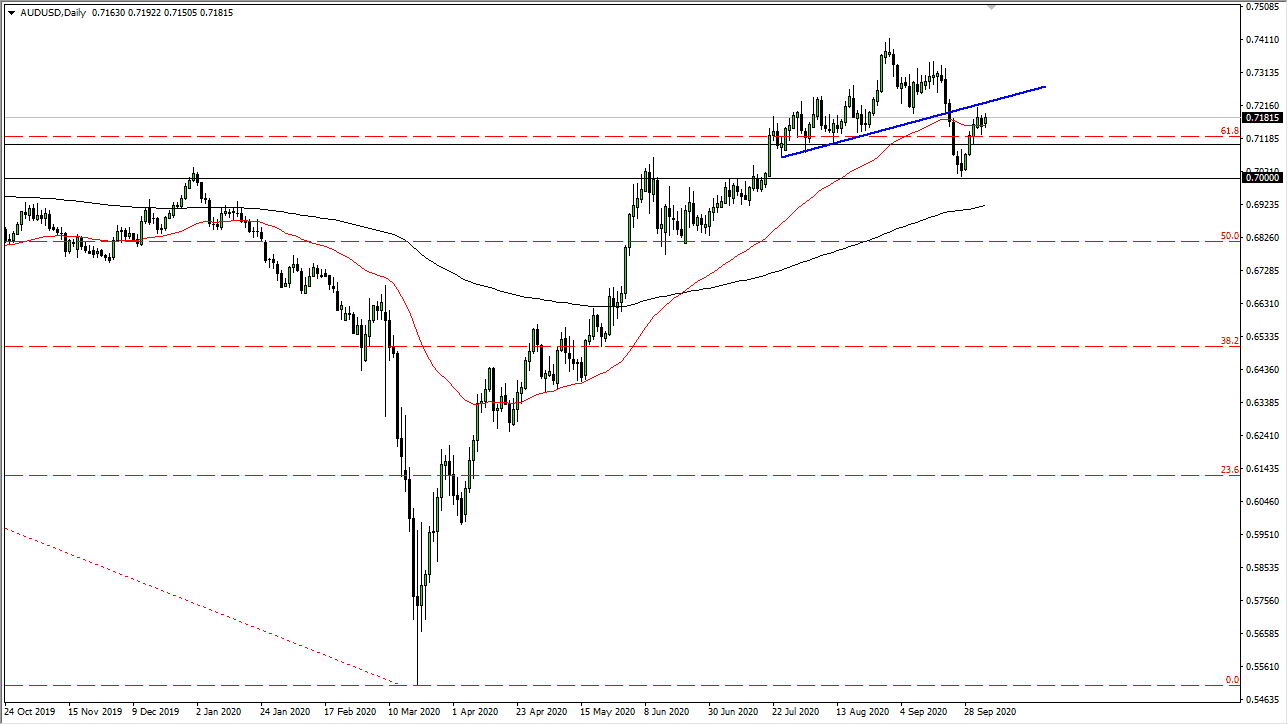

The Australian dollar rallied just a bit during the trading session on Monday again, as we continue to dance around the 50 day EMA. By doing so, the market looks very likely to continue going sideways in the short term, as we have just now tested the previous uptrend line for resistance. It has held so far, and it looks very likely that we will continue to struggle for any signs of clarity. This is a microcosm of what is going on in the currency markets, as severe lack of clarity and therefore I would not expect it to be any different here.

The Australian dollar is highly levered to the Chinese economy so that helps, but at the end of the day this is all about “risk-on/risk-off” when it comes to the global growth situation. At this point, the pair looks very heavy, but I am also fully aware of the fact that if we were to break above the highs from Friday, we could just take off towards the 0.73 level, possibly even farther. To the downside, I believe that the 0.70 level is massive support, that extends down to the 200 day EMA. The 200 day EMA is a large, round, psychologically significant figure when it comes to moving averages, so a lot of people will be paying attention to that for some reason.

By breaking through that, then we open up the door to the 0.68 level that has a lot of demand, and after that, the entire uptrend will collapse. This probably coincides with something ugly going on in Asia or perhaps more of a sell-off when it comes to risk appetite in general. I do not necessarily think that happens though. I think that the most likely outcome is that we simply bounce around between 0.72 and 0.70 for the short term, if not for the next month or so until the presidential election. There is too much noise in the media right now to have any type of clarity as to where the market may go. If we break higher, that will confirm the uptrend, but we have just recently made a “lower low”, which could be the beginning of a trend change. Confused yet? You probably should be as this is a very difficult trading action with all that is going on.