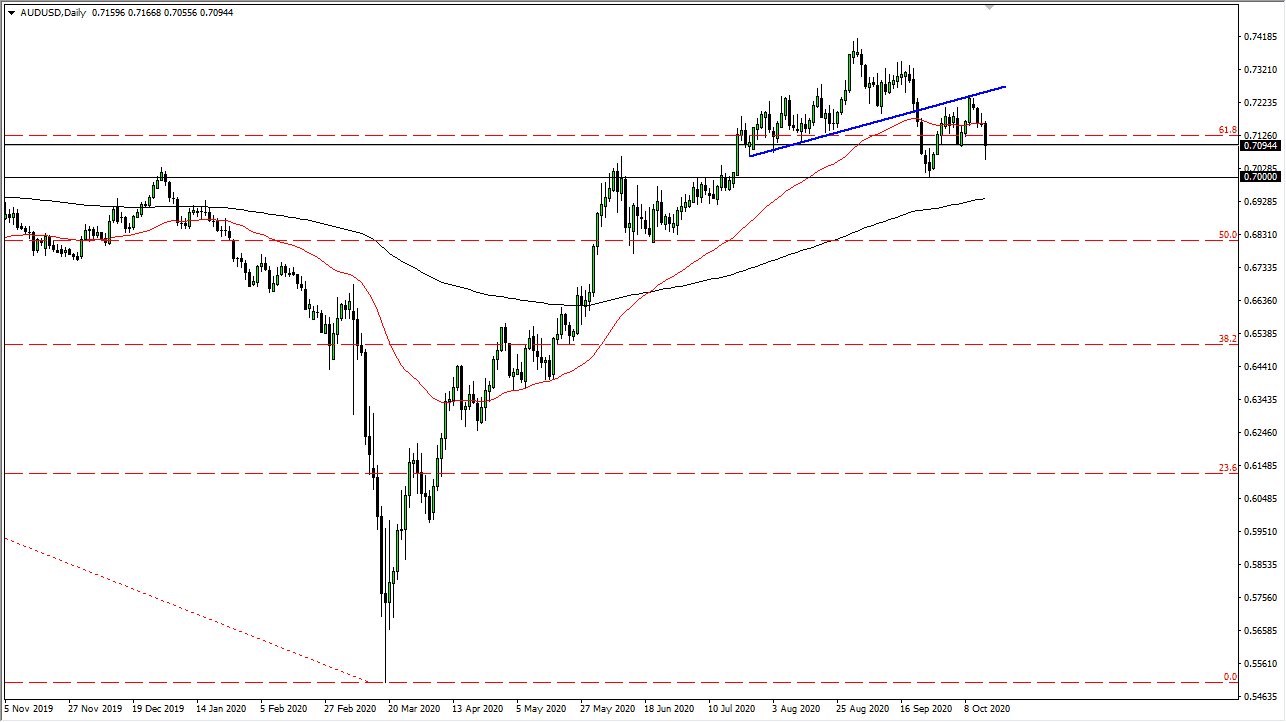

The Australian dollar has rallied a bit during the latter part of the trading session on Thursday after having a very brutal day. This shows that we do in fact have a certain amount of resiliency built into this currency, and even though I do think that ultimately, we may see more negativity, I suspect that the area between 0.71 and 0.70 continues to be very difficult to break through. Furthermore, the 200 day EMA sits just below there and will more than likely cause a certain amount of support as well.

Looking at the chart, if we were to break down through that area it is likely that we would see a significant move much lower. At that point, the market then is probably a very negative turn of events and we could see a bit of an acceleration as far as selling is concerned. Remember, the Australian dollar has been somewhat insulated due to the fact that we have a high correlation between the Aussie dollar and China. Ultimately, the market is likely to see a lot of questions as to whether or not we are going to get more of a “risk on/risk off” type of situation. After all, the Australian dollar also tends to go higher when there is more of a “risk on” type of scenario, just as the exact opposite is true.

The US dollar strengthening could be due to the fear out there, so it does make sense that we could break down below here. However, if we continue to talk about stimulus in the United States and there is any hope of actually getting it, we could see this market turning around to go looking towards the previous uptrend line. The previous uptrend line should now be resistance, so if we were to break above there then it is likely that we continue to go towards the 0.74 handle. Ultimately, this is a market that I think continues to see a lot of noise, but I think going into the weekend we may get a little bit of a short-term bounce due to the oversold nature, but longer-term I think we are most certainly going to work against the support area to see if we can break it down going forward. At this point, volatility is probably the only thing that you can count on.