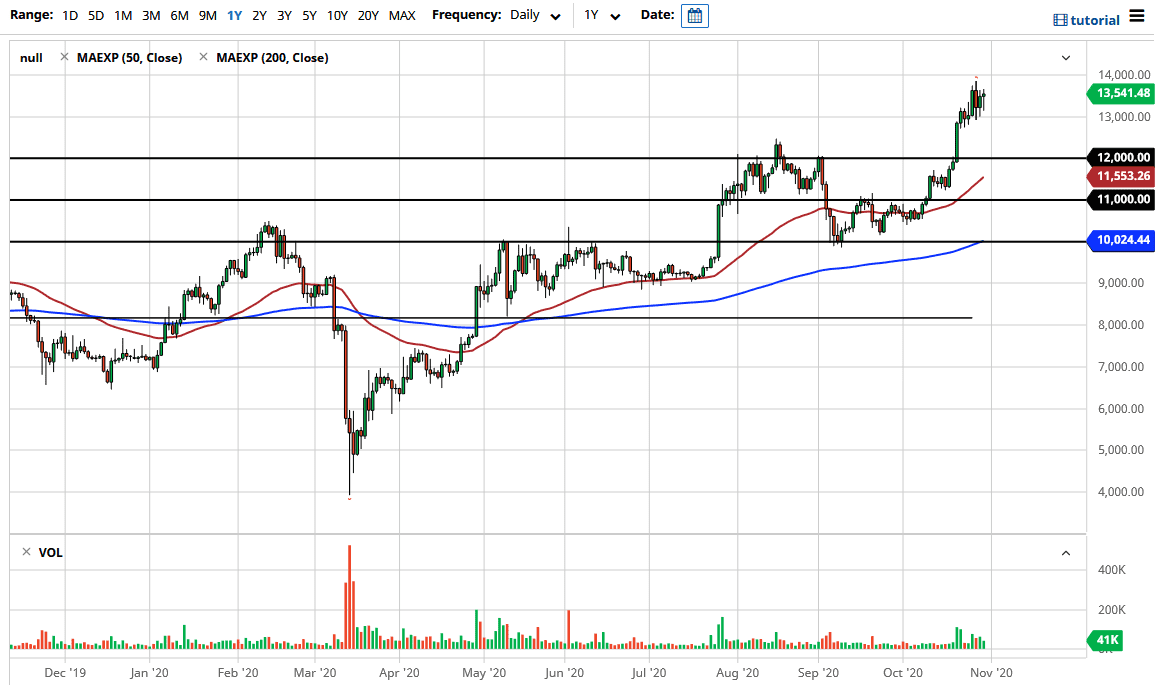

Bitcoin markets initially tried to rally during the trading session on Thursday but continue to find the $11,000 level to be a bit too much to overcome. That being said, the market looks as if it is trying to figure its way out for a longer-term move, and $11,000 is obviously a major resistance barrier that we cannot seem to get over. What is particularly interesting is that we had seen a lot of movement in the Forex markets due to the fact that the noise around Brexit continues, throwing the US dollar around.

Because of all of this, it looks as if we are going to stay in the same range that we have been in for a while, using the 11,000 level as resistance and of course the 10,000 level underneath as massive support. The $10,000 level is a large, round, psychologically significant figure that of course will continue to attract attention and the fact that the 200 day EMA is reaching towards that area should continue to cause a bit of support as well. Furthermore, I still look at the $9000 level underneath as massive support, so somewhere between here and there I would anticipate that we turn around. The real problem of course is that the market has to worry about so many different things going on at the same time that volatility is going to be a major issue.

We are still very much in an uptrend, but obviously we have a lot of noise. With that being said, the market is more than likely going to be one that you need to cautious about the size, but eventually we should get a little bit more clarity. In the meantime, I think that is very likely that you are going to have to trade back and forth on short-term charts. Because of this, and the fact that there is so much uncertainty out there when it comes to various things like stimulus the United States, and of course the entire Brexit situation, I do believe that bitcoin eventually get a bit of a bid, but it is going to continue to be noisy in the short term. It is not until we break down below the $9000 level that I become concerned about the overall uptrend, and with this type of noise simply scaling into a position makes the most sense.