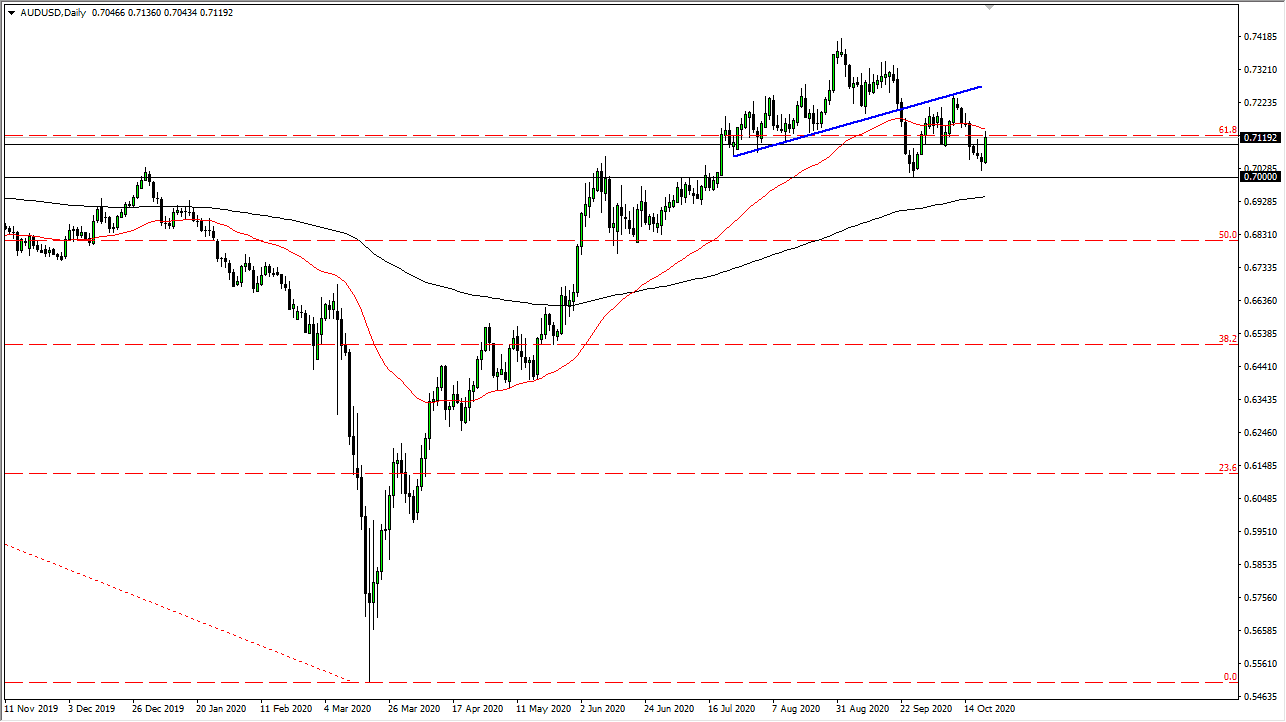

The Australian dollar has rallied significantly during the trading session on Wednesday, breaking above the 0.71 handle. At this point, the market tested the 50 day EMA before pulling back just a bit. Ultimately, the market would find resistance there as it is an indicator that people tend to pay attention to. We had previously broken down through an uptrend line, but then reached to test it again, and now the question is whether or not the 0.70 level has offered a bit of a “double bottom?”

The size of the candlestick is somewhat impressive, but really at this point, I think we still need to look at the possibility of the Reserve Bank of Australia cutting interest rates at the next meeting in a few weeks, which is very likely to continue to have the market paying attention to the RBA as to whether or not they will extend easing even further. The market will continue to be very noisy, with a larger range being defined by the 0.70 level underneath in the 0.73 level above. I think that we continue to go back and forth, but I would be a bit surprised if we made a “fresh high” breaking above the one that had touched the uptrend line.

We are paying attention to stimulus talks in the United States, and how big that will be because that obviously will have a major influence on the US dollar. That being said, the markets are already trying to price and the fact that stimulus is coming, so do not be overly surprised if the market does not react the way that you think it will. I am currently looking for short-term exhaustion to jump on, but if we break down below the 0.70 level is very likely that we go down to the 0.68 handle after that.

At this point, it is also worth noting that the 50 day EMA is sitting right at the 61.8% Fibonacci retracement level. That is something worth paying attention to because it is a very common level for traders to look to in order to get involved again. We have been in a massive downtrend for months, at least until summertime. The question now is whether or not this has been a nice recovery, or is it simply another opportunity to short the Aussie dollar? I suspect we will know the answer within the next month.