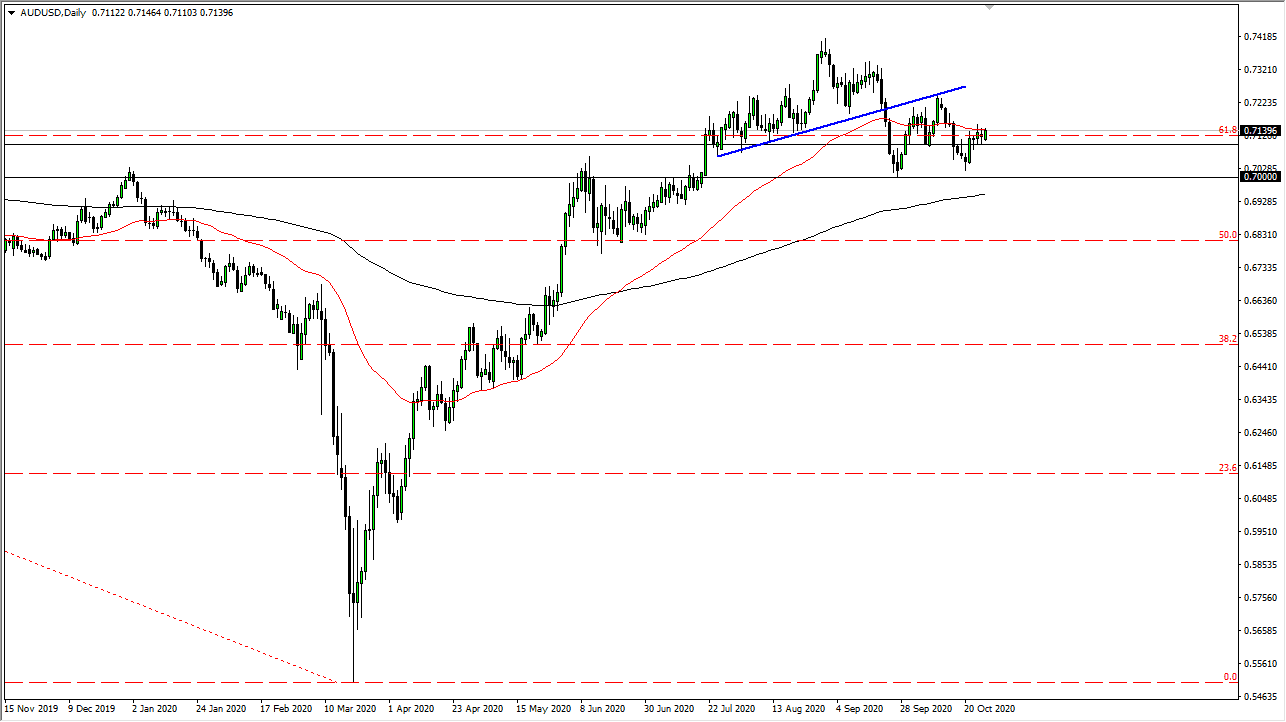

The Australian dollar has rallied during the trading session on Tuesday, to reach towards the 50 day EMA yet again. That being the case, the market is likely to see a lot of noise in this area, but I think it is only a matter of time before sellers come back in and push this market back down. At this point, it is likely that we will continue to struggle to go higher, due to the fact that the markets have so many different things to worry about and of course the Australian dollar is considered to be a “risk asset.”

Looking at the start, it is likely that we continue to see traders be a bit risk-averse as we head into the US election, especially with the uncertainty out there when it comes to everything. The argument about stimulus will continue to be a significant issue, and therefore a lot of traders have no idea what to do with the value of the greenback, because it of course if we get a significant amount of stimulus, that will drive down the value of the dollar. However, we also have to worry about the Reserve Bank of Australia cutting interest rates at the November meeting, which is just about week and ½ away. While the market already knows that, what it does not know is how stimulus ends up.

Most traders believe that stimulus is coming, but it is coming from everywhere, not just the United States. It is possible that we get a little bit of a boost in the Aussie dollar, followed by a significant pullback. The 0.73 level of course is an area that has been resistance in the past, and I think it will be resistance in the future. Breaking above there between now and the election seems to be very unlikely and therefore I think we are essentially stuck in a range between the 0.70 level on the bottom and the 0.73 level on the top. Because of this, I think you need to be cautious about your position size but recognize that it simply a bit of a back-and-forth market that you should be trading on short-term charts. If we do break down below the 0.70 level, it could open up the “trapdoor to the bottom” in this market and send us looking towards the 0.68 level rather quickly.