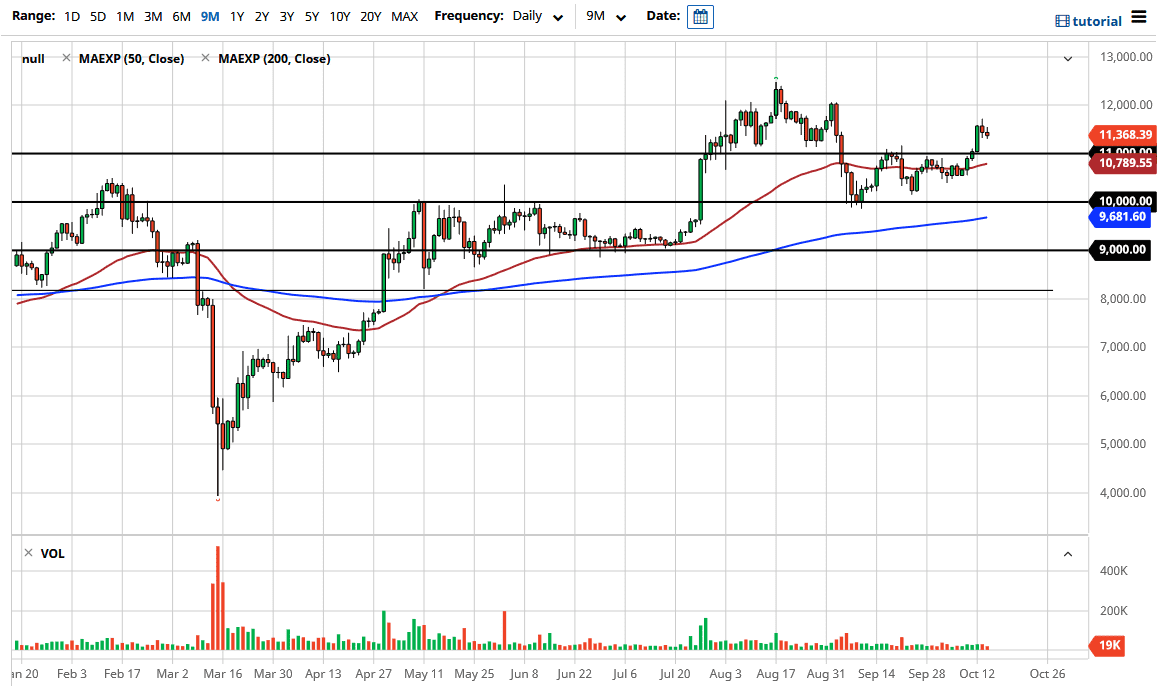

The Bitcoin markets have drifted a little bit lower during the trading session on Wednesday, as we have pulled back from the shooting star from the previous session. That being said, I would not read too much into this with the acknowledgment that we have been rallying quite significantly over the last couple of days and now it looks likely that we are simply trying to digest some of the biggest gains that we have seen in a while. We sliced through the $11,000 level like it did not even matter, so obviously, there will be people willing to take a certain amount of profits.

Another thing that is worth paying attention to is that the US dollar strengthened quite a bit during the trading session on Wednesday, and that worked against the value of Bitcoin. However, the market only pulls back ever so slightly so that tells me that Bitcoin still has a significant amount of strength underlying the move, and therefore I think it is only a matter of time before the market goes looking towards the 12,000 level. That is an area that had previously caused a significant amount of resistance, and perhaps even more importantly, supply.

Underneath, the 11,000 level will offer a certain amount of support, but we also have the 50 day EMA that is reaching towards the 11,000 level as well. All things being equal, I think that this is a market that should continue to attract a certain amount of buying pressure, and therefore I think that it is only a matter of time before buyers step in to pick up Bitcoin as it seems to be moving based upon the potential idea of central banks flooding the markets with liquidity. Therefore I think that the Bitcoin traders are starting to key off of that idea. With massive amounts of stimulus coming, Bitcoin is starting to act more and more like a commodity, and a way to avoid the pain that fiat currency will almost certainly go through as long as quantitative easing is the norm. That being said, we will get the occasional pullback and it looks like traders should be sitting underneath and willing to take advantage of this. I have no interest in shorting Bitcoin, even though I am the first person to tell you I am not a “Bitcoin believer.” Price is king, and it looks like we continue to grind higher.