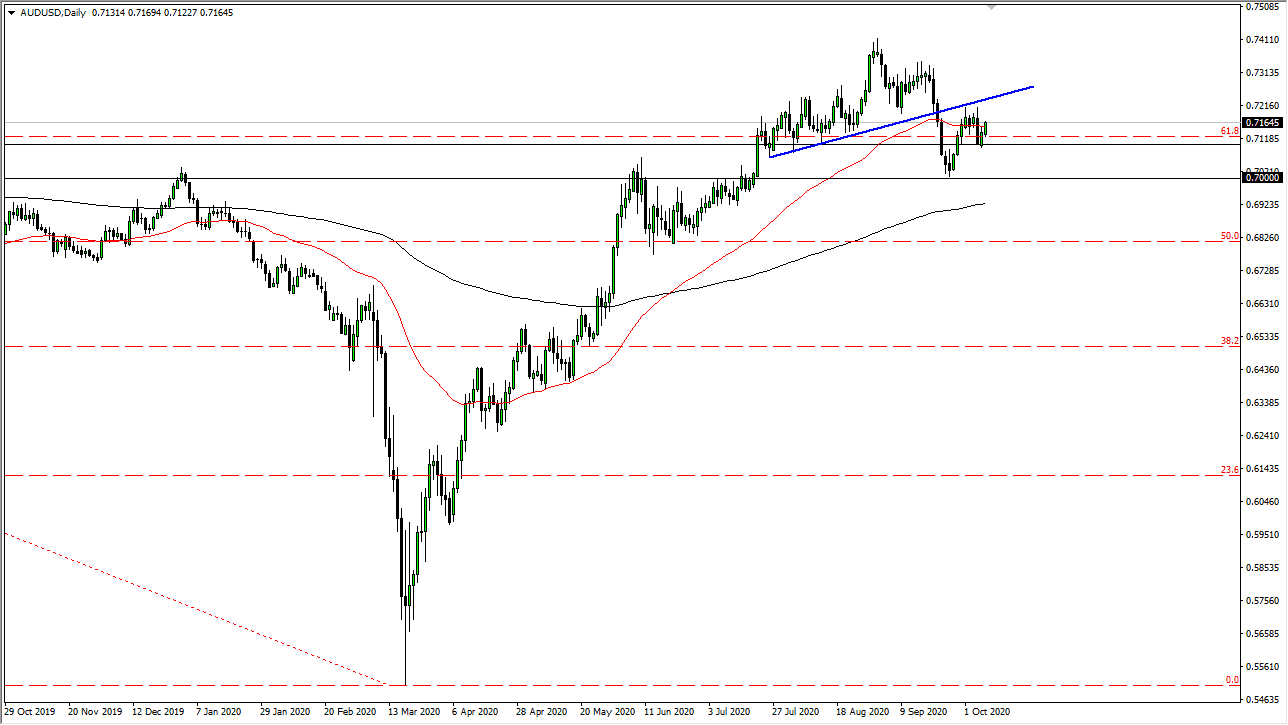

The Australian dollar rallied a bit during the trading session on Thursday, but still stayed within the massive negative candle from the previous session. What this suggests to me is that we may stay in the same area, as it has been a bit of a fight right around the 50 day EMA. We have recently broken through an uptrend line, tested it, and now are trying to figure out what to do next. I would anticipate a lot of noise in this general vicinity, so it is possible that we simply chop back and forth over the next couple of days.

To the downside, we have the 0.71 level, which of course has been the beginning of a significant range down to the 0.70 level. This is a zone of interest that a lot of people have been paying close attention to, and therefore I would expect a lot of noise in that area. The US dollar looks as if it is trying to stabilize a bit, recovering from the massive selloff that it had seen as of late. While the narrative on Wall Street suggests that we are going to see a much lower greenback, when you look at some of the world’s biggest currency pairs, they have recently broken through trendlines that suggests that perhaps the US dollar is going to put up a fight.

The 50 day EMA is flat, so that suggests the shorter trend is sideways as well, putting further credence into the idea of grinding sideways overall. I think at this point it is a bit difficult to imagine a scenario where people want to put a ton of risk on into the weekend, unless of course there is some type of massive stimulus package, that the market is willing to celebrate and therefore sell the US dollar. If we do manage to break above the top of the uptrend line that was broken through, that would be very bullish but right now this looks like a market that is trying to find some type of topping pattern. To the downside, if we were to break down below the 0.70 level, I think that is important enough from a psychological standpoint that it could lead to something much bigger. The Australian dollar is highly levered to China, so pay attention to how Asia moves. One thing that has kept the Australian dollar little quiet for the week is that we are celebrating Golden week in China.