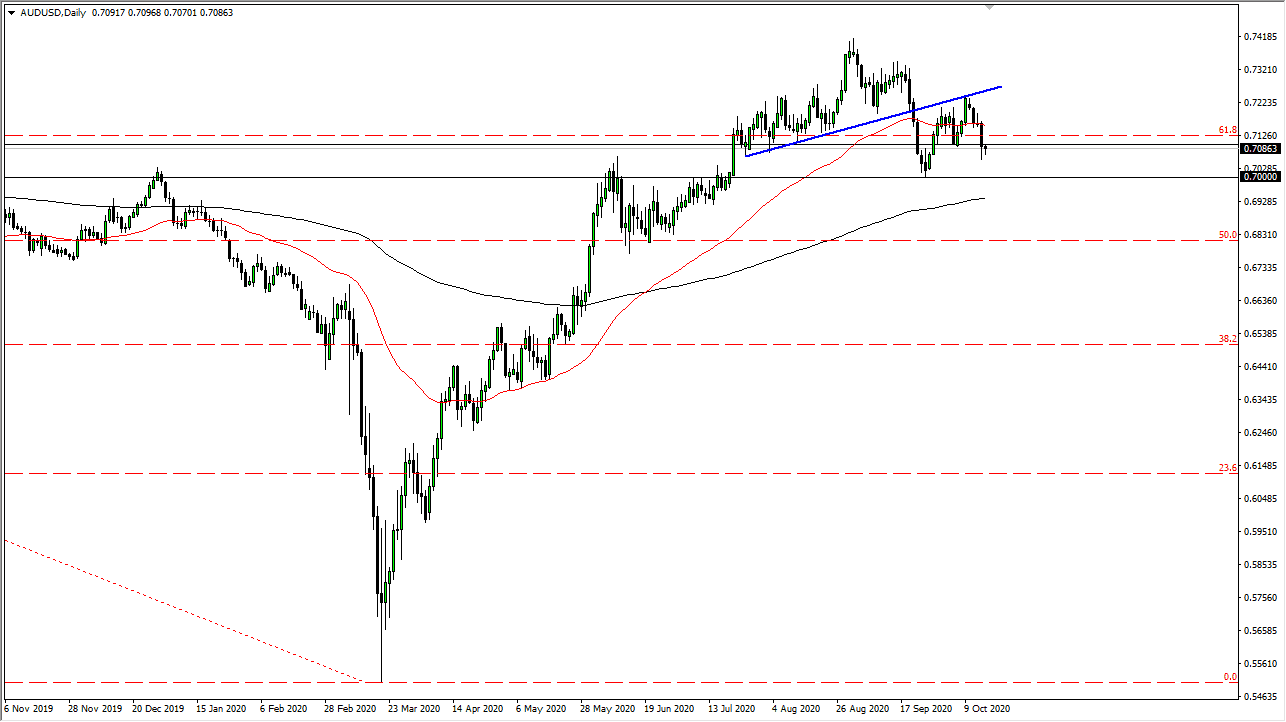

The Australian dollar initially dipped during the trading session on Friday but then recovered enough to come close to the 0.71 handle. That being said, the market is very likely to continue to see a lot of noisy trading. What is more important to me than anything else is watching the market after the break of a major uptrend line, which has already been tested for market memory. At this point, it looks like the trend is starting to change a bit, and now I am looking at this market with keen interest around the 0.70 level, because not only is it a large, round, psychologically significant figure, but it is also the bottom of a “zone of influence” that has been important more than once.

The 200 day EMA is starting to come towards the 0.70 level, and it is worth noting that there have been about 100 pips worth of support and resistance extending between the 0.70 level and the 0.71 handle. At this point, if we were to break down through this area, I think it sets up for a longer-term sell-off, as the downtrend could be kicked off for most traders. Pay attention to the fact that there was a trend line right, a retest of that trend line, and then a pullback from there. Breaking below the 0.70 level would create a “lower low”, after creating a “lower high.” In other words, the exact essence of a downtrend.

The Australian dollar has been insulated a bit due to the fact that it is highly levered to China, but I think at this point we are starting to focus more on the US dollar than anything else right now. If there is no stimulus, that will drive this pair much lower. Furthermore, it is also worth noting that the Reserve Bank of Australia has recently suggested that perhaps rate cuts are coming, so that works against the value of the currency as well. We are most certainly looking at a market that could be showing cracks in the ice now, so the move below the 0.70 level would have a lot of traders jumping in and pushing towards at least the 0.68 handle. It is not until we recovered the 0.73 level that I even have thought about buying the Aussie. I suspect that the best case scenario for the Australian dollar is that we simply go sideways between 0.73 and 0.70.