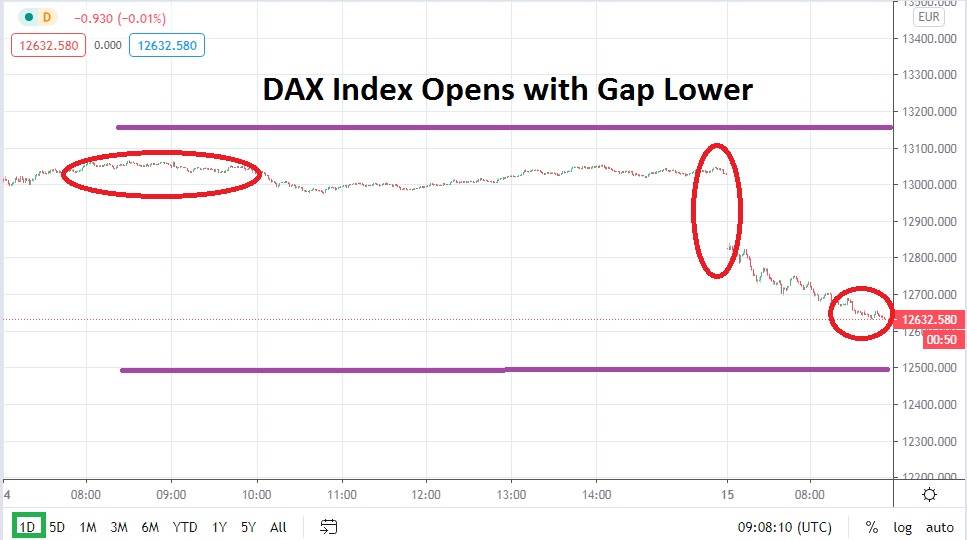

The DAX Index was rocked with a gap lower this morning as concerns are spreading throughout Europe regarding a new wave of coronavirus which is causing governments across the continent to consider new lockdowns. On top of the worries being generated in Europe, across the Atlantic traders in the US have turned in two rather lackluster trading days and have not been able to generate upside momentum in equities.

Early indications from US future markets point to a weak opening and speculators will want to be careful the next few hours as sentiment is considered. The downward spike in the DAX Index essentially has wiped out two and half solid weeks of trading and returned the German markets to values seen in early October.

Support for the DAX Index appears to be the 12550.00 level, but current trading is still above this juncture as the equity index is near the 12605.00 juncture as of this writing. The question for speculators is whether the DAX Index can produce some bullish momentum short term and this seems unlikely within the next couple of hours. Unless US future markets can suddenly return to positive territory, the DAX Index may be hard pressed to produce optimistic sentiment. If steep declines do occur on US markets later today, the DAX Index could see another leg downwards.

Speculators will certainly have opportunities today to take advantage of potential volatility. If traders are willing to take a gambit and pursue more downside action from the DAX Index they cannot be faulted. From a risk reward perspective it seems unlikely the DAX Index will generate a sudden wave upwards and challenge new highs today. Trading remains near the weaker tiers of value for the German index as investors seemingly take a wait and see approach regarding the US markets which will open later.

Equity markets have been difficult the past month of trading. Risk appetite certainly remains within a large segment of the investor community, and there are few options for financial institutions to put their money when seeking ‘safe profits’ other than equity indices. However, the news being generated from Europe this morning regarding renewed concerns about coronavirus and lockdowns has certainly spooked short term sentiment.

DAX Index Short Term Outlook:

Current Resistance: 12840.000

Current Support: 12550.000

High Target: 12950.000

Low Target: 12475.000