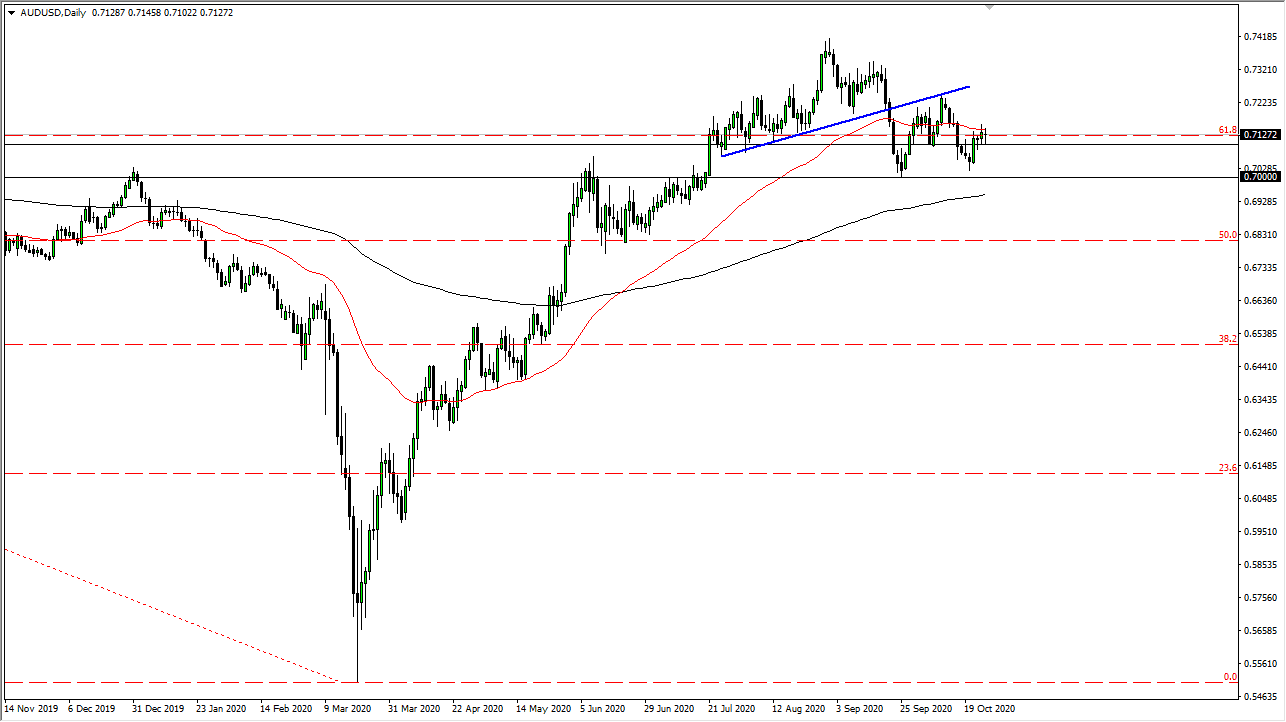

The Australian dollar has gone back and forth during the trading session on Monday, as we have nowhere to be right now. Ultimately, the market has found the 50 day EMA above offering resistance. The Australian dollar of course is sensitive to risk appetite, so you need to pay attention to what is going on in the world. Overall, the market looks likely to continue to pay attention to the 50 day EMA, and of course that support zone that I have been time again about for days, extending from the 0.71 level to the 0.70 level. At this point in time, if we were to break down below there it is likely that the market could break down significantly. However, I believe that would be a bit difficult to do.

To the upside, I believe that the 0.73 level is massive resistance, so I think it is only a matter of time before we see sellers in that area as well. Right now, we are simply sitting on top of a major support level that is going to be difficult to break down. I think we are probably more than likely going to go back and forth as we await the election and of course whether or not we are going to get some type of stimulus. Ultimately, this is a market that not only has to way this stimulus prospects, but global growth in general. After all, this is a market that is highly sensitive to the Chinese market, which of course by extension is highly levered to growth around the world.

If we were to break down below the support level underneath, the 200 day EMA would more than likely give way to a huge move down to the 0.68 level. Looking at this chart, if we were to break above the 0.73 level, then we could go looking towards the 0.75 handle. Looking at this chart, I think we are more than likely going to see a lot of back and forth going forward, so I essentially look at this as being stuck in a range between the 0.70 level and the 0.73 level. Once we break out of this range, then we can start to talk about bigger trade but right now it looks like we probably have more threat to the downside than up for a bigger move.