Switzerland reports an uptick in Covid-19 cases, but at a smaller pace than most of its European counterparts, as the continent braces for the second wave of infections over the next few months, mixed with the seasonal influenza virus. It comes on the back of data showing an economic recovery emerged with the KOF leading indicator surging to a ten year high of 113.8 for September. The increase represents the fourth consecutive monthly increase and places it at levels last seen at the end of the last global financial crisis a decade ago. The EUR/CHF completed a breakdown below its short-term resistance zone with more downside favored.

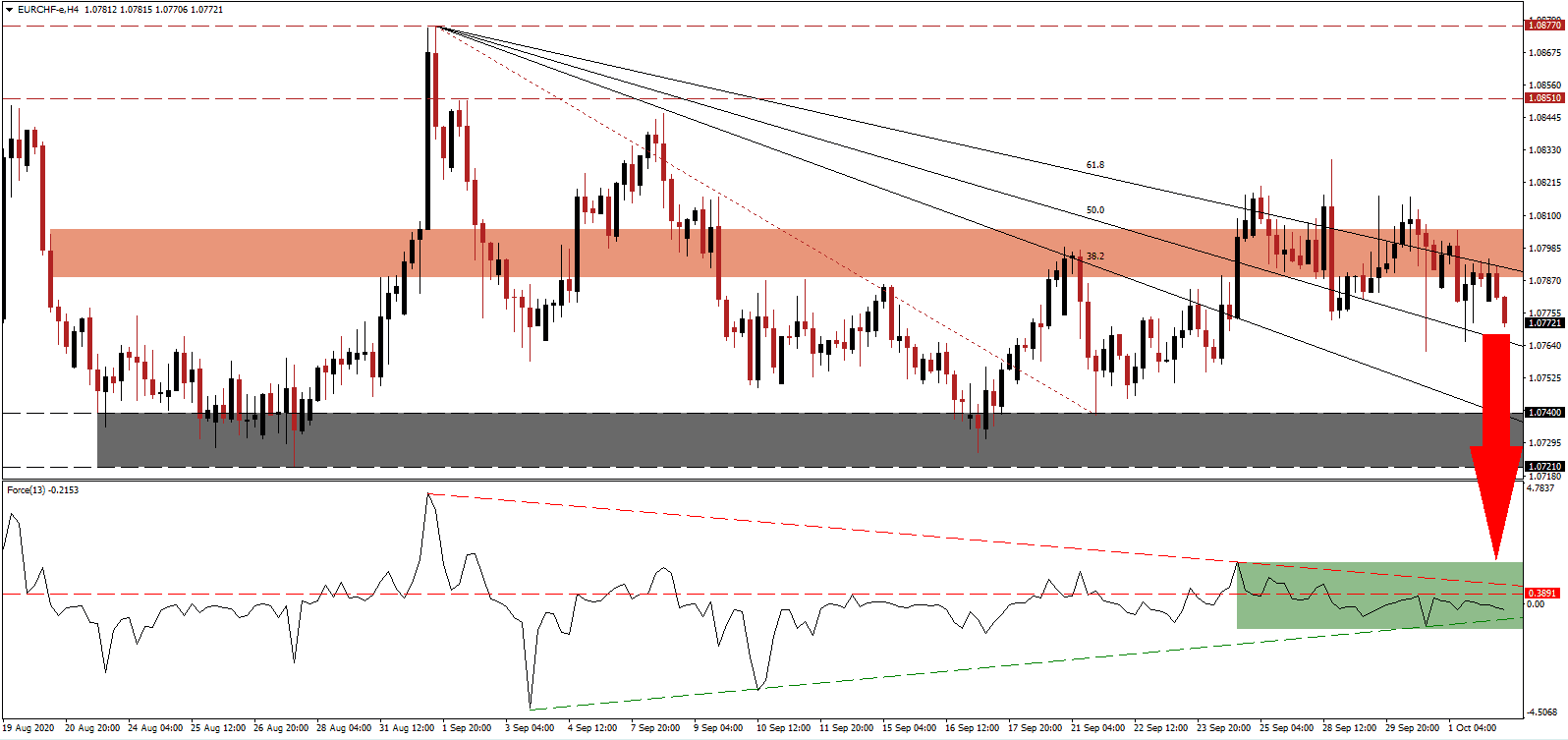

The Force Index, a next-generation technical indicator, confirms the dominance of bearish momentum, and it remains below the horizontal resistance level. Adding to downside pressure is the descending resistance level, as marked by the green rectangle, expected to guide this technical indicator below its ascending support level and steeper into negative territory. Bears maintain control of price action in the EUR/CHF.

Eurozone economic data remains mixed, with a decrease in September activity visible. France is leading Eurozone Covid-19 infections. The threat of a severe economic slowdown in the fourth quarter of 2020 and the first and second quarters of 2021 remains. Following the breakdown in the EUR/CHF below its short-term resistance zone located between 1.0788 and 1.0805, as marked by the red rectangle, price action faces increasing selling pressure from its descending 61.8 Fibonacci Retracement Fan Resistance Level.

One critical development to monitor is the Swiss National Bank (SNB) and its market manipulation of the Swiss Franc. Official data released yesterday, for the first time, revealed the SNB spent CHF90.0 billion on interventions in the first half of 2020, more than the past three years combined. SNB President Thomas Jordan cautioned that more massive ones could follow in the years ahead. Despite SNB interventions, the EUR/CHF is poised to collapse into its support zone located between 1.0721 and 1.0740, as identified by the grey rectangle. An extension into its next support zone between 1.0603 and 1.0635 is favored.

EUR/CHF Technical Trading Set-Up - Breakdown Extension Scenario

- Short Entry @ 1.0770

- Take Profit @ 1.0605

- Stop Loss @ 1.0805

- Downside Potential: 165 pips

- Upside Risk: 35 pips

- Risk/Reward Ratio: 4.71

A breakout in the Force Index above its descending resistance level could lead the EUR/CHF into a temporary price spike. Forex traders should sell any advance from present levels amid growing economic uncertainty. With Covid-19 infections on the rise, safe-haven demand for the Swiss Franc is set to accelerate, countering SNB interventions. The upside potential remains confined to its resistance zone between 1.0851 and 1.0877.

EUR/CHF Technical Trading Set-Up - Confined Breakout Scenario

- Long Entry @ 1.0830

- Take Profit @ 1.0870

- Stop Loss @ 1.0805

- Upside Potential: 40 pips

- Downside Risk: 25 pips

- Risk/Reward Ratio: 1.60