Last Thursday’s signals were not triggered as there was no bearish price action at any of the resistance levels which were hit last Thursday.

Today’s BTC/USD Signals

Risk 0.50% per trade.

Trades must be entered before 5 pm Tokyo time Tuesday.

Long Trade Ideas

- Go long after a bullish price action reversal on the H1 time frame following the next touch of $11,185 or $11,023.

- Place the stop loss $50 below the local swing low.

- Move the stop loss to break even once the trade is $50 in profit by price.

- Take off 50% of the position as profit when the trade is $50 in profit by price and leave the remainder of the position to run.

Short Trade Ideas

- Go short after a bearish price action reversal on the H1 time frame following the next touch of $11,460, $11,557, or $11,804.

- Place the stop loss $50 above the local swing high.

- Move the stop loss to break even once the trade is $50 in profit by price.

- Take off 50% of the position as profit when the trade is $50 in profit by price and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

BTC/USD Analysis

I wrote last Thursday that Bitcoin remained an attractive long-term buy close to $10,000 but offered little another opportunity.

I was correct about the opportunity existing in the long rather than the short side, as we have seen the price of Bitcoin finally start to rise with some momentum from the area around $10,000. Most notably, the price has got established above what was very key medium-term resistance at $11,023 – the break above this level is a bullish sign and should be an exciting development for Bitcoin traders. The price has not been this high for a month.

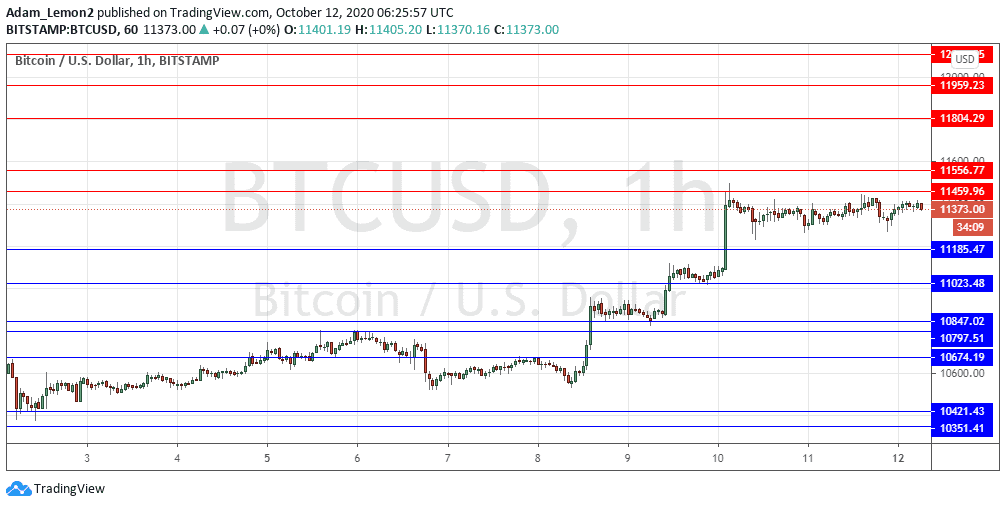

Note in the price chart below how after breaking above $11,023 the price tested the level from above which then produced a strong bullish movement. This is a confirmatory sign that the breakout was significant.

We do see a clear obstacle to a further immediate rise in the resistance level at $11,460 which is holding as very strong resistance. A short-term short trade from this level may be possible but the best odds remain on the long side.

I will be very happy to take a long trade from a bullish bounce at either $11,185 or $11,023 if either situation sets up later.

There is nothing of high importance due today regarding the USD.