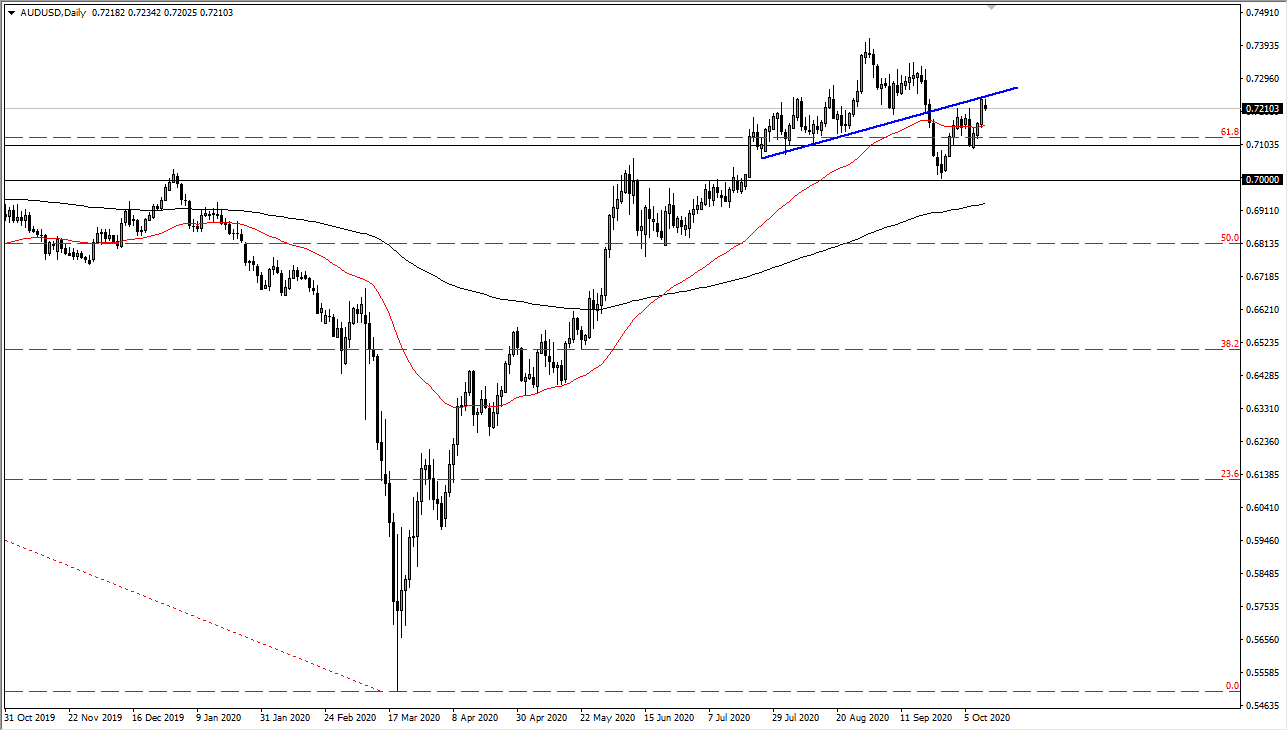

The Australian dollar gapped lower during the trading session on Monday but then turned around to rally to test the highs of the Friday session. Furthermore, the uptrend line that had previously been holding the market up is now offering quite a bit of resistance. The candlestick for the session certainly suggests negativity, so if we can break down below the bottom of the candle it is likely that we could go towards the 50 day EMA underneath. The 0.7150 level is an area that has attracted some attention on short-term charts currently, and there is likely some buyers in that area to get involved. Underneath there, the 0.71 level offers support that extends down to the 0.70 level. Ultimately, this is a market that we should continue to see a lot of support for.

Having said all of that, if we were to break down below the 0.70 level it would change quite a bit in this market. The 0.70 level attracts a lot of attention due to the fact that it is such a large, round, psychologically significant figure. The area between here and the 0.71 level is most likely to be the area in which the market goes back and forth and, as we have broken through a major uptrend line, but still have so much support underneath. This is a market that is probably going to come back and forth between these areas due to whatever people feel about the US dollar at that point. Ultimately, this is a market that will be looking towards stimulus in the United States, which if we do have plenty of stimulus out there, it is likely that the market will punish the greenback.

However, we have a lot of concern out there then it makes quite a bit of sense that the Aussie may fall. Nonetheless, one of the biggest concerns for this pair might simply be the fact that people are concerned about the global growth picture out there, which the Aussie is highly sensitive to as it is not only a commodity currency but also highly levered to China. While China is doing much better than the rest of the world, if they do not have customers people may step back from the Aussie. At this point, there are so many different moving pieces that we should expect a lot of choppy sideways behavior.