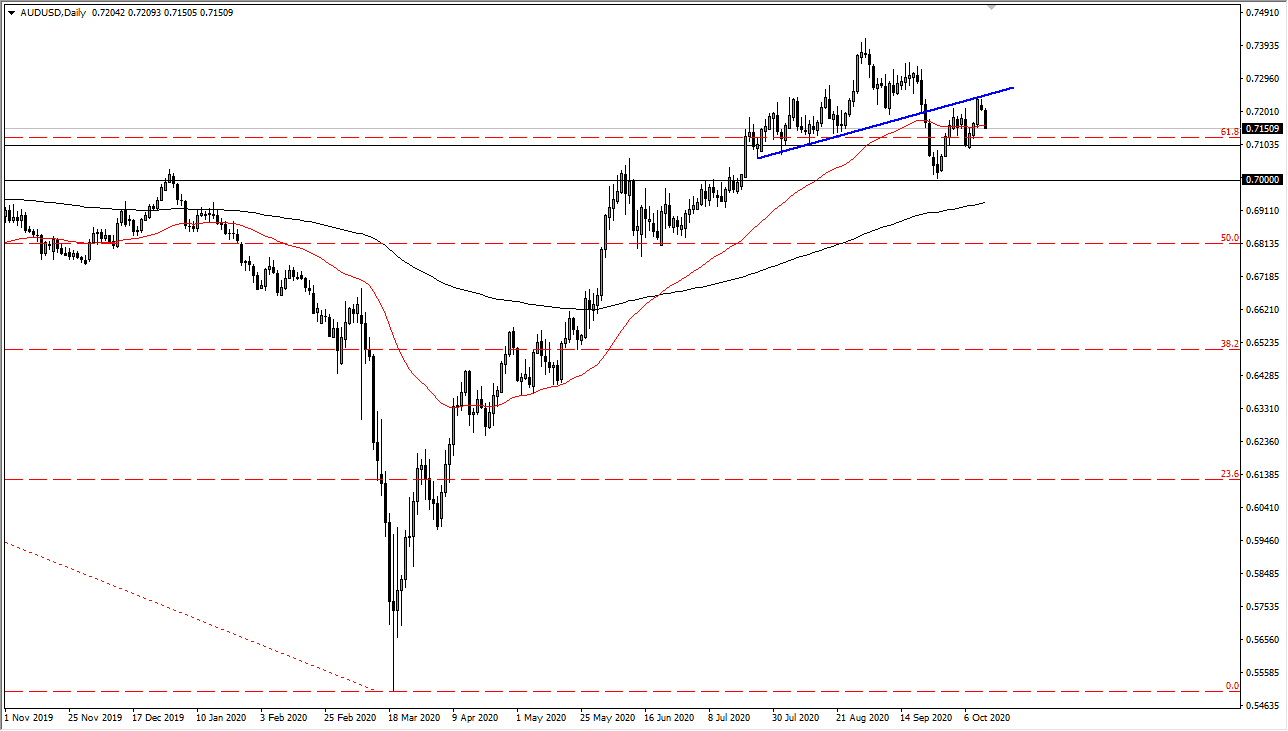

The Australian dollar has fallen rather hard during the trading session on Tuesday to slice through the 50 day EMA. The market still has to deal with the 0.71 level that extends down to the 0.70 level as a “zone of influence.” At this point in time, the market looks as if it is trying to show itself as changing overall directionality, but after we have tested this uptrend line and fallen back, it is only the beginning of the trade signal.

We still need to make a “lower low” in order to confirm a selloff. If you are quicker to get involved in this market, shorting just below the 0.71 handle is a possibility. Otherwise, if you wait until the 0.70 level it would only be further confirmation. The 200 day EMA is starting to reach towards the 0.70 level. That is an area that is a large, round, psychologically significant figure so that only compounds the idea of offering support. A breakdown below that level will open up the trapdoor for this pair to go lower, and I think it could bring in a significant amount of momentum to the downside. This would probably have people looking towards the US dollar on the whole, and the Australian dollar is one of the last ones to fall as it is highly levered to China. Because of this, it is very likely that the market is likely to go into the hyperdrive to the downside. On the other hand, if the US dollar gets sold off, the Australian dollar will be the first place that people jump into the market and push to the upside.

Ultimately, this previous uptrend line that I have marked on the chart is resistance, so if we were to break above there it is likely that the market goes looking towards the 0.73 handle. Breaking above there could then continue to allow the market to go looking towards the 0.75 handle. Ultimately, that is something that is going to be difficult to deal with, I think will keep people from buying this pair for any significant amount of time. The candlestick is closing towards the bottom of the range for the day, so that suggests that there could be a bit of continuation just waiting to happen. This would most certainly be a “risk-off” type of trade. However, we have a lot of work to do before we decide the bigger direction.