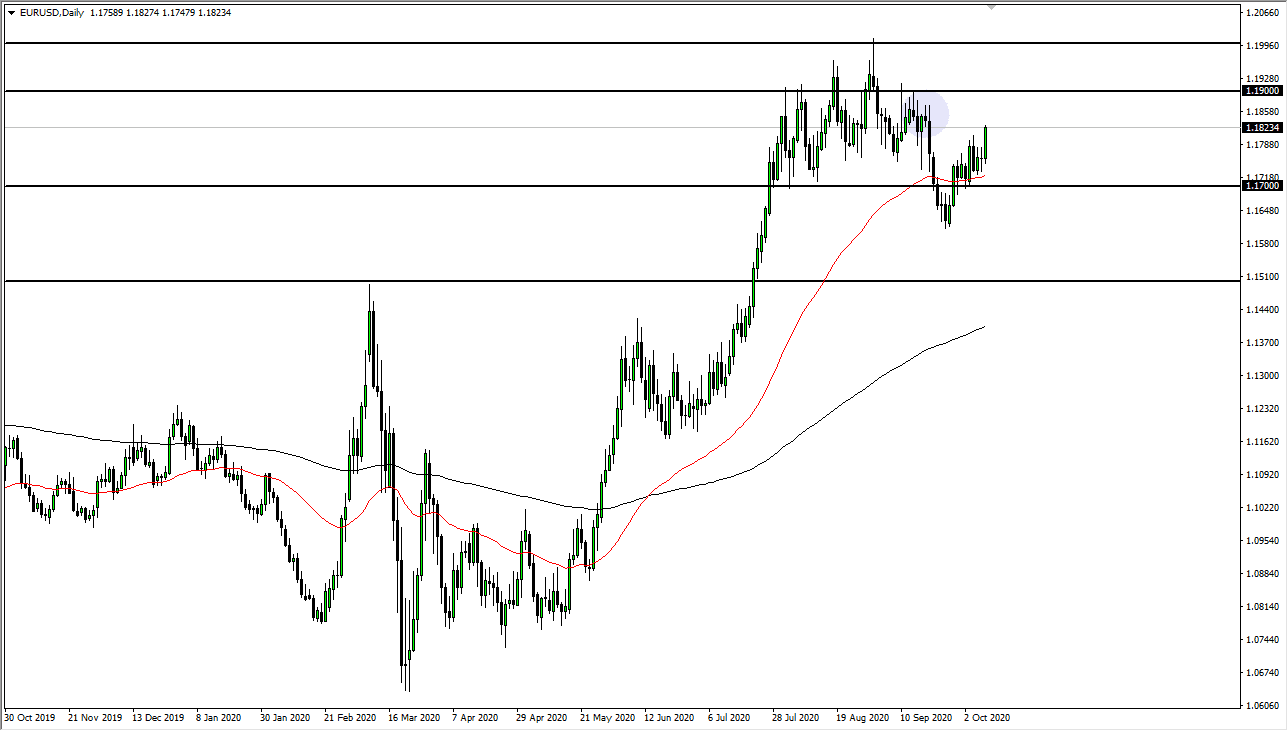

Saying that, you are essentially saying what happens in Europe does not matter. At this point in time, that seems to be 100% correct. That being said, we are only 20 pips or so away from the breakdown which I have marked by a purple circle on the chart, so I think that we could run into a little bit of trouble here. Beyond that, there is a lot of noise above that is going to continue to cause issues for the Euro, perhaps extending all the way to the 1.20 level. In other words, this is a market that is going to have to grind higher with a lot of effort. I believe in the short term we could very well see the Euro fall against the US dollar at the first sign of trouble. I certainly would not be a buyer here, even though I am the first to admit that the candlestick for the Friday session is decidedly bullish. The biggest problem is all that noise just above and therefore I think there are easier currencies to buy against the greenback if we do in fact continue the anti-US dollar move.