The EUR/USD appeared to be reestablishing a solid mid-term bullish trend higher as it incrementally rose and made resistance look vulnerable going into last weekend. However, talks between the European Union and the UK regarding a working framework for the Brexit have apparently hit another roadblock as another deadline approaches.

The first thing that should be mentioned is that deadlines often can be proven to be figments of the imagination and can be altered. Meaning the gusts of winds being created from the politicians engaged in the Brexit negotiations must be looked on with a healthy dose of skepticism.

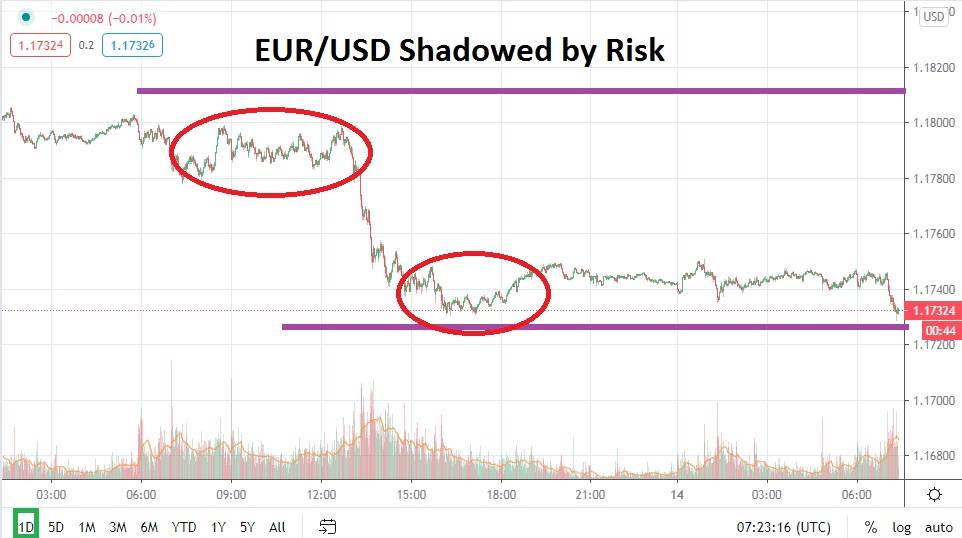

The EUR/USD started to sell off rather slowly as this week started, but yesterday the Single Currency found itself within a steep spike downwards. The EUR was testing highs near the 1.18300 mark on the 9th of October, but as of this morning the EUR/USD is near the 1.17330 vicinity. Traders with a sense of humor may actually be amused by the ability of the EUR/USD to create violent forex movements as if it were an emerging market currency pair.

However, short term traders should not be fooled by these sudden spikes downward as shadows persists from the Brexit negotiations which have been taking place for an eternity it seems. Instead speculators should keep in mind that a bullish trend has been firmly established in the EUR/USD since the middle of March and it might not be about to relent. In other words, yesterday’s steep decline in value should be welcomed by traders who have the ability to trade the EUR/USD near term and are incline to pursue risk taking.

The EUR may be oversold at this juncture and it current price levels are touching important short term support. Yes, risk appetite will certainly be put to the test the next few days as politicians perform their public charades and express their outrage at their counterparts, but expect cooler heads to prevail in the end and expect a rather optimistic outlook to emerge. And do not be surprised if the deadline to reach an agreement is politely postponed.

Traders may want to buy the EUR/USD with limit orders on slight retracements lower towards short term support. Speculators will certainly have to have stop losses in place to guard against the potential the European Union and the UK will continue to rankle each other publically, but if a degree of polite dialogue is achieved near term and global risk appetite steadies, now may be an opportunity to look for upside for the EUR/USD.

EUR/USD Short Term Outlook:

Current Resistance: 1.17580

Current Support: 1.172500

High Target: 1.17950

Low Target: 1.17060