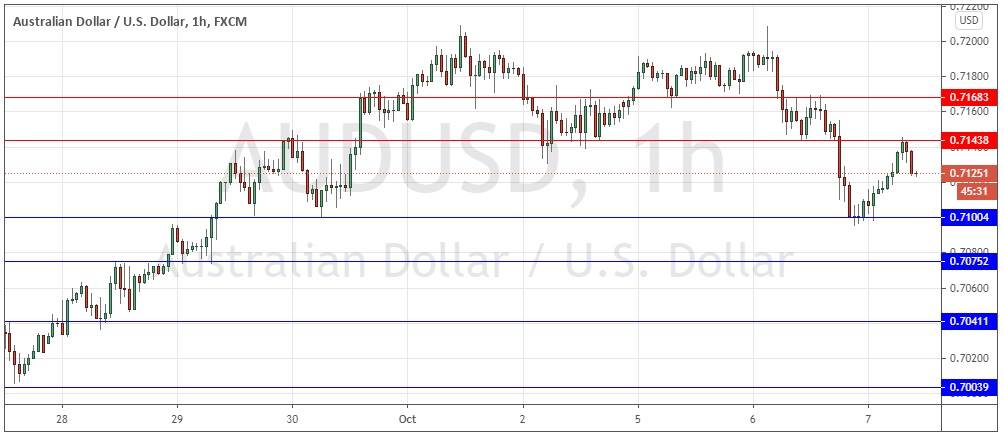

Yesterday’s signals produced a profitable long trade from the bullish doji candlestick which rejected the support level identified at the round number of 0.7100. It would probably be wise to exit from any remainder of that trade as the price action has turned more notably bearish in recent hours.

Today’s AUD/USD Signals

Risk 0.75%.

Trades must be entered between 8 am New York time Wednesday and 5 pm Tokyo time Thursday.

Long Trade Ideas

- Go long following bullish price action on the H1 time frame immediately upon the next touch of 0.7100, 0.7075, or 0.7041.

- Place the stop loss 1 pip below the lowest recent price.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade Ideas

- Go short following bearish price action on the H1 time frame immediately upon the next touch of 0.7144, 0.7168, 0.7229, or 0.7248.

- Place the stop loss 1 pip above the highest recent price.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside, or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

I wrote yesterday that we were seeing a bullish consolidation above 0.7130 and much seemed likely to depend upon whether the new lower resistance at 0.7168 held or not. This was a good call as that level did and then not only did the price fall the overall action is still bearish. However, I did say I was not ready to take that short trade yet, which was a mistake.

The lower high which has formed a few hours ago at 0.7144 is a bearish sign, and as long as this level holds, we are likely to see lower prices.

On the bullish side, it should be noted that the round number at 0.7100 acted as strong support.

The outlook for this currency pair has become more bearish due mostly to the Australian interest rate being seen as likely to be lower from next month, more than yesterday’s blow to risk sentiment after U.S. economic stimulus package talks collapsed.

This pair is quite likely to be sensitive to the content of the U.S. FOMC meeting minutes release due later.

Until that release, I would be happy to take a short-term long trade from a bounce at 0.7100 or from further bearish rejections of either of the nearby two resistance levels.

There is nothing of high importance scheduled today concerning the AUD. Regarding the USD, there will be a release of FOMC meeting minutes at 7 pm London time.