With the German economy under intensifying stress from the second wave of Covid-19 infections, questions over the strength of a post-Covid-19 recovery remain elevated. Before the pandemic forced global trade into a recession, the 2020 GDP forecast for a 1.1% increase was considered overly optimistic. The German economy entered a stealth manufacturing recession in 2019, intensified by the US-China trade war, and stalled Brexit negotiations. Fiscal conservatism ended as Germany violated its constitutional debt ceiling, limiting its future growth prospects. The DAX 30 collapsed below its short-term resistance zone but has entered a short-covering rally, from where a lower high is favored.

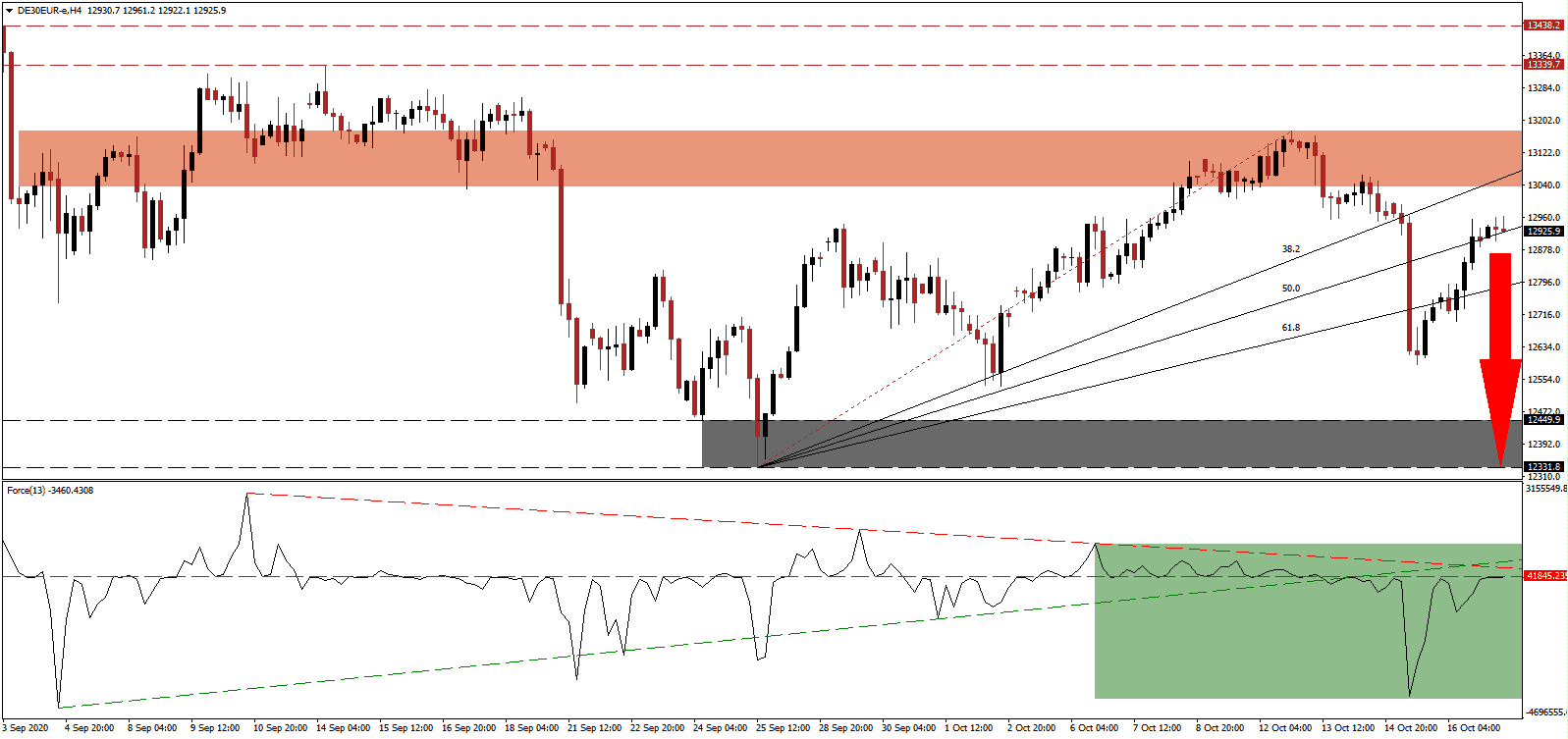

The Force Index, a next-generation technical indicator, maintains its position below its horizontal resistance level. Bearish momentum expanded after the collapse below its ascending support level, while the descending resistance level magnifies downside pressures, as marked by the green rectangle. Bears remain in full control over the DAX 30 with this technical indicator below the 0 center-line.

While all thirty DAX 30 components rely heavily on exports, global trade remains weaker than anticipated. Japan reported a contraction in September exports, and the Chinese economy grew less than forecast in the third quarter. Leading German economists published a joint forecast, revising the GDP outlook downward for 2020 from a drop of 4.2% to 5.4%. The 2021 prediction was lowered from an expansion of 5.8% to 4.7%, with a 2022 growth target of 2.7%. Bearish momentum from the breakdown in the DAX 30 below its short-term resistance zone located between 13,035.7 and 13,175.0, as marked by the red rectangle, remains dominant.

New restrictions across German threaten domestic resistance and will harm demand going into the holiday shopping season. Together with the threat of tariffs between 10% to 15% on exports to the UK following the end of the transition period in less than ten weeks, the German export engine driving the EU economy faces a halt in its recovery tracks. A move in the DAX below its ascending 50.0 Fibonacci Retracement Fan Support Level will clear the path for a renewed sell-off into its support zone between 12,331.8 and 12,449.9, as identified by the grey rectangle.

DAX 30 Technical Trading Set-Up - Breakdown Resumption Scenario

Short Entry @ 12,925.0

Take Profit @ 12,330.0

Stop Loss @ 13,100.0

Downside Potential: 5,950 points

Upside Risk: 1,750 points

Risk/Reward Ratio: 3.40

A breakout in the Force Index above its ascending support level, serving as resistance, could lead to a price spike in the DAX 30. The upside potential remains limited to its downward revised long-term resistance zone between 13,339.7 and 13,438.2. Depressed global trade weights on this export-heavy index, expected to keep selling pressure dominant over the next few months. Traders should continue selling rallies in the fourth quarter.

DAX 30 Technical Trading Set-Up - Reduced Breakout Scenario

Long Entry @ 13,200.0

Take Profit @ 13,400.0

Stop Loss @ 13,100.0

Upside Potential: 2,000 points

Downside Risk: 1,000 points

Risk/Reward Ratio: 2.00