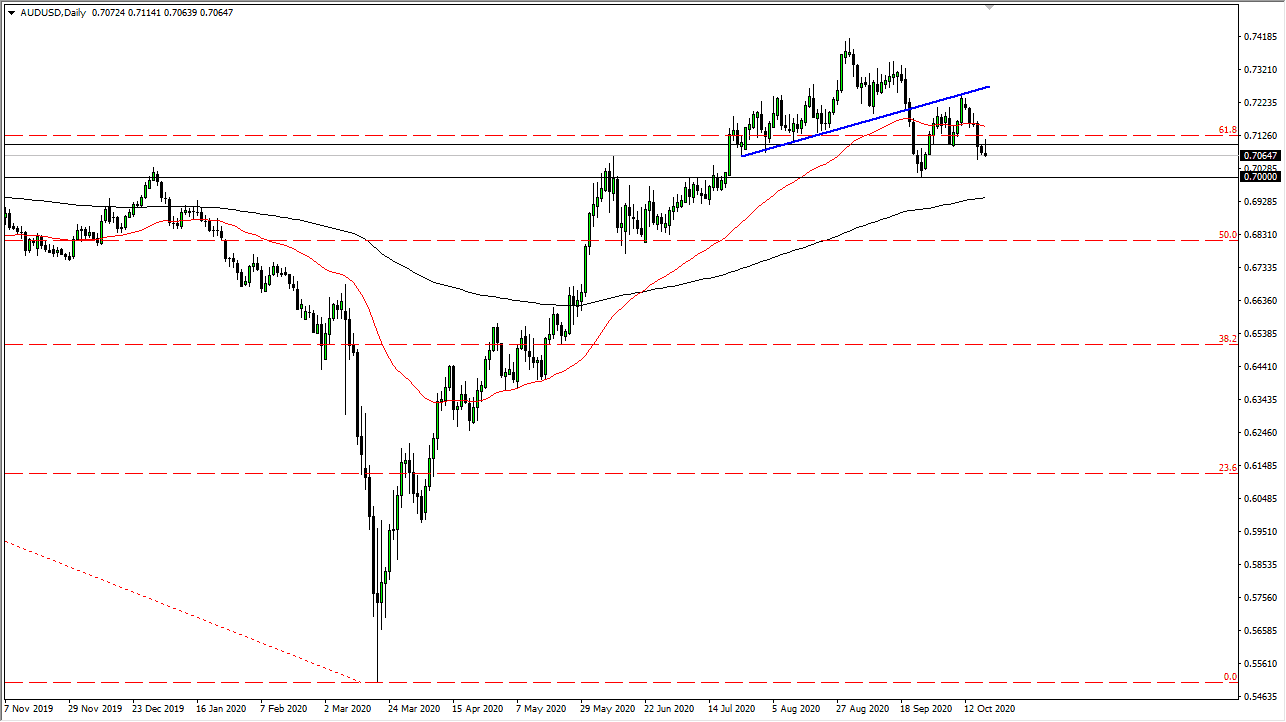

The Australian dollar initially tried to rally during the trading session on Monday but found the area above the 0.71 level to be far too much to overcome, as the market has pulled back. Ultimately, this suggests to me that the market is going to continue to drift lower, perhaps finding the 0.70 level rather quickly. That is an area that is worth paying attention to due to the fact that it was the most recent low, and we have the 200 day EMA sitting just below there. The 200 day EMA will attract longer-term traders to begin with.

When you look at the chart, between the 0.70 level in the 0.73 level we have seen a lot of action. However, I also would point out that we had recently broken through the bottom of an uptrend, but bounced enough to test it for resistance, and then pulled back. This could be the beginning of a bigger downtrend, and it is worth mentioning that the Reserve Bank of Australia has suggested that lower interest rates were more than likely coming. As long as that is going to be the case, that should work against the value of the Aussie.

On the other side of the equation, we also have the US dollar which is strengthening due to the idea that stimulus may not be coming in the short term. Wall Street and other trading venues around the world have been banking on stimulus, and at this point, it looks like we are going to be waiting a while to get that. If that is the case, then perhaps the market has gotten ahead of itself. If that is going to be the case, then fading short-term rallies will continue to be the best way to play this market. To the downside, if we were to break down below the support at the 0.70 level, I believe that the market will go looking towards the 0.68 handle. Rallies at this point should continue to offer selling opportunities, as I do think that the US dollar is starting to strengthen quite a bit. If we get an opportunity to short this market on short-term charts with exhaustion, that might be the best way going forward. At this point, I do not have any interest in buying the Aussie dollar.