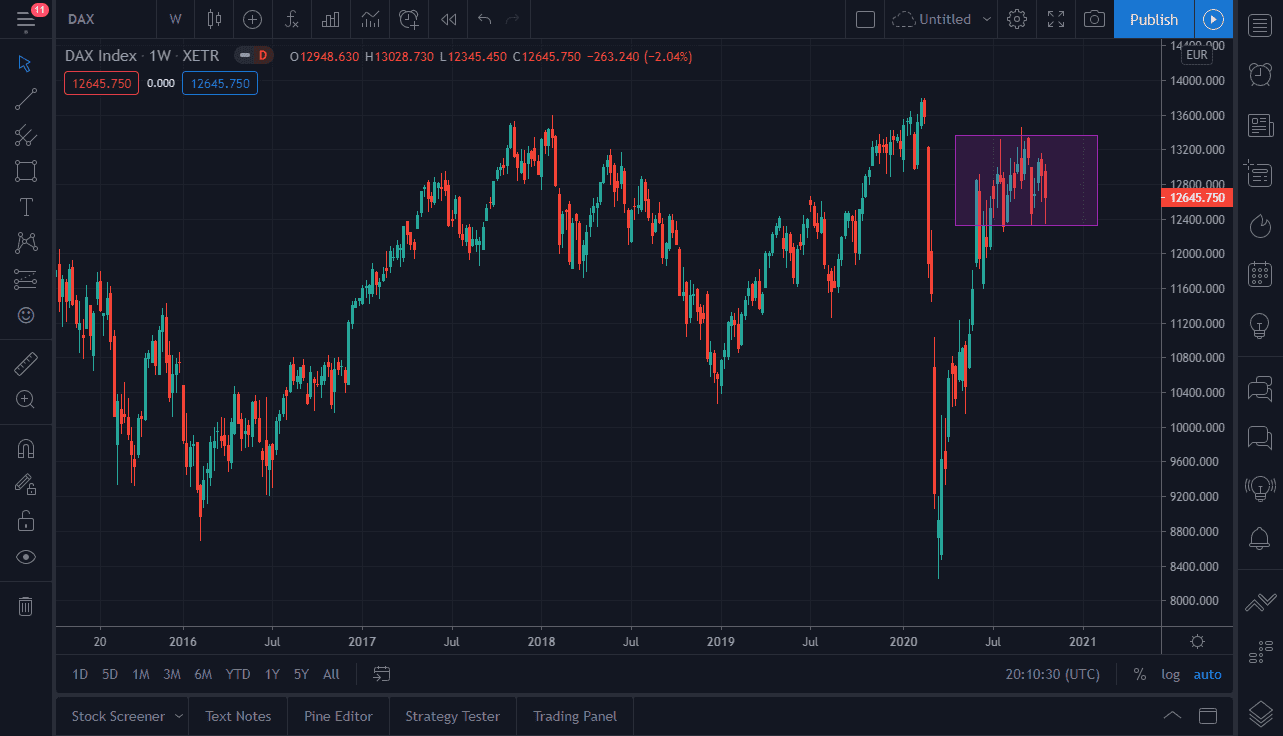

The DAX has gone back and forth during the course of October, as we are still trying to figure out what to do next. Looking at this chart, you can see that we have been stuck between the 12,400 level and the 13,400 level. At this point in time, it is likely that we will continue to see a lot of back and forth in this range going forward until we can figure out what is going to go on with the European Central Bank. After all, the economic numbers have been a bit anemic in Europe, and we have recently filled a major gap

The 13,500 level has offered significant resistance, so I think at this point we are trying to figure out whether or not we can blow through this. At this juncture I think the most likely candidate for pushing this above there would be the ECB flooding the markets with stimulus yet again. Quantitative easing could be the way going forward, because that is all central banks can do. The central banks around the world will continue to loosen monetary policy one way or the other, so we are playing a game of relative weakness, which of course is good for stocks. The cheaper that the currency gets, the better things are going to be, at least in theory.

Stock markets are quick way to play currency devaluation, so I think that is probably the biggest case for DAX strength. However, if we do break down below the lows of the month, then we could go looking towards the 11,200 level where we would see more support. In general, we are almost completely done with wiping out the massive loss from the beginning of the year. If we can break above there, then we go much higher. That seems to be very unlikely though, so I would anticipate another month of waiting around to see if ECB central bankers will do everything that they can to lift the market. The overall sideways reaction that we have seen tells me that we are simply just killing time to try to figure out what to do next. The DAX will probably rally based upon the idea of the cheaper Euro if we get it. Ultimately, this is a market that should continue to be trading right along with the currency markets but in general stock markets have done well and I think that we are either going to break out or by the dips for the next month at the very least.