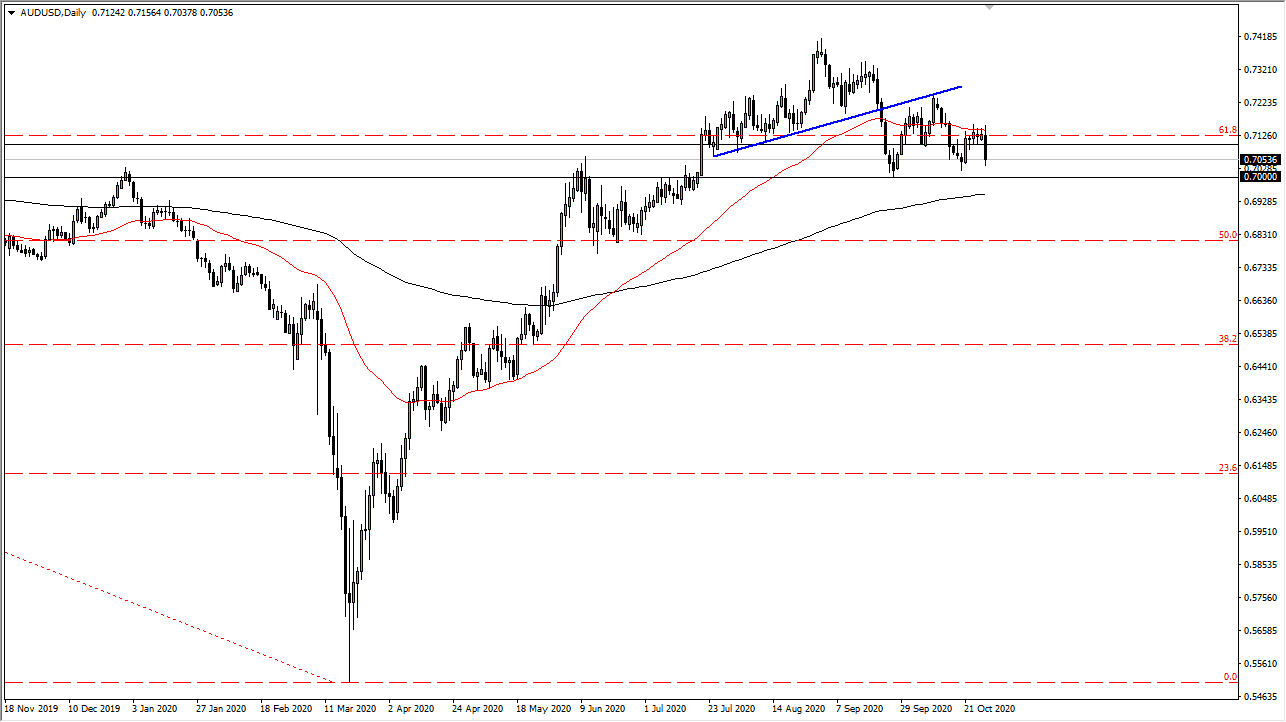

The Australian dollar initially tried to rally during the trading session on Wednesday but then broke down towards the 0.7050 level. At this point, we are essentially sitting in the middle of the range between the 0.70 level and the 0.71 handle, an area that I considered to be a “zone of influence” or perhaps even a “zone support.”

If we break down below the 0.70 level, that opens up the possibility of a real challenge to the 200 day EMA which would be the last vestige of support from a longer-term standpoint. At the very least, I anticipate that we would probably go looking towards the 0.68 handle, perhaps even lower than that if things get ugly. Looking at this chart, I think that short-term rallies will continue to be sold into, and it now looks as if the 50 day EMA is starting offer a little bit of dynamic resistance above. Beyond that, the Australian dollar is highly sensitive to risk appetite in general, so it does make quite a bit of sense that we will be paying close attention to the coronavirus figures, because if they continue to skyrocket in places like Europe and the United States, that is going to weigh heavily upon the idea of any type of risky assets such as the Aussie dollar.

At this point in time, we are still in a range bound area between the 0.70 level in the 0.73 level from a longer-term standpoint, so this point it is likely that we are going to continue to see a lot of choppy back-and-forth type of action. However, if we finally leave that area then it should bring in quite a bit of momentum to the market. Keep in mind that the US dollar will be bought and over fist if we have a lot of concerns, which of course is very likely this point in time due to the fact that we not only have the coronavirus figures in the European Union, but we also have them in the United States. Beyond that, we have to worry about the election, and of course Brexit. There is a whole host of issues just waiting to cause nervous trading around the world, and that of course will show itself in the strength or weakness of the US dollar.