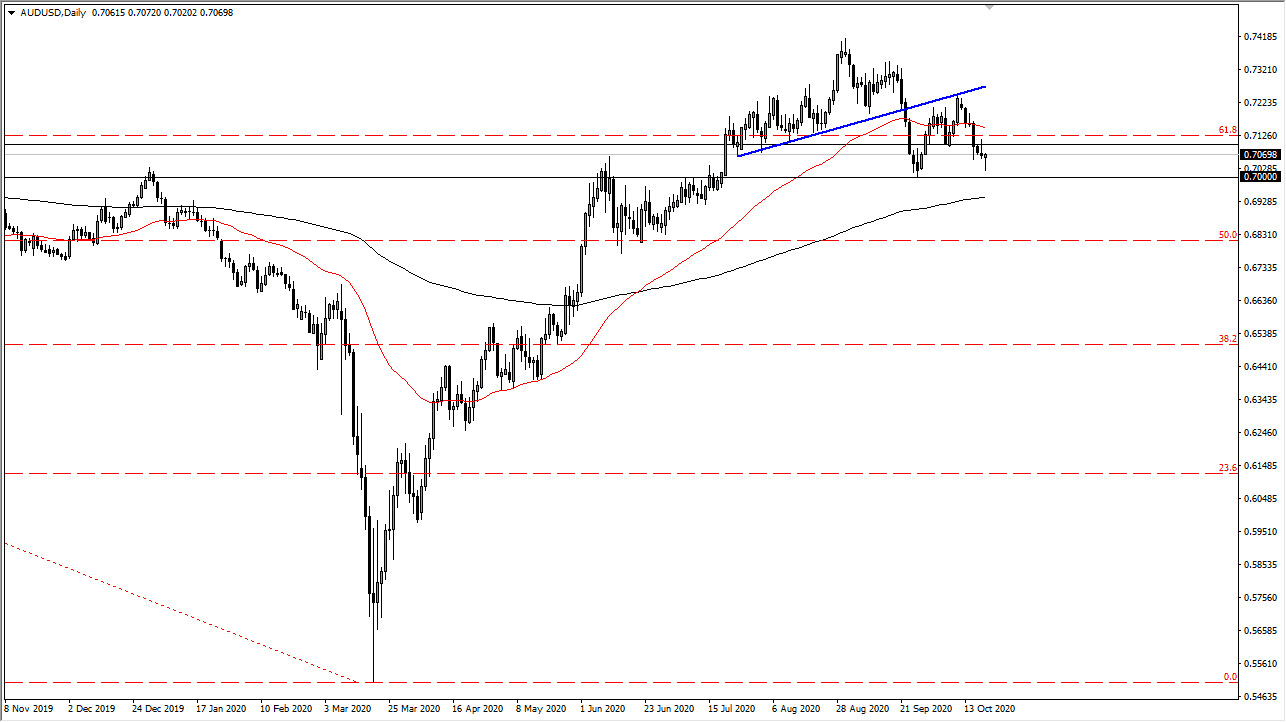

The Australian dollar initially fell during the trading session on Tuesday, reaching down towards the crucial 0.70 level. However, we have turned around to form a bit of a hammer which is preceded by a shooting star shaped candlestick. In other words, it looks like we are banging around in a short-term range between the 0.70 level in the 0.71 level, at least roughly. What this tells me is that the market is trying to make a decision as to whether or not we are going higher or lower, and let us be honest here, it looks very dire at the moment.

Looking at this chart, you can see that we had recently broken through an uptrend line, tested it, and that have fallen from here. Ultimately, I think that the market is at the bottom of an overall range, so if we were to break down below the 0.70 level, the market is likely to open up to the downside. The very short-term target would probably be the 0.68 level underneath there, but there is the 200 day EMA that probably causes a bit of noise. That being said, the Australian dollar has been overvalued in correlation to other currencies in the fact that the Reserve Bank of Australia is hinting that there are rate cut coming soon, and that of course will weigh upon the currency itself.

Looking at the chart, it is obvious that there is a lot of noise in this general vicinity, so I think we continue to see a lot of this behavior. A lot of people are focusing on the idea of stimulus coming out the United States, but that has already for the most part been priced into the markets and I think that the effect will not be as strong as people think. However, if there is no stimulus to be had, the US dollar will strengthen quite drastically. Rallies at this point I think continue to get sold into on signs of exhaustion. I do not necessarily think that we are going to collapse, but the Australian dollar had been so highly insulated against the rest of the world that has a little bit of “catch-up” to do when it comes to the slowing global growth situation. Furthermore, there may be a bit of a safety trade going back towards the US dollar the way things are going.