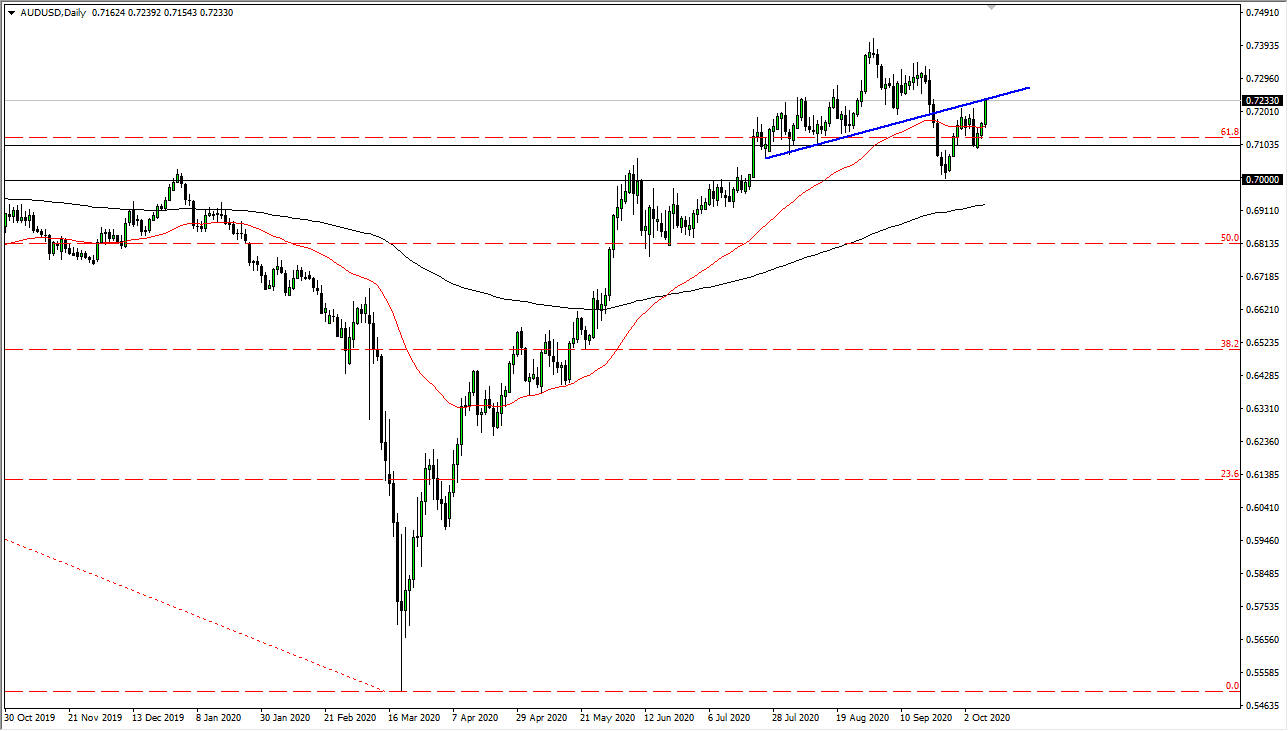

The Australian dollar has rallied significantly during the trading session on Friday, as we continue to see a lot of noise out there based upon the idea of the stimulus. At this point, the market is continuing to show a lot of volatility, and now it looks like we could be reaching towards the 0.73 level if we can break above the trend line, which is significant resistance. Ultimately, this is a market that I think is trying to figure out where to go next, and with stimulus being in everybody’s conscience, it looks likely that the US dollar will continue to struggle. However, we have to worry about what happens over the weekend and that can be anybody’s guess.

Given enough time, the market is likely to continue showing a lot of noise, and a pullback from here is not completely out of the question, especially if we get some type of headline that suggests that stimulus is not coming. To the downside, the 0.71 level is significant support that extends down to the 0.70 level underneath. The 200 day EMA sits underneath there as well, so it is more than likely going to continue to attract attention as it has in the past. That being said, I think there is a lot of noise out there and that will continue to be a major issue.

Looking at this chart, it is obvious to me that we will continue to see a lot of noise, and that we will continue to move back and forth between “big figures”, and other words numbers such as 0.71, 0.72, 0.73, and so on. In other words, this is a market that still has a lot of noise and therefore will be susceptible to headline risk. The trend to the upside is still intact at the moment, but if we start to turn lower than that will become questioned again. At this point, this all comes down to the stimulus package in the United States, and I believe that the world is essentially ignoring anything that is going on in Australia right now. That being said, the Australian dollar is highly levered to the Chinese economy so that helps the situation as well. The idea is that more stimulus will create more demand which will have more exports coming out of China.